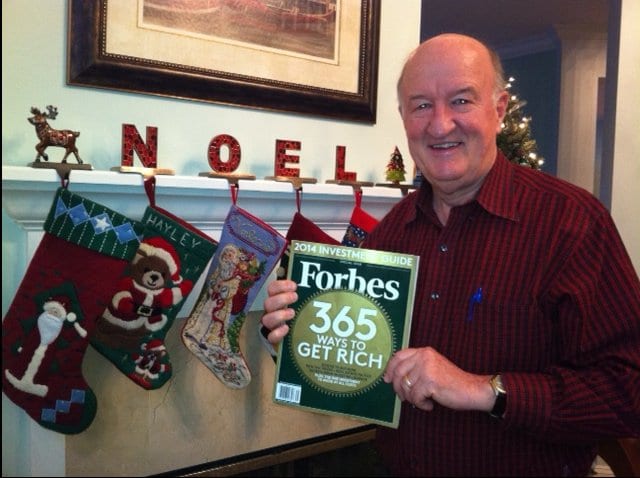

I’m celebrating Christmas early — I have a major article on page 50 of this week’s Forbes magazine (circulation 1 million). You can read it here.

It makes the case for a new pro-business, pro-growth national statistic, Gross Output, which the Feds will be releasing in the spring 2014 along with GDP. Check it out.

The special Forbes issue (dated Dec. 16) also offers 365 tips on making money and getting rich.

Oddly enough, my favorite way to get rich isn’t found among the 365 tips: buy dividend-paying stocks in solid growth companies.

To show you how successful this strategy has been for my Forecasts & Strategies subscribers, let me tell you a story:

True Story: “You made me a rich man!”

Last week, I visited St. Kitts in the Caribbean for the Liberty Forum conference. As I was standing in line to go through immigration, the man next to me said, “Are you Mark Skousen?” I said “yes,” and he said, “I’m a lifetime subscriber, and you’ve made me a rich man. In fact, I’ve made more money from your newsletter than from my business as a trial lawyer!” He and his wife were coming to the Caribbean to stay at their vacation home they had bought with profits from my newsletter recommendations. He made my day.

A Great Christmas Gift

The special Forbes issue contained a lot of great sayings on Wall Street, many of which are found in my classic “The Maxims of Wall Street,” the only single collection of more than 800 financial adages, ancient proverbs and worldly wisdom — over 20,000 copies sold! I just got an order for 150 copies of “The Maxims of Wall Street” from a Dallas money manager who is giving copies to his clients as Christmas gifts. Call Eagle at 1-800/211-7661 if you want to buy a copy for you or your friends. Pay only $20 for the first copy and $10 for any additional copies. Be sure to mention code MAXIMS. It’s been endorsed by Warren Buffett! Discover more information.

Also, my friend and colleague, Chief Investment Strategist Alexander Green at the Oxford Club, has written an excellent new book, “An Embarrassment of Riches.” This is not just a book about getting rich, but about being rich. (Like J. Paul Getty, you should know and appreciate the difference.) A terrific read, it is both thought provoking and inspiring, the perfect Christmas gift for anyone on your list whose spirits could use a bit of lifting. You can order the book on Amazon at 40% off of the cover price.

You Blew It! IMF Endorses a Wealth Tax!

“There’s much revenue in economy… and no revenues is sufficient without economy.” — Ben Franklin

Apparently the International Monetary Fund (IMF) has been reading David Stockman’s book, “The Great Deformation,” wherein he urges the United States and other countries in fiscal crisis to impose a “one-time only” 30% wealth tax on its citizens to “solve” its financial problems.

Now the IMF has joined the bandwagon in favor of a wealth tax.

There are several reasons why a wealth tax is not a good idea:

1. It makes almost everyone a criminal by encouraging people to go underground. Why? Because a wealth tax requires for the first time for you to list all your assets, not just real estate and stocks that are listed in public records or brokerage statements, but a lot of valuable assets that are private such as cash, gold and silver coins, and art collections. A wealth tax is a way for the government to find out everything you have — and most people want some private assets not known to snoopy federal agents or neighbors.

2. A wealth tax is a tax on capital, and capital is the source of economic growth, research & development, new stock issues, etc.

3. Last but not least, another tax will not necessarily solve our fiscal crisis because it does nothing to attack the real source of the crisis — excessive and wasteful government spending. We need a cap on spending (such as a balanced budget amendment), not a new source of revenue to feed the fat beast.

Ben Franklin said it best: “No revenue is sufficient without economy.”

In case you missed it, I encourage you to read my e-letter column from last week about my Gross Output (GO) statistic’s adoption by the federal government. I also invite you to comment in the space provided below.