“The Federal Reserve has a great reputation but a lousy record.” — Milton Friedman

Next Monday, on December 23, 2013, we observe the 100th anniversary of the Federal Reserve Act. Yesterday, I happened to be driving down to Florida to my winter home and stopped by Jekyll Island to commemorate the founding of the Federal Reserve — the Jekyll Island Club is where a half-dozen financial and political figures secretly convened to create the first central bank in the United States since the demise of the Second Bank of the United States back in the 1830s.

The year 1913 saw three critical changes in U.S. history that brought about Big Government — the beginning of the federal income tax (16th amendment), the direct election of senators (17th amendment) and the creation of the Federal Reserve.

Should we celebrate the Fed or condemn it?

The Fed was set up to defend the dollar and control inflation, and to be the lender of last resort during a monetary crisis. It has failed at the first job and has a mixed record in the second.

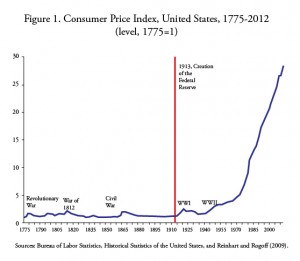

This historical chart demonstrates clearly that the Fed is a promoter of inflation rather than an enemy.

As the graph demonstrates, price inflation was virtually non-existent prior to 1913, due to the gold standard, but took off after the Fed was created.

The Fed failed miserably as a lender of last resort during the 1929-32 monetary collapse, as Milton Friedman has demonstrated in his classic work, “A Monetary History of the United States,” co-author with Anna Schwartz. (I have an autographed copy.)

The Fed did intervene and inject trillions of dollars into the economy after the 2008 financial crisis, but it still must take responsibility for failing to prevent the real estate bubble — it encouraged that bubble with its easy-money policies under Greenspan and its failure to regulate the banks properly (it allowed subprime and no-documentation loans).

The Fed is a central bank out of control, adding trillions of dollars to its balance sheet and thus promoting more inflation and instability down the road.

As an institution, the Federal Reserve and other central banks around the world are here to stay, but hopefully we can set better standards and rules of behavior so that another monetary crisis won’t engulf us. However, I suspect the most recent crisis won’t be the last under this unstable, out-of-control monetary policy.

You Blew It! An Embarrassment of Fat

My wife and I stopped by a Cracker Barrel restaurant to have lunch, and I couldn’t help but notice the number of overweight and obese people. I sometimes wonder if people who are extremely overweight feel embarrassed to go out in public, especially if they feel their excess weight makes them look grotesque.

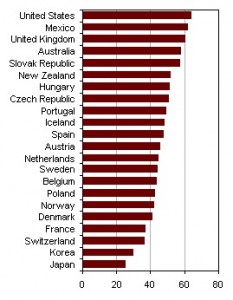

I see from this chart below that Americans are the most overweight people in the world. We’re number one in a lot of positive things, but this is indeed an embarrassment. Maybe ObamaCare will work wonders and have a silver lining — people may become so afraid of using the medical system in America that they will become super healthy, eat better and lose weight — and not have to go to the doctor or the hospital.

I could probably lose 10 pounds myself — perhaps it’s time for the First Lady to take on a “losing” cause!

In case you missed it, I encourage you to read my e-letter column from last week about the best way you can get rich. I also invite you to comment in the space provided below.