One of the fascinating aspects of earnings season is that it reveals which sectors and stocks are tomorrow’s market leaders. I incorporate the use of “sectors” because of the overcrowded trade in exchange-traded funds (ETFs), which are influencing the underlying components more than the component holdings are influencing the ETFs. This is a new and weird dynamic that is getting a lot of press and is one reason Vanguard founder John Bogle has been such a vocal critic of ETFs due to concern such funds encourage day trading and speculation.

The right or wrong of how ETFs ought to be viewed is entirely up to each investor and how they exhibit personal discipline when investing or trading. ETFs add tremendous liquidity and reduce risk through diversification and therefore offer, in my view, more positives than negatives. Plus, those who oversee the management of ETFs are busy making sure the holdings within each fund are the best stocks in each respective sector.

So with two-thirds of the first-quarter earnings reports in the books and four months of economic data to chew on, there are some definite takeaways for considering how to shape one’s portfolio going forward. With only 31% of all S&P companies beating top-line revenue estimates amid a parade of lower Q2 guidance notes within the Q1 numbers, it’s no surprise the Fed backed away from trying to time any future rate hikes.

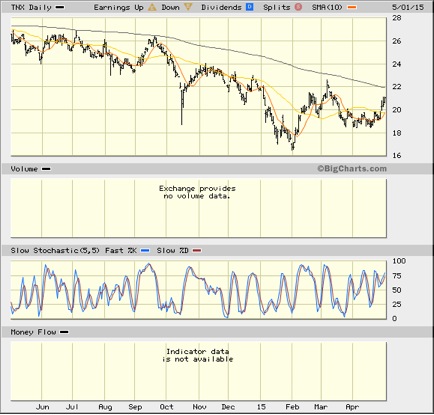

As such, the dollar has been selling off to help support a modest bounce in energy and commodities, along with a pop in bond yields, with the 10-year T-note yield now up to 2.1% in what would seem to be a counterintuitive move — given the slowing data. The bump in yield is more related to the 5% decline in the Dollar Index (DXY) during the past three weeks and from the one-year chart of the 10-year T-note below, 2.2% offers stiff technical resistance where the 200-day moving average lies overhead. Macro data, micro data, anecdotal data and forward sales and profit growth don’t support a move above 2.2%.

Assuming interest rates, the dollar and crude prices stabilize at current levels, as I suspect they will following the recent adjustment, those sectors that stand to outperform in the current quarter include mega banks, investment banks, mobile device technology, digital content non-cable media, cybersecurity, cloud computing, travel, select healthcare, casual apparel, big box and discount retailers.

Of late, the phrase “unicorn” has been coined to describe private technology companies with gorilla-sized valuations that have soared to $1 billion or higher based on fundraising. The billion-dollar tech startups were once the stuff of myth, but now they seem to be everywhere, backed by a bull market and a new generation of disruptive technology. When they finally trade as public companies, they are fully valued, leaving little upside for the new shareholders while the insiders and venture capitalists cash in.

Fortune magazine counts more than 80 unicorns attracting massive capital, with Uber, Palantir, Airbnb, Dropbox, Snapchat, SpaceX and Pinterest among the familiar names that command valuations from $5 billion to $40+ billion. It is an amazing time for disruptive technology and life sciences. So how can retail investors get in on the action? One way is to consider taking a position in Business Development Companies (BDCs) that are targeting very young private companies within these hot spaces.

Enter Horizon Technology Finance (HRZN), a specialty finance company that lends to and invests in development-stage companies in the technology, life sciences, healthcare information and cleantech industries. HRZN also is a Cash Machine recommendation. The investment model for Horizon is to generate current income from originated loans, along with capital appreciation from the warrants received when making such loans.

All the portfolio loans are senior secured “venture loans” to companies backed by established venture capital and private equity firms within their target industries. In essence, we have a high-tech, higher-beta BDC with a portfolio of 35 companies where 55% are technology, 22% are life sciences, 17% are healthcare information & services and 6% are in cleantech.

Loan interest supports a current yield of 9.75% for shares of HRZN. The payout ratio relative to Net Investment Income is a very attractive 86.0%, with the last 90 days showing upward earnings revisions by the eight analysts that cover the stock. The stock trades at 0.97 of book value, which currently is $14.14 per share. Consensus earnings estimates for 2015 of $1.46 per share comfortably support a $1.38-per-share annual dividend payout. One other very attractive feature about Horizon shares is that the stock pays out a monthly dividend, which increases long-term price stability.

In an era where it’s almost impossible for retail investors to get a piece of the action in the hottest companies prior to initial public offering (IPO) pricing, a company like Horizon Technology Finance that casts a net over three dozen companies is not only garnering a very attractive yield for investors but is in position to benefit in a huge way if one, two or a few of its portfolio companies become the next Uber. And in the private equity world, all it takes is one.

In case you missed it, I encourage you to read my e-letter column from last week about how to make the right moves in a market correction. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.

Upcoming Appearance

I invite you to join me at the MoneyShow Las Vegas, May 12-14, 2015. With stock picking taking on renewed importance as the market shows signs of volatility, this event offers an opportunity to hear from a number of experts, including my Eagle Financial Publications colleagues Mark Skousen, Doug Fabian and Chris Versace.

Be a guest of Eagle Financial Publications and register for FREE by using priority code 038657 and calling 800-970-4355 (toll free in the United States and Canada) or signing up online.

In case you missed it, I encourage you to read my e-letter column from last week about how to make the right moves in a market correction. I also invite you to comment in the space provided below my commentary.