****************************************

Note from the Publisher

For all of you dividend fans out there, I am thrilled to announce that we have added www.DividendInvestor.com to the Eagle family of products. With screening tools, an all-star ranking of dividend stocks, the best dividend calendar on the web, personalized alerts and more, this site is a great complement to our investment products. Check it out today… go to www.DividendInvestor.com now!

Roger Michalski

Publisher, Eagle Financial Publications

****************************************

Heading into earnings season, Wall Street analysts’ views were very mixed as to how America’s leading multinational corporations would fare against a macroeconomic backdrop where the Fed is chomping at the bit to tighten rates at least once before year-end while the U.S. dollar index is turning back up in correlation with the Fed rhetoric and a weaker euro post-Greek deal.

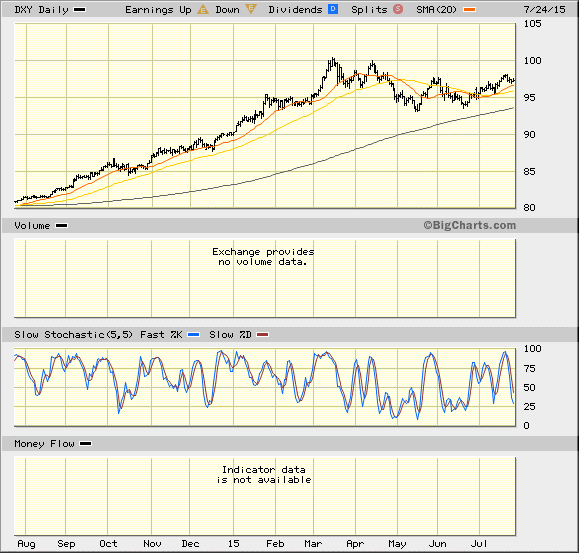

However, following this past week of earnings misses by some of the most notable blue-chip companies because of the negative effect of the foreign exchange market (“forex”), Janet Yellen & Co. may just have to take a sabbatical come the September Federal Open Market Committee (FOMC) meeting if they don’t want to yet another upward spike in the value of the greenback. Looking at the one-year chart below, one would have to hunt extensively to find a more bullish technical formation.

It didn’t take long to see the heavy toll taken on some of the nifty-fifty stocks. Names like Johnson & Johnson (JNJ), Honeywell (HON), 3M Corp. (MMM), UTX Corp. (UTX), Caterpillar (CAT) and IBM (IBM) have all seen serious downside pressure on their respective share prices in the latest week, and it’s early in the reporting season. With many dozens of blue-chip companies conducting 50% or more of their business overseas, it’s no surprise the market is re-pricing, which is code for giving a haircut to, the forward earnings prospects of those companies exposed to a higher dollar.

Regardless of what the collective members of the Federal Reserve may have on their bucket list of policy changes, they have to be sitting up in their respective chairs, taking notice of the material impact the strong dollar is having on corporate profits, much less what it will mean to second half 2015 bottom line results if forex conditions worsen. As of Friday, the multinational-laden Dow Jones Industrial Average, which opened the year at 17,823, is now trading at 17,617 amid all the talk of a recovering economy.

Just don’t tell anyone in the bond market of the Fed’s rosy optimism, because they obviously don’t believe it. The benchmark 10-year Treasury Note that touched 3.0% in January 2014 is currently trading with a yield of 2.26%, hardly the stuff of a market preparing itself for an up-rate cycle. And it’s not just a bullish move in the dollar that the Fed needs to fret about. There is a bear market unfolding in the commodities space that is going from worry to outright fear, especially in the oil sector.

So where does money go to steer clear of negative dollar currency risk and take advantage of cheap commodity inputs? A few places: refiners of gasoline, diesel fuel, jet fuel, lubricants and solvents are enjoying some of the best operating margins based on what is called the “crack spread.” This is the difference between what refining companies can buy crude oil for versus what they can sell refined product for in end markets. In the latest quarter, crude prices have come down much faster than the price of gasoline, diesel fuel and jet fuel, thereby setting the table for very upbeat quarters for all refiners.

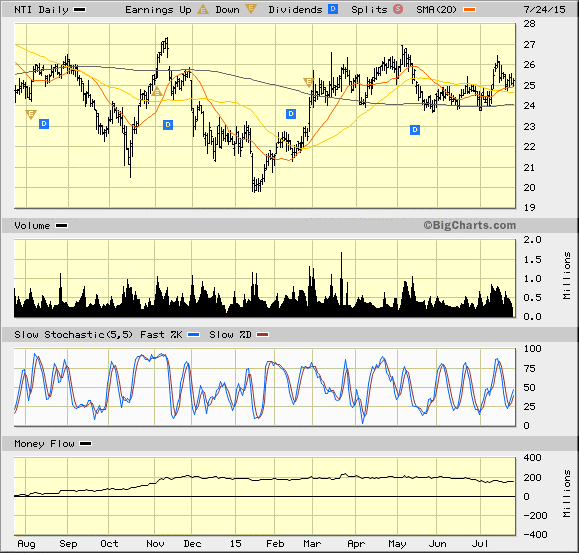

A recent addition to Cash Machine’s High-Yield Aggressive Portfolio is Northern Tier Energy LP (NTI), a master limited partnership that has operations in refining, transfer of hydrocarbon products and retail fueling stations. Assuming business conditions have only firmed up in the second quarter, I expect NTI to post excellent Q2 results on Aug. 4 and pay out a distribution that will maintain its gorilla-sized 17.2% current yield. The chart below also has the look and feel of a stock that wants to pop big on good news.

This is just one way energy investors can turn a lemon backdrop into lemonade gains. It’s like being in the candy business while the price of sugar tanks, a best-case scenario. And for the balance of 2015, the refiners will resemble candy stores for investors that are seeking not just terrific income, but also nice capital gains like chocolate sprinkles.

In case you missed it, I encourage you to read my e-letter column from last week about high-yield income from the high-tech sector. I also invite you to comment in the space provided below my commentary.