“Gross Output, long advocated by Mark Skousen, will have a profound and manifestly positive impact on economic policy and politics. He deserves the Nobel Prize for his work!”

— Steve Forbes

J. Paul Getty, America’s first oil baron, insisted that the key to successful investing was to “buy into companies and industries that burgeon as time goes by.”

That means looking not only at the company’s bottom line, or earnings, but how it achieves those earnings — the company’s top line, or sales/revenues. No good analyst on Wall Street looks only at earnings. Top-line sales is essential. And sometimes sales and earnings can move in opposite directions.

The same holds true in looking at the economy. Good economists need to look not only at the value of final output, known as gross domestic product (GDP). They also should look at how the final output was achieved by measuring the stages of production, or the supply chain.

Good news! Last year was a watershed time in this regard. In 2014, the U.S. government began publishing a quarterly statistic called Gross Output (GO), which measures the top line of the economy — sales/revenues at all stages of production. It amounted to more than $31 trillion last year. The government (Bureau of Economic Analysis (BEA), a part of the U.S. Department of Commerce) has published GDP every quarter for years. GDP is equivalent to the bottom line, a measure of value added, or earnings, of the whole economy.

Only last year did the government decide to measure the top line of the economy, sales throughout the supply chain, what we might call business to business (B2B) transactions. Welcome to the 21st century!

It All Started with My Book ‘The Structure of Production’

The GO announcement last year came as a personal triumph. In my book, “The Structure of Production,” I advocated GO as an essential macroeconomic tool and a better way to measure the economy and the business cycle.

In honor of this news, New York University Press has just released the 3rd edition of “The Structure of Production,” with my new introduction.

To buy the book, go to either one of these sources: NYU, Amazon.

Want to see what GO looks like? Here’s the quarterly data for Gross Output at the BEA site.

I issue a quarterly report. For my commentary on first-quarter GO, read this column.

Is GO valuable as a statistic? Yes! Gross Output fills in a big piece of the macroeconomic puzzle. It establishes the proper balance between production and consumption, between the “make” and the “use” economy, between aggregate supply and aggregate demand. I make the case that GO and GDP complement each other as macroeconomic tools and that both should play a vital role in national accounting statistics, much like top-line and bottom-line accounting are employed to provide a complete picture of quarterly earnings reports of publicly traded companies.

Because GO attempts to measure all stages of production (known as Hayek’s triangle), it is a monumental triumph in supply-side “Austrian” economics and Say’s law.

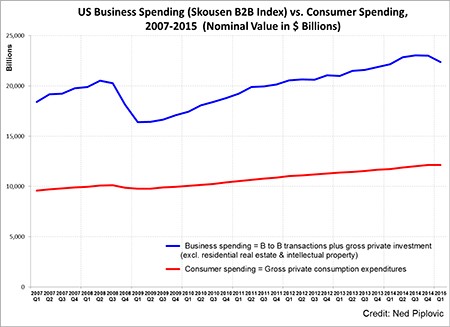

Using GO, I demonstrate that consumer spending does not account for two-thirds of the economy, as is often reported in the financial media, but is really only 30-40% of total economic activity. Business spending (B2B) accounts for more than 50% of the economy. Thus far, it is far larger and more important than consumer spending, more consistent with economic growth theory and a better measure of the business cycle. (See chart below.)

What do we learn from GO and B2B spending? First, business spending is a better measure of where the economy is headed. Second, do not depend on consumer spending or retail sales to determine the direction of the economy or the stock market. Business indicators do a better job.

Reviews of ‘The Structure of Production’

“Now, it’s official. With Gross Output (GO), the U.S. government will provide official data on the supply side of the economy and its structure. How did this counter revolution come about? There have been many counter revolutionaries, but one stands out: Mark Skousen of Chapman University. Skousen’s book ‘The Structure of Production,’ which was first published in 1990, backed his advocacy with heavy artillery. Indeed, it is Skousen who is, in part, responsible for the government’s move to provide a clearer, more comprehensive picture of the economy, with GO.” — Steve H. Hanke, Johns Hopkins University (2014)

“The development of Gross Output is a good idea and a better measure [of economic activity] than GDP.” — David Colander, Eastern Economic Journal (2014)

“This is a great leap forward in national accounting. Gross Output, long advocated by Mark Skousen, will have a profound and manifestly positive impact on economic policy.” — Steve Forbes, Forbes magazine (2014)

“Skousen’s Structure of Production should be a required text at our leading universities.” (referring to the second edition) — John O. Whitney, Emeritus Professor in Management Practice, Columbia University

“Monumental. I’ve read it twice!” (referring to the first edition, published in 1990) — Peter F. Drucker, Clermont Graduate University

“I am enormously impressed with the care and integrity which Skousen has accomplished his work.” — Israel Kirzner, New York University

For Interviews or Lectures

To interview Dr. Mark Skousen or arrange a lecture on Gross Output or his book, “The Structure of Production,” contact Valerie Durham, media relations, or email her at vdurham@skousenpub.com.

You Blew It! Father Serra Founded Spanish California, But His Actions Weren’t Always Saintly

Father Junipero Serra, a Franciscan friar who helped found California in the late 18th century, is considered a visionary. He helped establish missions in San Diego and Carmel, the first two of California’s 21 missions. In addition to advancing the Catholic Church, the austere priest helped integrate the local Indians into Spanish society and to develop the economy, especially cattle and grain production. The missionaries taught schooling and farming to the natives.

Father Junipero Serra (1713-1784)

When Pope Francis visited the United States last week, he elevated Father Serra to sainthood at the Mass at the Basilica of the National Shrine of the Immaculate Conception in Washington.

But there’s a dark side to Father Serra and his missionaries. He forced the Indians to abandon their tribal culture and convert to Christianity. At this time, Catholic priests told them that if they weren’t baptized, they were going to Hell. Historians report that he imposed severe discipline on the Indians and had them whipped and imprisoned. He also was accused of approving torture.

Such behavior is hardly worthy of calling someone a saint.

In case you missed it, I encourage you to read my e-letter column from last week about Newt Gingrich’s number one lesson for investors. I also invite you to comment in the space provided below my commentary.

Upcoming Conference

New Orleans Investment Conference, Oct. 28-31, New Orleans Hilton Hotel

Join me for the “granddaddy of all investment conferences.” Other speakers include Charles Krauthammer, Mark Steyn, Jim Rickards, Marc Faber, Dennis Gartman and Robert Prechter, among many others. Register now to save. Call toll-free 1-800-648-8411, or go to www.neworleansconference.com. Be sure to mention you are my subscriber.

![[Wall St. Sign]](https://www.stockinvestor.com/wp-content/uploads/1024px-Wall_Street_Sign_NYC.jpg)