During the past two trading sessions, we’ve seen a very nice move higher in the major averages. The Dow surged more than 300 points Thursday, and midway through Friday trade, the Industrials were up more than 100 points.

Solid earnings reports from the likes of Amazon.com (AMZN), Alphabet (GOOGL), Microsoft (MSFT) and others helped inspire the buying, but the real driver of equity prices during the past two trading sessions has been global central banks.

The central-bank-induced buying began with European Central Bank (ECB) President Mario Draghi’s “dovish” surprise. Although the ECB left interest rates unchanged, during Draghi’s presser, he suggested that both growth and inflation were facing “downside risks.” He also specifically cited December as a time to “re-examine” current policies.

What the Draghi comments told Wall Street is that the ECB is going to implement more quantitative easing (QE) in December — and history tells us that when more QE is implemented, nominal stock prices go higher.

Then overnight, we got word from China, where its central bank cut the cost of borrowing by 25 basis points. This isn’t exactly QE, but it’s a dovish move by a major central bank — and that move is bullish for global equities (and hopefully for the Chinese economy).

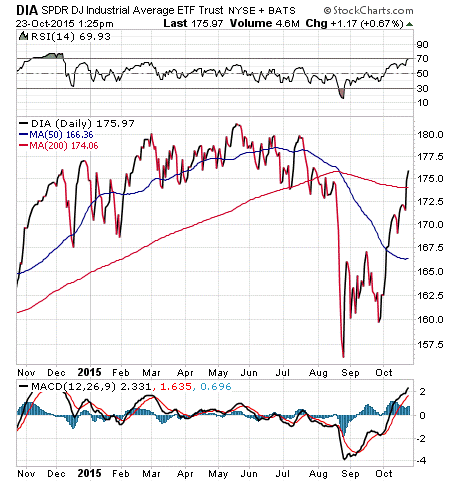

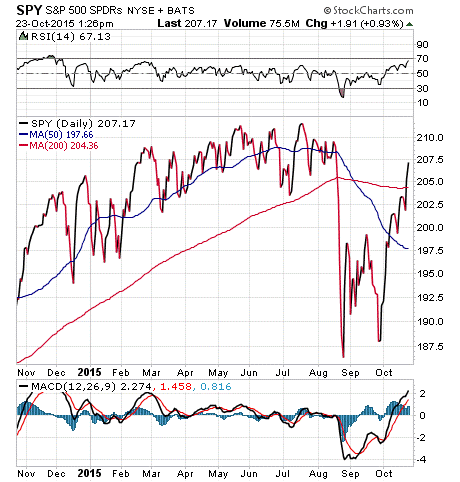

The move higher during the past couple of weeks has pushed the major domestic indices back above their respective 200-day moving averages.

After the steep plunge in August and another plunge in late September, the move so far in October has been a welcome turn of events for the bulls.

Now the question is: when do you buy back into stocks if you have cash to put to work?

That’s the very issue we’re addressing right now in my Successful ETF Investing newsletter. Last week, we added some targeted sector positions for both growth investors and investors looking for aggressive buys.

And, if the market continues to move higher, we could soon get a technical buy signal that would give us the go-ahead to move into stocks big time.

If you want to be ready to buy the right funds, and at the right time, then subscribe to Successful ETF Investing right now!

An ETF for the Next Cyber Attack

Cybersecurity is a serious problem.

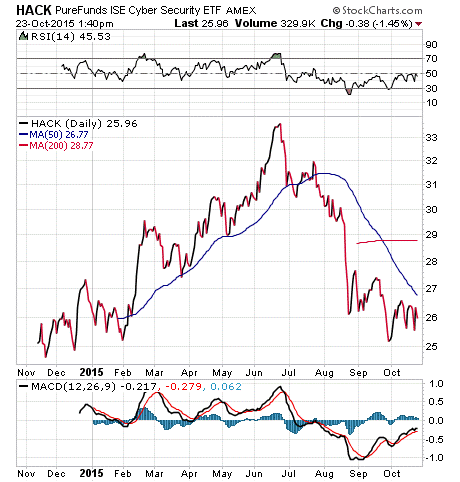

From the U.S. Office of Personnel Management, to MIT, to American Airlines and Ashley Madison — the cyber hits just keep rolling along and doing serious damage to the U.S. economy.

During the past several years, the volume of high-profile attacks has sparked a massive demand for cyber defense.

What that means for you is the opportunity to profit from one of the most innovative ETFs to come to market during the past few years, the PureFunds ISE Cyber Security ETF (HACK).

I really believe in this fund, which is why I recently hosted a free online webinar featuring a panel of cybersecurity experts, as well as investment experts from PureFunds.

Now, I am happy to tell you that a replay of that free webinar is available for viewing right now.

If you want to understand the cybersecurity boom and how to properly invest in this burgeoning area, this free webinar is a must.

I guarantee you’ll feel more secure knowing that some great companies are out there waging the cyber war against hackers, identity thieves and other nefarious sorts.

On Age and Patience

“One problem with age is that patience begins to ebb.”

— Carl Hiaasen

Carl Hiaasen is a novelist known for his engaging characters, as well as for his great sense of humor. And though his quote here brings about a chuckle, it also tends to be true for many of us. The older we get, the less patient we tend to be, and that’s something we need to keep in mind when it comes to investing.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week on Eagle Daily Investor about why investors are piling into precious metals ETFs. I also invite you to comment in the space provided below my commentary.