This back and forth narrative fashioned by the Fed about the future of short-term interest rates has entered a “silly stage.” The stock market ended the midweek affair on a flat note as investors walked back recently adjusted rate-hike expectations for the year.

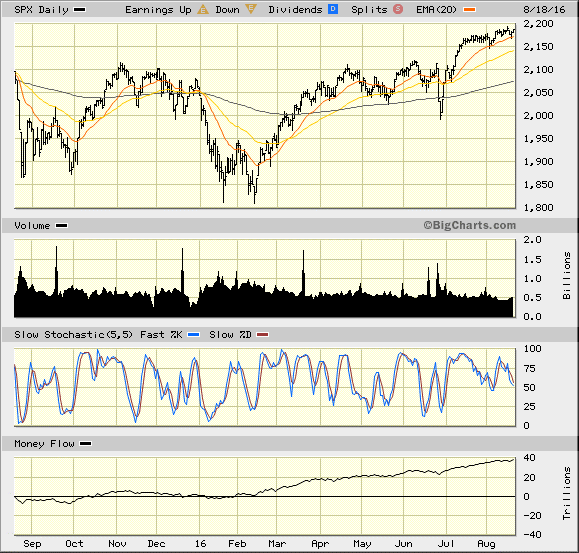

The change in thinking followed some dovish remarks from St. Louis Federal Reserve President James Bullard, a Federal Open Market Committee (FOMC) voter and less-hawkish-than-feared minutes from the FOMC’s July meeting. The S&P 500 has spent the past seven weeks slowly grinding higher toward 2,200 after a clean upside breakout in early July.

The future path of interest rate normalization remained in focus as investors looked to substantiate somewhat hawkish remarks from New York Fed President James Dudley, another FOMC voter, and Atlanta Fed President Dennis Lockhart, a non-FOMC voter. The two fed officials pushed forward rate-hike expectations, signaling that at least one rate increase remains possible before the end of the year. But it gets even more convoluted.

St. Louis Fed President Bullard helped elicit some buying interest after he suggested that the Fed may only be likely to raise rates one time between now and late 2018. The comment echoed remarks made by Mr. Bullard in the past, citing trend growth remaining under 2.0%. So, there is dissension among the ranks of the Fed, but it is all noise and at the end of the day, Fed policy remains unchanged.

The latest minutes indicated that the Federal Open Market Committee was split on whether or not an interest rate hike would be appropriate in the coming months. The committee agreed that economic data and labor markets had improved, but hiring sustainability and inflation continuing to run below the 2% objective worried some members. Several members said they preferred to delay another increase in the fed funds rate until they were more confident that inflation was moving closer to 2% on a sustained basis.

Treasuries ended the week on a higher note, enjoying a decent bid across the complex. The yield on the 10-year note slipped two basis points to 1.53%. So in what is now a long and drawn out three-act opera of competing views, very little, if anything, has changed except for the most important takeaway that truly matters to professional fund managers. It is my view the Fed is sending a message it will not raise rates until December at the earliest and err on the side of playing catch up with the economy that registered lower-than-forecast retail sales and gross domestic product (GDP).

As of Friday, 85% of bond futures traders predict the Fed will make no move at the Sept. 21 FOMC meeting. That number dips to 79% at the Nov. 2 meeting (no chance with the elections) and comes in at 53% for the Dec. 14 meeting. Four and a half months with the Fed stuck in neutral is like an eternity for fund mangers trying to make their year. In essence, staying the course through December is like hanging out a sign on the beach stating “Come on in, the Water’s Fine” or “Free Hot Dogs with Every Stock Purchase.”

Futures Expiry: September 2016

| Target Rate (bps) | Current Probability % | Previous Day Probability % |

| 25-50 | 85.0 | 85.0 |

| 50-75 | 15.0 | 15.0 |

It is a green light for the bulls and especially for investors wondering if they should buy yield-bearing assets. Even if the Fed does raise rates in December, trading pros are already touting it will be a one-and-done situation for a while. It is my view that a quarter-point bump in the Fed Funds Rate won’t move the needle and will be received as a “no harm, no foul” move that satisfies the “let’s get it over with” crowd and the fiscal academia at the Fed that so desperately wants to rationalize policy as working and deserving of normalizing rates to any extent possible.

In the wake of this forward landscape from do-nothing Fed, income investors are welcome to feed off of my high-yield advisories that are posting steady weekly and monthly gains accompanied by serious cash flow. The most recently launched income advisory, Instant Income Trader, involves the use of the bull-call-spread option strategy, which is even suitable for individual retirement accounts (IRAs).

This super easy to apply strategy is structured to deliver an average of 8-10% per month in realized gains and income when followed properly. Best of all, the strategy requires nominal trading capital that uses long-dated call options, called LEAPS, to control stocks that trade well over $100 per share. The strategy takes less than 10 minutes per week to maintain. All anyone has to do is follow my instructions and make the trades I recommend. I invite you to click here to try it out risk-free and see how top stocks, which I would love to identify for you, are set to pay off handsomely during August while we have no less than seven more trades in play for September.

Take advantage of the Fed-friendly bull market for equities and make the most of your capital dedicated for risk-on income. It’s the best of times for a year-end bull run and it’s the best of times to have a dynamic bull-call-spread advisory working for your capital 24/7. It’s also how a lot of trading pros post outsized returns using the biggest and best stocks listed on the NYSE.

In case you missed it, I encourage you to read my e-letter column from last week about the effect of poor retail data on the dollar and bonds. I also invite you to comment in the space provided below.