To say that the equity markets have been Fed-driven during the past seven years would be an exercise in stating the obvious. Yet on days like today, we get that message drummed home to us with a very loud beat.

As I woke up and scanned the financial media this morning, all I saw was speculation on what Fed Chair Yellen’s Jackson Hole conference talk would mean for the markets.

The press did have a transcript of Yellen’s prepared remarks. When those remarks were released at 10 a.m. EDT, stocks immediately moved higher by about 100 Dow points.

The key comment in the Yellen statement was that the economy was strong enough to justify a rate hike. The way she put was as follows:

“Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.”

The Yellen comments were widely regarded as a benign signal, and a repeat of what the Fed chair has said before on rates. The result was a sort of reading on the comments by traders that there would be no rate hike until sometime in 2017.

Yet nearly as soon as Ms. Yellen made her remarks public, the No. 2 man at the central bank, Fed Vice Chairman Stanley Fischer, came out and said that the strength in the economy could justify a rate hike in September.

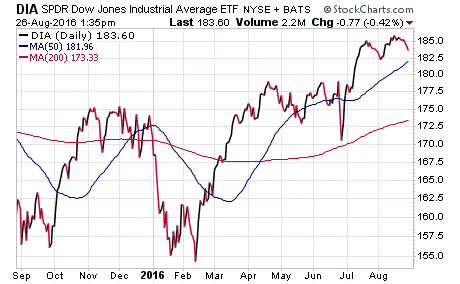

Talk of a rate hike just about four weeks from now spooked markets, and that caused selling that sent the Dow falling from +100 points to -80 points. The Dow has since stabilized, but the flip-flop in the Industrials is notable for one big reason.

That reason is because the fuel for this current, post-Brexit rally has been the notion that interest rates around the world will remain ultra-low for as far as the eye can see. That idea has kept bond yields down, and equity prices up.

If, however, the market starts to get a growing sense that the Fed is going to hike this year, then that can and likely will pressure markets. In fact, it could even bring about a significant correction off the near-all-time highs.

So, how will you know this market is in correction mode? How will you know when it’s time to take shelter, sell equities and move to the safety of cash?

The answers to those profoundly important questions can be found in my Successful ETF Investing advisory service.

If you want to make sure you’re in stocks when the going is good, and out of stocks when things get dicey, then you owe it to yourself to check out Successful ETF Investing today.

That’s How Winning is Done

“Let me tell you something you already know. The world ain’t all sunshine and rainbows. It is a very mean and nasty place and it will beat you to your knees and keep you there permanently if you let it. You, me, or nobody is gonna hit as hard as life. But it ain’t how hard you hit; it’s about how hard you can get hit, and keep moving forward. How much you can take, and keep moving forward. That’s how winning is done.”

— Rocky Balboa

One of the most inspirational characters in all of film history, “Rocky” is the epitome of toughness and perseverance. In the above quote, Sylvester Stallone’s hero tells his son what the real key to winning is… which is to keep on going no matter what the obstacles, and regardless of the setbacks. Words to live by, indeed.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my column from last week about how you can outsmart bearish billionaires. I also invite you to comment about my column in the space provided below my commentary.