- The Bond Market Bubble That Everyone Fears

- ETF Talk: Huge Emerging Markets Fund Offers Diversification

- On Knowing Yourself, and Your Enemy

When it comes to talk of a market “bubble,” it’s not equities that are the real worry among the smart money.

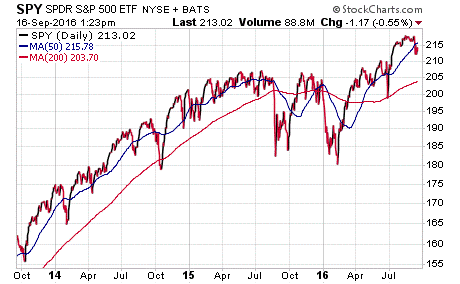

Sure, stocks in the Dow, S&P 500 and NASDAQ Composite all are trading near their all-time highs. But despite the lofty values, you don’t really get the sense that stocks feel “bubble”-like.

The real worry for a bubble is in the much bigger bond market.

Indeed, we’ve been hearing for years now about a possible bubble bursting in the bond market, and in particular the U.S. Treasury bond market. The reason actually is quite simple, and it has a lot to do with central banks and interest rates.

While the Federal Reserve, the European Central Bank and the Bank of Japan don’t directly control bond yields, each of these key central banks sets policies that make investors choose certain asset classes over others.

During the past several years, ever since the “Great Recession” started in about 2009, we’ve seen central banks around the globe go into hyper-easing mode. That’s made long-term Treasury and other government bonds attractive despite the pitifully low yield they pay.

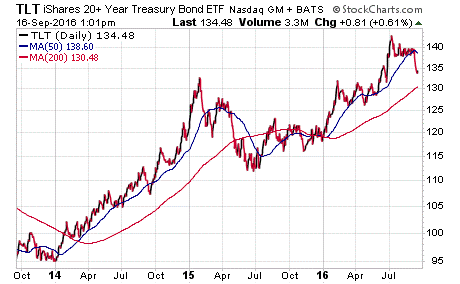

It also has made bonds a virtual “growth” asset over the past several years, as capital appreciation has been great if you own bonds like those in the iShares 20+ Year Treasury Bond (TLT). That fund is up some 20% over the past five years, and that doesn’t include the yield.

Yet as we told you last week, this time it could be different for bonds, as the Federal Reserve is looking as though it will hike interest rates at least once this year.

While no rate hike is expected when the Federal Open Market Committee (FOMC) issues its statement on Wednesday, all market watchers will be looking to see if the Fed gives us any hints of a rate hike in December. Right now, the market is placing the odds of a December hike at about 50%.

Such a hike likely would cause bond prices to fall and bond yields to rise, and that is what so many bond bubble theorists are afraid will trigger the beginning of an exodus from the bond market such that the bond prices will continue falling and bond yields will continue rising.

That could cause a bursting of the bond bubble, and that’s the theory of a lot of really smart bond fund managers, including Jeffrey Gundlach of DoubleLine Capital.

As we mentioned in last Friday’s Weekly ETF Report, Gundlach recently said that this is “a big, big moment,” for markets, predicting that “interest rates have bottomed.”

If Gundlach is right, that means bond yields are about to rise and bond prices are about to fall. That’s not good for bonds, and it’s not good for stocks.

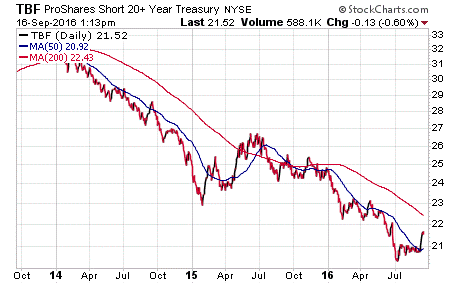

It is, however, good for inverse bond ETFs such as the ProShares Short 20+ Treasury (TBF). If the bond market does turn, we won’t hesitate to use funds like TBF to take advantage of falling bond prices.

And while I am not ready to do that just yet, it is something that all prepared investors need to be familiar with, as the last thing you want is to be caught by surprise when an enormous bubble is bursting.

If you want to make sure you’re ready for a potentially destructive bond bubble, then you need to click here to check out my Successful ETF Investing advisory service. Waiting any longer to be prepared is just inviting an ugly outcome.

****************************************************************

ETF Talk: Huge Emerging Markets Fund Offers Diversification

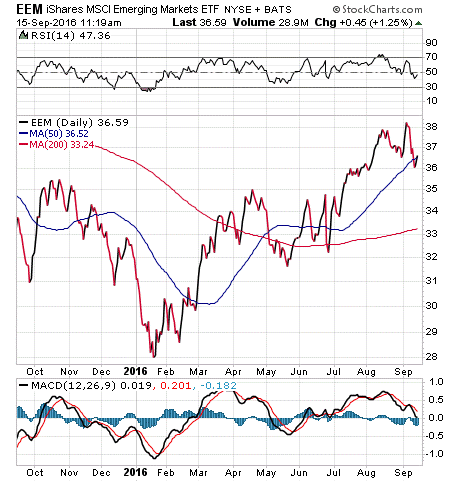

Our coverage of broad-based emerging markets exchange-traded funds (ETFs) today features another huge U.S.-based emerging markets fund, the iShares MSCI Emerging Markets Index (NYSE: EEM), with a whopping $30.6 billion in net assets.

A “broad-based” emerging markets ETF is one with investments not concentrated in a specific region. The fund seeks to track the investment of the MSCI Emerging Markets Index, which is composed of large- and mid-capitalization emerging market equities.

With money in more than 800 emerging-markets stocks, it is an understatement to say EEM’s portfolio is well diversified. The holding with the highest weight in the portfolio only makes up 3.77% of the fund’s investments, and all except nine holdings in the portfolio have weightings of less than 1%. This means two or three underperformers likely will have scant impact on the fund’s overall performance.

EEM has had a terrific year in 2016, with a total cash inflow of more than $6.7 billion, a number exceeded by only four other ETFs in the world. Its year-to-date return is 13.17%, beating the S&P 500’s 4.66% return by a large margin. The chart below indicates a clear rise in the price of the fund in 2016, starting at $28 at the beginning of the year to its current price of around $37, a tremendous increase of 32%.

View the current price, volume, performance and top 10 holdings of EEM at ETFU.com.

The fund has a dividend yield of 1.67% and an expense ratio of 0.69%. EEM’s top five holdings are Tencent Holdings Ltd, 3.77%; Samsung Electronics Co Ltd, 3.40%; Taiwan Semiconductor Manufacturing Co Ltd, 3.39%; Alibaba Group Holding Ltd ADR, 2.80%; and China Mobile Ltd, 1.89%. EEM typically holds onto most of its investments for the long term.

If you are interested in gaining exposure to large- and mid-sized companies in emerging markets and simple access to over 800 emerging market stocks, consider iShares MSCI Emerging Markets Index (EEM).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

On Avoiding Envy

“Nothing in this world can so violently distort a man’s judgment than the sight of his neighbor getting rich.”

— J.P. Morgan

Comparing your achievements to those of others is a losing proposition. This is especially true when it comes to feelings of jealousy with respect to money. Don’t let yourself play the comparison game, as no matter how rich you are or how nice your life is, there will always be someone you’ll envy… and it’s no surprise that envy is considered one of the seven deadly sins.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week about how Friday’s sell-off could indicate a turning point for your investments. This article, and many other past Weekly ETF Reports, can be found on StockInvestor.com, which is the new home of Eagle Daily Investor. I invite you to bookmark the site and follow it on Facebook and Twitter.