With all the layers of regulation that emerged from the banking crisis in the Great Recession of 2007-2009, capital became very difficult to access for small business owners. To some extent, that challenging credit cycle remains in place. Going through a bank or the Small Business Administration (SBA) for a loan can take several weeks. When small businesses need to acquire equipment, build inventory or secure space and labor, they usually need capital right away.

Business Development Companies (BDCs) are involved in helping grow small companies in the initial stages of their development. BDCs must be registered in compliance with Section 54 of the Investment Company Act of 1940 and are structured very much like real estate investment trusts (REITs) with a few exceptions. Like REITs, they are Regulated Investment Companies (RICs) which have to pay out 90% of net income to shareholders.

What makes BDCs uniquely different from REITs is that BDCs can use leverage to fatten up returns and employ the use of derivatives like equity warrants. Management can also charge a performance fee. When buying shares of BDC stocks, it’s important to get some idea of whether management is being paid a fair wage or are overcharging for its services, as would seem to be the case in some of the more high-profile BDCs.

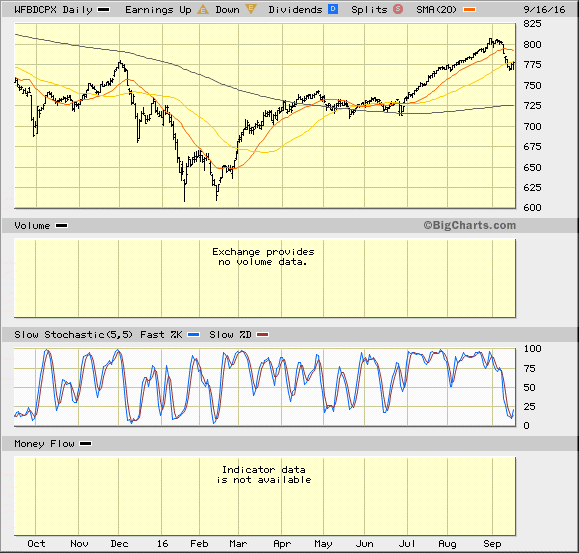

There is an index for BDCs that was created a few years ago. It is the Wells Fargo Business Development Company PR Index (WFBDCPX), the one-year chart of which is displayed below. The index reflecting the sector started 2016 out at the level of 725, got sold down with most everything in the January-February market correction and has since powered its way to new a 52-week high of 807 before the most recent bout of selling this month has seen the index pulling back to its 50-day moving average. At its current level of 777, the index is up 7.2% year to date, ahead of the S&P.

The BDC sector is an appealing investment proposition at this time in the investment cycle for a few reasons. First, small- to medium-sized companies can access capital in rapid fashion, being funded in as little as a week to 10 days. Secondly, many of the loans BDCs are originating in the current environment are of the floating-rate variety. If interest rates rise, so too will interest income from outstanding loans, which in turn will result in higher dividend payments because BDCs are pass-through securities. Third, as the economy improves, so does the creditworthiness of borrowers, and the risk of non-performing loans declines.

This recent pullback in the market and specifically in the BDC space is, in my view, an excellent buying opportunity. The sector is akin to a floating-rate, high-yield corporate bond portfolio, something that doesn’t exist in any form that investors can buy for their portfolios. The savvy move for BDCs at this point in the interest rate cycle is to fix their borrowing costs and issue most, if not all, new loans with adjustable rate features. This way, their margins expand big time if rates move up in any material way.

At a time when many brokers and talking heads are recommending banks before the Fed begins to tighten short-term rates, whenever that is, where dividend income is negligible, income and dividend investors can saddle up to the BDC sector with several well-positioned stocks, exchange-traded funds (ETFs) and even exchange-traded notes (ETNs).

Having exposure to the broader financial sector by way of investing in non-bank issues is where I’m seeing more interest. The regulatory overhang isn’t there, the business of what they do is almost 100% domestic in nature and the yields BDCs throw off are incredibly attractive. How does 6-13% sound when the S&P 500 is paying 2.0%, the 10-year Treasury Note is paying 1.7% and the average utility stock is yielding 3.4%?

My flagship service Cash Machine has several years of working with being in and out of the BDC sector and just recently, just before the market sold off, we booked profits on three BDC stocks for gains of 21.3%, 22.8% and 32.1%, respectively. With cash on the sideline, I’m coming back into at least two recommendations this week now that there is an attractive entry point. If you want to get in on these next best ideas in the BDC space, click here and become a Cash Machine member. Yes, there are places for income investors to go when rates eventually start to rise, and it’s exciting for me to show investors just where those places are.

In case you missed it, I encourage you to read my e-letter column from last week about how the Fed’s flip-flopping rhetoric affected the market landscape.