- No Fed Surprise Gives Stocks a Boost

- ETF Talk: Featuring an Effective Investment in Emerging Markets

- Fear of a Bond Bubble

- Madison on Power

The big news event this week came from Fed Chair Janet Yellen and her band of central bankers, who opted to leave interest rates alone, as was widely expected.

The Federal Open Market Committee (FOMC) also changed some verbiage in its official September meeting statement, and those changes also were widely anticipated.

Here’s one of the key lines from the FOMC statement:

“The committee judges that the case for an increase in the federal funds rate has strengthened but decided, for the time being, to wait for further evidence of continued progress toward its objectives.”

The Fed always wants to make sure it has an “out” in case the “further evidence” is negative enough for them to hold off once again. But as of today, the market is pegging the chances of a December hike at 50-50.

Another key line in the statement was that the Fed now thinks that “near-term risks to the economic outlook appear roughly balanced.” That is Fed code for yes, we will hike rates in December, so be ready, Mr. Market.

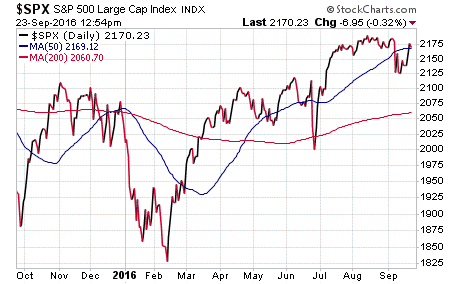

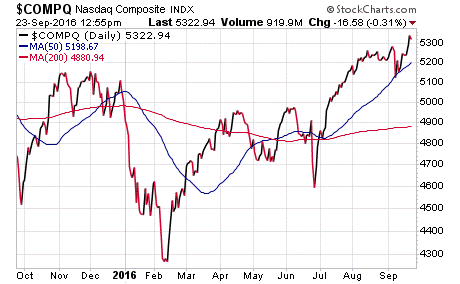

While we may get a rate hike in December, for now the market has breathed a sigh of relief that there were no surprises in the Fed statement. The result was a strong relief rally on Wednesday and Thursday that sent stocks up nicely on the week.

Today, stocks have pulled back a bit, and that is to be expected after the gains over the prior two trading sessions. And while stocks remain in an uptrend, trading near their all-time highs, there are plenty of reasons to feel uneasy about this market.

One source of uncertainty likely to play a big role over the next seven weeks is the presidential election.

The markets hate uncertainty more than they love or hate either major party candidate. So, the more contentious things get, and the closer the race gets, the more likely it is that we’ll see more volatility and more safety-oriented positioning in stocks as Election Day draws near.

If you want to make sure you’re prepared for election uncertainty, market pullbacks and bull-market spikes, then my Successful ETF Investing advisory service is for you.

We’ve been helping investors navigate all kinds of political, economic and market waters for nearly four decades, and this year is no different.

****************************************************************

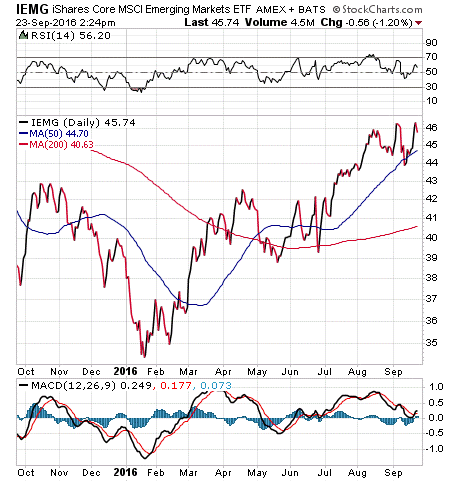

ETF Talk: Featuring an Effective Investment in Emerging Markets

The iShares Core MSCI Emerging Market ETF (IEMG) is an exchange-traded fund (ETF) that offers investors a chance to invest broadly in emerging markets as a whole rather than take the heightened risk of buying into a specific sector or country.

This broad-market approach involves IEMG tracking the investment results of an index that consists of all types of emerging market equities — large-, mid- and small-cap companies from around the globe are all included in this fund. Founded in 2012, IEMG originally was viewed as a cost-effective alternative to the main emerging market benchmark ETF, the iShares MSCI Emerging Markets (EEM).

IEMG is only half the size of EEM, which has a giant market cap of $30 billion. Even so, IEMG has attracted a lot of attention in the four years since its inception and currently boasts year-to-date fund flows of almost $5 billion. One possible explanation for IEMG’s quick growth in funds under management could be its lower annual fees compared to its bigger rival. EEM charges an annual fee of 0.71%, whereas IEMG charges investors just 0.16% annually.

In terms of asset allocation, IEMG is invested almost entirely outside of the United States, with 72% of its portfolio in Asian stocks. Europe and South America account for a combined 27% of the remaining portfolio.

Despite the turbulence of global markets this year, IEMG has a respectable year-to-date return of 16.9%. This isn’t the strongest return among emerging markets thus far this year, but it still is impressive since emerging markets as a whole are more resistant to extreme price swings than individual sectors or countries. Investors in this fund can expect an expense ratio of 0.16% and a 2.1% dividend yield.

View the current price, volume, performance and top 10 holdings of IEMG at ETFU.com.

IEMG is fairly well diversified among different sectors, but its biggest investments are in technology, 23.18%; financial services, 21.56%; and consumer cyclical, 12.34%. The fund’s top holdings and their percentage of the portfolio’s assets include Tencent Holdings Ltd., 3.72%; Taiwan Semiconductor Manufacturing, 3.52%; Samsung Electronics, 3.46%; Alibaba Group Holding, 2.79%; and China Mobile, 1.85%.

So far, 2016 has been a year of ups and downs for many investors, but the emerging markets have been a bright spot in the financial landscape this year. If you like the idea of investing in emerging markets but aren’t thrilled to be putting your hard-earned capital at risk, consider a broad emerging market fund such as the iShares Core MSCI Emerging Market ETF (IEMG) as a possibility.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

*****************************************************************

Fear of a Bond Bubble

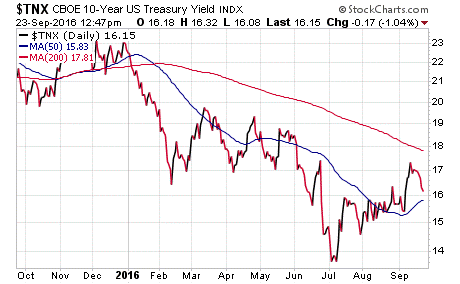

When it comes to talk of a market “bubble,” it’s not equities that are the real worry among the smart money.

Sure, stocks in the Dow, S&P 500 and NASDAQ Composite all are trading near their all-time highs. But despite the lofty values, you don’t really get the sense that stocks feel “bubble” like.

The real worry for a bubble is in the much bigger bond market.

Indeed, we’ve been hearing for years now about a possible bubble bursting in the bond market, and in particular the U.S. Treasury bond market. The reason why actually is quite simple, and it has a lot to do with central banks and interest rates.

While the Federal Reserve doesn’t directly control bond yields, global central banks set policies that make investors choose certain asset classes over others.

During the past several years, in fact, ever since the “Great Recession” started in about 2009, we’ve seen central banks around the globe go into hyper-easing mode. That’s made long-term Treasury and other government bonds attractive despite the pitifully low yield they pay.

Yet this time it could be different for bonds, as the Federal Reserve is looking as though it will hike interest rates at least once this year.

While no rate hike was delivered this week at the FOMC meeting, there is a strong possibility of a rate hike in December. Such a hike likely would cause bond prices to fall and bond yields to rise, and that is what so many bond bubble theorists are afraid will trigger the beginning of an exodus from the bond market such that the bond prices will continue falling and bond yields will continue rising.

That could cause a bursting of the bond bubble, and that’s, in part, the theory of a lot of really smart bond fund managers, including Jeffrey Gundlach of DoubleLine Capital.

As I wrote last week, Gundlach recently said that this is “a big, big moment,” for markets, predicting that “interest rates have bottomed.”

If Gundlach is right, that means bond yields are about to rise and bond prices are about to fall. That’s not good for bonds, and it’s not good for stocks.

Madison on Power

“The truth is that all men having power ought to be mistrusted.”

— James Madison

The brilliant founding father James Madison has so many fantastic quotes it’s hard to pick his best. Yet this simple quote may just be his most important, as Madison reminds us all about the need to be skeptical of those who wield the power of the state. Let’s keep this in mind while we watch the presidential debate on Monday night.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week about the bond market bubble that could lead to the next financial crisis. This article, and many other past Weekly ETF Report e-letters, can be found on StockInvestor.com, which is the new home of Eagle Daily Investor. I invite you to bookmark the site and follow it on Facebook and Twitter.