The Dow is nearly at 20,000, and optimism about the U.S. market and the American economy are brimming.

Yet does that mean that U.S. stocks are going to lead the charge higher in 2017? Not necessarily.

After all, it’s rare that one market has a great year, and then leads the way higher the succeeding year. It also is rare that markets that have been beaten up for several years remain battered.

When it comes to international equities, we have a situation where after many years of relative underperformance, the opportunities are starting to look very attractive.

In fact, right now, subscribers to my Successful ETF Investing advisory service have been repositioning their portfolios to gain more exposure to international stocks. The reasons why are pretty simple.

First, a strong U.S. dollar is bearish for currencies such as the euro and the yen, and weak currencies in these respective markets are bullish for equities.

Second, on a valuation basis, international stocks are relatively inexpensive compared to U.S. stocks. For example, the price-to-earnings (P/E) ratio on stocks in Europe and Japan is, on average, about 12-13.

The P/E ratio on stocks in the S&P 500 is roughly 19. This means international stocks offer a better value proposition than domestic stocks at this juncture.

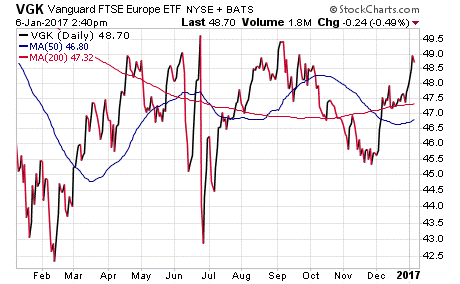

Finally, after struggling throughout much of the past two years, stocks in the Far East, Europe and Japan all are enjoying technical breakouts.

The charts above of the iShares MSCI EAFE (EFA), the Vanguard FTSE Europe ETF (VGK) and the Vanguard FTSE Pacific ETF (VPL) show each fund now breaking above its respective 50-day moving average and heading toward new 52-week highs.

It is this renewed optimism in international equities that has gotten my attention, and it’s something I think should get your attention as well.

If you’d like to put the power of this proven plan in place for your investments — one that has worked for nearly four decades — then I invite you to check out Successful ETF Investing right now.

A Special Announcement, Part I

Today’s Weekly ETF Report will be the last issue sent on a Friday.

Beginning next week, this publication will be sent out on Wednesdays.

The new day of the week really is the old day of the week, as we originally wrote and sent this publication on Wednesdays. I must admit I prefer doing this publication Wednesdays, as it gives me a chance to touch base with readers midweek rather than at the back end of the week.

So, be sure to check your email inbox around this time every Wednesday for the Weekly ETF Report.

Next week, I’ll be giving you another special announcement about this publication, one that I think you’ll like quite a bit.

On the Consistent Man

“A consistent man believes in destiny, a capricious man in chance.”

— Benjamin Disraeli

If you want to achieve anything in life, you must be consistent and you must believe in yourself. Forget about whim and chance, those aren’t to be counted on. The only thing you can control is how consistent you are with reality. So, be consistent, and craft your own destiny.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Doug.

In case you missed it, I encourage you to read my e-letter article from last week about the ups and downs we saw in the markets during 2016.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)