“Our study reveals that the risk-takers who optimistically invested in equities [the stock market] were the group who triumphed in the long run.”

— “Triumph of the Optimists” (2002), p. xi.

I asked Jeremy Siegel last week if anyone has written a book on foreign stock markets similar to his classic book, “Stocks for the Long Run.” In his work, the Wizard of Wharton showed that U.S. stocks had sustained a long-term upward trend since 1802, despite devastating wars, depressions and bank panics. In other words, it pays to be a bull.

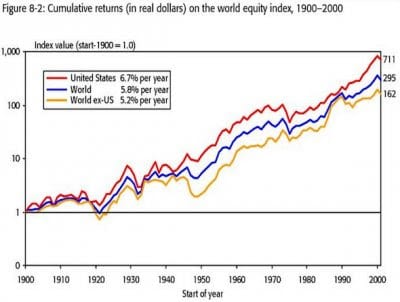

Siegel told me that a similar study was done on foreign stocks called “Triumph of the Optimists: 101 Years of Global Investment Returns,” by three British professors at the London Business School. They demonstrated that in all 16 countries (primarily in Europe and North America) in their survey, stocks outperformed bonds and gold over the long term and enjoyed a long-term upward trend during the 20th century — despite two world wars, the Great Depression, runaway inflation, currency crises and other unstable conditions. See the chart below.

World stock markets 1900-2000.

Source: “Triumph of the Optimists” (2002)

I thought Japan would be an exception due to World War II and the fact that the Nikkei Index topped out at 39,000 in 1990, and has yet to fully recover. That’s a 27-year bear market! Moreover, the Japanese market collapsed during World War II. And yet… the overall trend is upward. Japanese stocks rose 89-fold during the 20th century!

One Important Lesson about Country Funds

But there’s nothing automatic about these long-term bull markets.

After all, the survey does not include the numerous countries that do not have sufficient data or whose stock exchanges were forced to shut down during the 20th century. Not a single country in Latin America is included in the survey — not even Mexico, Brazil or Argentina. That’s because their economic conditions were so bad that their stock exchanges were moribund or closed for years.

Argentina is a classic example. The Buenos Aires Bolsa was established in 1854, and was active and growing into the 20th century as Argentina became the 10th largest economy in the world due to heavy European immigration and an explosion in commodity exports.

Then came the Great Depression and the election of the populist authoritarian Juan Perón, who nationalized industries and sent the economy into a nosedive from which it has never fully recovered. The Buenos Aires stock exchange went years without significant trading, and only re-established itself with the MERVAL index in 1986.

Stocks of major industrial countries recovered and returned to their long-term bullish trend. The reason is that after the wars and economic turmoil, they returned to a more stable, capitalistic model of economic growth.

In sum, the underlying assumption of a bull market on Wall Street or any other foreign stock exchange is a free-market economy. A bull market is not automatic. Eliminate or shackle that capitalist economy and you will end up with a bear market or a closed exchange.

When will the music stop on Wall Street? When the United States no longer favors free-market capitalism. You can never take for granted that stocks will inevitably move higher. It all depends on government policy and setting the right environment for a bull market.

Investors have made money in the long run by investing as private sector companies that were free to pursue their own best interests and their customers’ without too many suffocating regulations, taxes and inflation. So far, the increasing burden of taxes and regulations (Sarbanes-Oxley, Obamacare, Dodd-Frank, etc.) and central bank policy has not been sufficient to stop the bulls from making money. There also are efforts afoot to lower taxes and regulations while reigniting growth, which is bullish.

Therefore, I continue to ignore the merchants of doom and gloom and stay 100% invested in the stock market.

Long live the bulls!

In case you missed it, I encourage you to read my e-letter from last week about how the Fed is looking to tighten interest rates.

Upcoming Conferences

The traditional Tax Day, April 15, falls on this Saturday, so when I was invited to address the Los Angeles chapter of the American Association of Individual Investors (AAII), I decided to speak on “How to Maximize Your Profits and Minimize Your Taxes.” The meeting starts at 9 a.m. at the Skirball Cultural Center in Los Angeles. To sign up, email the AAII program director Fred Wallace at fredwallace77@gmail.com. My subscribers are welcome to attend. The fee is $12 at the door. After my talk, I will be autographing copies of the new 5th edition of “Maxims of Wall Street.” With the IRS giving an extension to file taxes until April 18 this year, join me on April 15. See you there!

Las Vegas Investment Club, April 18, Orleans Hotel: I’ll be speaking at the Club meeting on Tuesday, April 18, about the Trump Agenda and how it will affect your business and investments. Also speaking is Dr. Bo Bernhard, PhD executive director for International Gaming Institute. For more information on attending, go to http://lvinvestmentclub.com.

MoneyShow Las Vegas, May 15-18, 2017, Caesars Palace: Join me at the MoneyShow in Las Vegas to hear the latest tips about investing strategies. Other speakers include Mike Turner, Jeffrey Saut, Jim Stack, Pamela Aden, Marilyn Cohn and Matt McCall. I hope to see you there. To register free as my guest, call 1-800-970-4355 or 1-941-955-0323 and mention priority code 042818. Click here if you prefer to sign up online.