Investment-grade bonds have been surprisingly strong performers this year in defiance of conventional wisdom.

One way to take advantage of rising bond prices is through the iShares Core U.S. Aggregate Bond ETF (AGG), an exchange-traded fund (ETF) that focuses on investment-grade U.S. bonds. As its name implies, the ETF invests in U.S.-based bonds such as Treasuries and high-quality corporate bonds.

With $43.83 billion in total assets, a daily trading volume of $265.3 million and a whopping 6,203 total holdings in its portfolio, AGG is an enormous fund. However, it operates with high efficiency and high liquidity, boasting an expense ratio of only 0.05%, which is considerably lower than most of its rivals.

AGG maintains its liquidity by only lightly investing (about 11%) in long-term bonds that have a maturity date of 20 years or more. Instead, 85% of AGG’s bonds have a maturity date of less than 10 years.

A bond is considered investment grade, if its credit rating is BBB- or higher, as determined by Standard & Poor’s. Roughly 72% of bonds held by AGG are AAA rated, and about 28% are rated in the range of AA to BBB.

Bear in mind that bonds tend to move in the opposite direction of stocks. They also tend to be sensitive to changes in interest rates, so pay attention to any expected rate hikes from the Fed and make sure you take appropriate action.

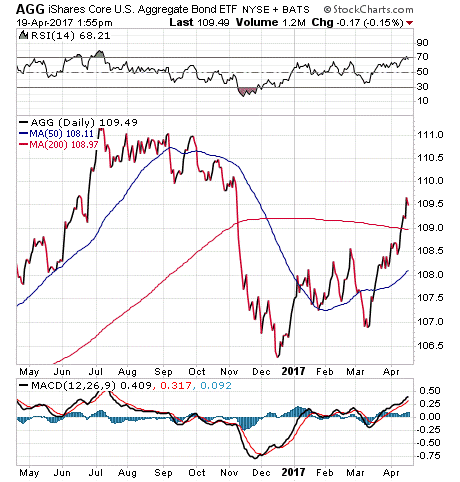

From the chart below, you can see that AGG took a hit during the “Trump Rally” in the stock markets, starting in November 2016. Since the beginning of the year though, AGG recently has been on a path to recovery. Year to date, AGG has a return of 1.68%, versus the S&P 500’s return of 5.54%. AGG has a distribution yield of 2.67%.

AGG’s top five holdings are the U.S. Treasury, 36.86%; Federal National Mortgage Association, 14.20%; Federal Home Loan Mortgage Corporation – Gold, 7.45%; Government National Mortgage Association II, 7.25%; and Federal Home Loan Mortgage Corporation, 0.75%.

If you are seeking dedicated exposure to U.S. investment-grade bonds during their surprising rise this year, I encourage you to look into iShares Core U.S. Aggregate Bond ETF (AGG) as a potential investment.