All truth goes through three stages.

First, it is ridiculed.

Second, it is violently opposed.

Finally, it is accepted as obvious.

— Arthur Schopenhauer

I’ve recently written a lot about why I think, after a spending a decade in the dog house, global investing is back.

I’ve taken a lot of flack for this view in both emails and online comments.

But like Arthur Schopenhauer, I am taking the ridicule in stride.

I am now more convinced than ever that we are in the early innings of a long overdue bull market in global stock markets.

Investors have long forgotten that between 2003 and 2007, emerging markets stocks were the single best-performing asset class in the world.

The MSCI Emerging Markets Index generated between 25.95% and 56.28% returns for five years straight.

Here’s Why Emerging Markets Are Set to Soar

First, U.S. stocks have been the top-performing stock market in the world over the past three and 10 years. Over a five-year period, U.S. stocks trailed only Ireland.

Such extremes inevitably “revert to the mean.”

Second, U.S. stocks are as expensive relative to the rest of the world as they have ever been on a Cyclically Adjusted Price Earnings (CAPE) basis.

Popularized by Yale Nobel Laureate Robert Shiller, CAPE is the current price of a market divided by the average of 10 years of earnings adjusted for inflation.

Think of CAPE as a long-term price-to-earnings (P/E) ratio.

Today, U.S. stocks are trading at a CAPE ratio of just under 30. That makes U.S. stocks the third most expensive stocks in the world after Denmark and Ireland.

In contrast, emerging markets trade at a CAPE ratio of just 14.9.

Such a huge divergence tells you a lot about future expected returns.

In the United States, you can expect to earn about 4% real returns per year over the next decade.

In emerging markets, you can expect twice that amount — 8%.

I believe that the outperformance of emerging markets has just started.

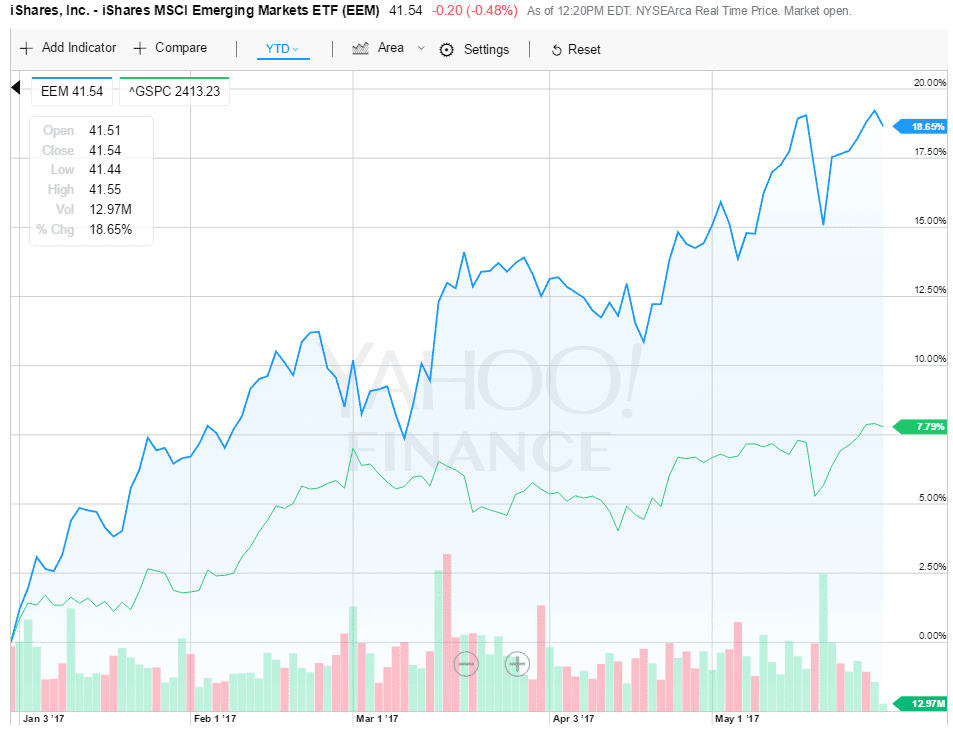

Emerging market stocks have already outperformed their U.S. counterparts by almost 3-1 over the past three months.

iShares MSCI Emerging Markets (EEM) versus the S&P 500

Emerging Europe: The World’s Biggest Bargain

I am not alone in pointing out the value in emerging markets.

Hedge manager Jeff Gundlach’s favorite trade for 2017 is to buy the MSCI EM ETF (EEM) and short an S&P 500 Index ETF (SPY).

Yet, I bet that you haven’t heard that among emerging markets, the best-performing region over the next five years is likely to be emerging Europe.

That’s because “Emerging Europe” is the red-headed stepchild even among emerging markets.

While China and India together make up for 30% of the world’s gross domestic product (GDP), countries in emerging Europe rarely reach the size of average U.S. states.

The core emerging European countries consists of the former Eastern Bloc — Poland, Hungary, The Czech Republic and Slovakia.

In terms of population, Hungary equals Michigan; the Czech Republic is Georgia; Slovakia stands in for Minnesota.

The big dog of the region is Poland, with a population equal to that of California.

Even taken together, the former Eastern Bloc’s combined economies as measured by GDP are smaller than the state of Florida.

No wonder portfolio managers work hard to expand their definition of “Emerging Europe” to include Greece and Turkey.

The SPDR S&P Emerging Europe ETF includes Greece and Turkey, as well as the titan of the region, Russia, which alone accounts for over 50% of the Index.

Why Invest in Emerging Europe

There are three reasons to invest in Emerging Europe.

First, markets are cheap.

Emerging Europe as a whole trades at a CAPE ratio of 8.3. That’s over a 40% discount to emerging markets as a whole. Or the emerging Europe CAPE ratio trades at a 73% discount to the S&P 500.

An incredible five out of the top seven cheapest markets in the world, as measured by CAPE, are in emerging Europe (Russia, Czech, Turkey, Poland and Hungary).

Drilling down even further, tiny Hungary boasts three of the top six cheapest stocks on the planet through the lens of CAPE.

That’s three Hungarian stocks from a global universe of roughly 45,000 listed stocks on the planet.

Second, investors hate emerging Europe. The thought of investing your hard-earned money in Russia or Turkey is unlikely to make you feel warm and fuzzy. From an investment standpoint, that’s a good thing.

Third, except for Russia, the region’s stock markets are in an uptrend. As a group, they are among the top-performing stock markets in 2017.

How Can You Invest in Eastern Europe?

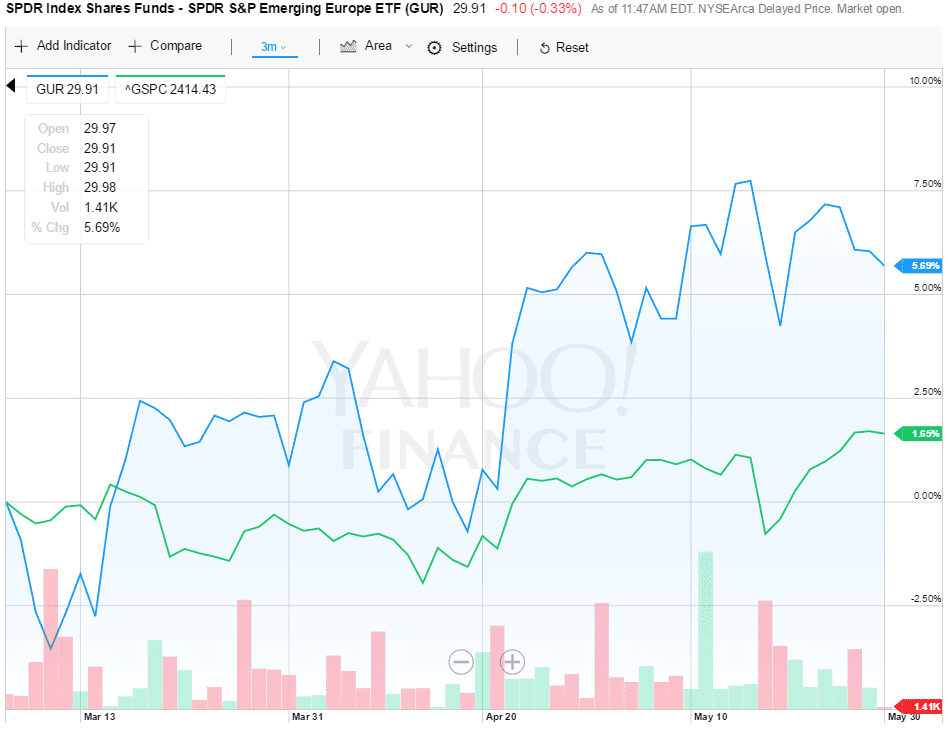

You can invest in the emerging Europe through the S&P 500 Emerging Europe ETF (GUR).

S&P 500 Emerging Europe ETF (GUR) versus the S&P 500 over three months.

This ETF has outperformed the S&P 500 over the past three months, despite holding about 50% of its investments in Russia — the world’s worst-performing market in 2017, after Nigeria.

Instead, I recommend you invest in individual country ETFs.

That’s a challenge as smaller markets like the Czech Republic and Hungary don’t have any ETFs.

Below are three Emerging European ETFs you can consider.

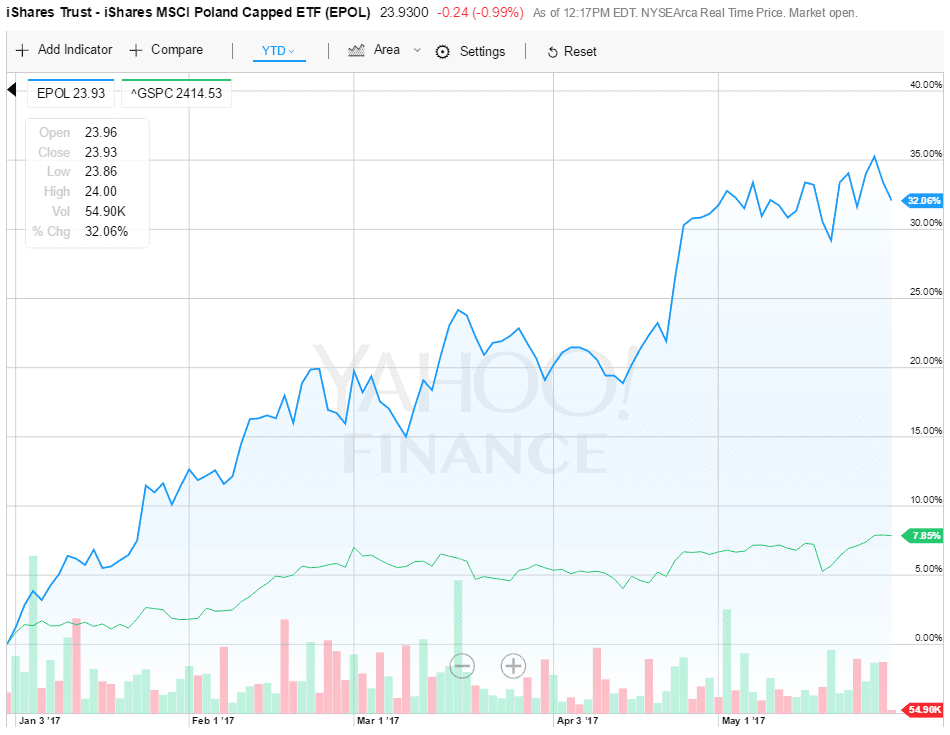

I. iShares MSCI Poland Capped ETF (EPOL)

iShares MSCI Poland Capped ETF (EPOL) versus the S&P 500 year to date.

Poland is the only Eastern European country with an ETF. It ranks #2 among 47 global markets I track daily. Its CAPE ratio is 11.4, and it is the fifth-cheapest market in the world. With $293 million in assets, EPOL is up 33.39% year to date.

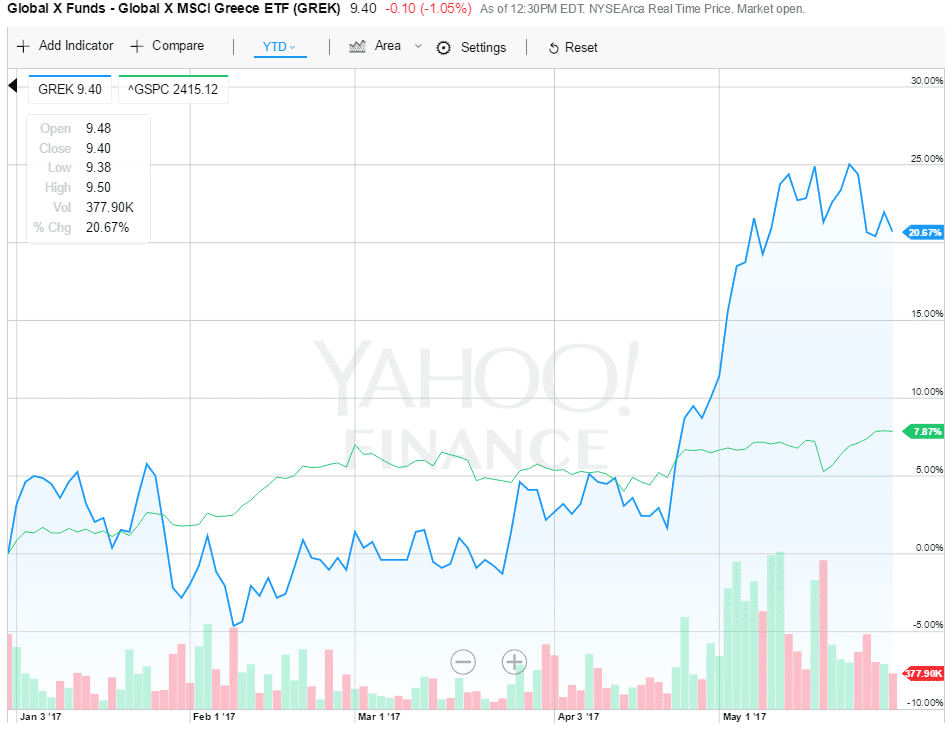

II. Global X MSCI Greece ETF (GREK)

Global X MSCI Greece ETF (GREK) versus the S&P 500 year to date.

You may be surprised to learn that this crisis-wracked country is the ninth-best performing foreign stock market ETF among 47 global markets in 2017. With $376 million in assets, GREK is up 21.95% year to date.

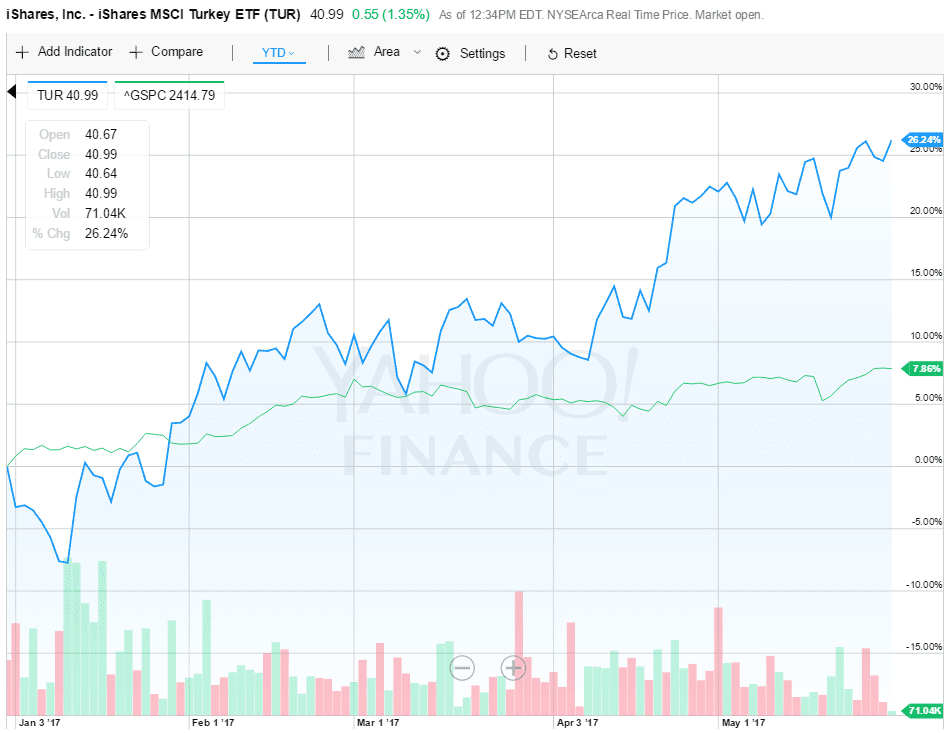

III. iShares MSCI Turkey (TUR)

iShares MSCI Turkey (TUR) versus the S&P 500 year to date.

Turkey ranks #6 among the 47 global markets I track daily. With a CAPE ratio of 10.1, it is the third-cheapest market in the world. TUR has $409 million in assets and is up 24.36% year to date.

What is to Be Done?

The lesson is clear.

Stock markets have their seasons. The U.S. stock market has been “in season” for the past decade.

In contrast, global stock markets have been a terrible place to invest.

I believe the seasons are now changing.

If you want to generate more than a 4% real return in the U.S. stock market over the next decade, grit your teeth and go global.

You’ll be glad you did.

P.S. Global stock markets today are all about momentum, as is my new trading service, Momentum Trader Alert. With 34 of the 47 global stock markets I track up by at least double-digit percentages so far this year, you can be sure that you’ll see a lot of global stock picks in the service in the months ahead. To find out more, please click here.

What I’m Reading

More Money Than God: Hedge Funds and the Making of New Elite

This old school hedge fund is going quant

“10 Stocks to Last the Decade” — A look back at a Fortune article from the heights of the tech bubble.

When Will AI Exceed Human Performance? Evidence from AI Experts

What I’m Listening To

Interview With “Mr. Serenity“ and “Market Wizard” Tom Basso

Advice I am Considering

Todd Coombs — one of Warren Buffett’s two potential successors — career recommendation? “Read 500 pages per day.”

Fact of the Week

The world’s top 25 hedge-fund managers have seen their combined earnings almost halved from the $21.2 billin they were taking home three years ago. The fall in pay to $11 billion — the lowest total in 12 years — is due to investors withdrawing $70bn from hedge funds last year, according to Hedge Fund Research.

In case you missed it, I encourage you to read my e-letter from last week about what chess master Garry Kasparov’s loss to IBM’s Deep Blue in 1997 tells you about market trading today.