The PureFunds ETFx HealthTech ETF (Nasdaq: IMED) stands at an interesting crossroads between the field of medicine itself and the technology used to advance medical knowledge and treatment in new and exciting ways.

This intersection between medicine and technology has been dubbed “HealthTech.” Medicine continuously is driven forward by the application of new technology and data solutions to devices and procedures. “HealthTech” has made things like 3D-printed prosthetics, robot-assisted surgery and telemedicine popular buzzwords in the medical field.

One advantage that HealthTech has over other, more stagnant areas of the market and the medical field is its growth prospects. Obamacare initiatives and biotech, the drug manufacturing arm of the medical field, face an uncertain future under President Trump’s proposed policies, but there is always going to be demand for better and more advanced technology to keep the medical field on the cutting edge. According to Fortune, venture funding into HealthTech jumped 200% over five years (2010-2014) and the industry was valued at $72 trillion in 2015 in the United States alone.

Despite this, HealthTech has been slow to get investor attention, probably because of the tendancy to invest in more traditional medical plays, such as biotech. PureFunds, the manager/sponsor of the popular cybersecurity ETF HACK, saw that there was no ETF assigned to the HealthTech arena and launched IMED just last year for that exact purpose.

Created on August 31, 2016, IMED is tied to the ETFx HealthTech Index and tracks companies around the world that use technology to design and deliver health care solutions. The fund avoids pharmaceutical companies, which are currently on uncertain footing, and instead targets medical infomatics, instruments and devices.

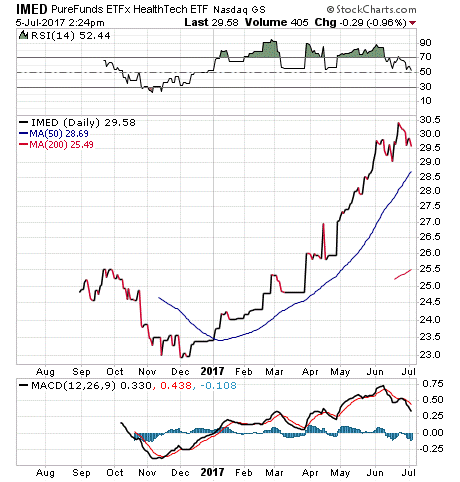

According to Andrew Chanin, CEO of PureFunds, IMED has less than 40% overlap with any other health care ETF currently available. The fund does not pay a dividend at present, has an expense ratio of 0.75% and only about $4.4 million in net assets, partly as a result of being less than a year old. In terms of performance, IMED has done well since its inception and is up close to 24% year to date.

A company must have a market capitalization of at least $500 million to be included in the index, and it contained 22 foreign investments as of June 2016. IMED itself holds 48 positions currently and is approximately 75% in health care and 25% in technology. Its top five holdings are: Teladoc, Inc. (TDOC), 3.12%; Medidata Solutions, Inc. (MDSO), 3.00%; CompuGroup Medical SE, 2.78%; athenahealth, Inc. (ATHN), 2.77%; and Veeva Systems, Inc., Class A (VEEV), 2.67%

In short, HealthTech has the potential to be long-term player in the medical and health care field. If the intersection between medicine and technology sounds like an interesting investment strategy, then the PureFunds ETFx HealthTech ETF (Nasdaq: IMED) could be a solid choice.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.