The Global X Uranium ETF (URA) is an exchange-traded fund (ETF) that is capable of energizing of your investment portfolio. The fund jumped 22% in the first three weeks of January, but it has been on a roller-coaster ride since then, with stomach-churning ups and downs.

Despite the recent price gyrations, here are a few reasons to like uranium as an investment.

Nuclear power serves as a key energy source around the world, and that means there is a strong base level of demand that exists for uranium as a fuel for power plants. Unlike solar and wind power, nuclear energy is not dependent on weather conditions. Furthermore, uranium is an efficient source of energy. For instance, one pound of uranium can generate as much energy as approximately 100,000 pounds of coal.

In addition, uranium leaves behind a fraction of the carbon footprint that coal does. With demand for energy showing no signs of dissipating, especially as China and India continue relatively fast-paced economic growth, uranium prices ultimately should rise.

However, interest in the energy source has diminished in countries such as Germany, and that’s largely due to the adverse consequences of last year’s accident at Japan’s Fukushima nuclear power plant that was caused by the devastating effects of an earthquake and a tsunami. The incident brought recollections of the April 1986 Chernobyl nuclear plant accident in the Ukraine, which stalled development in the nuclear industry for a number of years.

Yet, despite the fears generated from the Fukushima incident, there are ample reasons to believe uranium demand will remain high, and taking advantage of this can be accomplished with an investment in Global X Uranium ETF.

The fund seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global Uranium Index. URA gives you exposure to uranium mining companies worldwide, with the vast majority of mined uranium being used in the nuclear energy industry.

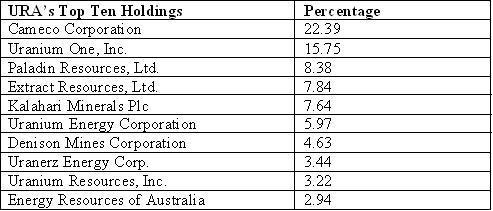

The table below shows the top ten holdings in URA.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my ETF Trader service. As always, I am happy to answer your questions about ETFs, so do not hesitate to email me by clicking here. You just may see your question answered in a future ETF Talk.