The big question swimming around every market pundit’s head right now is whether we are in an equity market bubble, and whether that bubble is going to burst and send stocks collapsing the way they did in 2008-2009, in 2000 and in 1987.

From high-profile bond fund managers to doom-and-gloom prophets to Nobel Prize winners, the banter is all about bubbles. Now, I can certainly understand this fascination, as the bursting of a market bubble can be extremely hazardous to your wealth, especially if you insist on investing the way the Wall Street marketing machine wants you to, and that is to buy-and-hold and sweat it out through any market action.

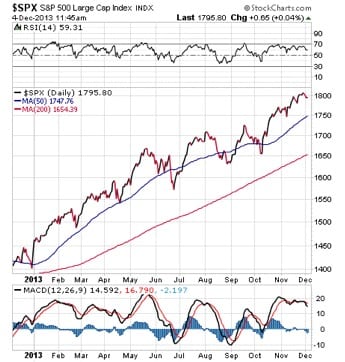

I think the question of bubbles is logical given the fact that the S&P 500 has vaulted some 26% year to date. In fact, the broad measure of the domestic market is on pace to have its best year since 2003. When things get this bullish, we all start to worry about how long the good times will last.

The chart here of the S&P 500 Index during the past 12 months shows just how strong this market has been. It also shows the complete lack of any substantive pullback over the year. And, aside from modest June, August and September dips, this market has kept up its relentless move to the upside.

Now, while the move higher in U.S. stocks continues, things have been different in the emerging markets. The chart here of the iShares MSCI Emerging Markets (EEM) shows the volatility in this market segment. This chart demonstrates the recent breakdown in emerging markets. That breakdown could be the first sign of a selling trigger in U.S. stocks.

However, until we see a significant breakdown in the price of major averages such as the S&P 500, the Dow and the Russell 2000 Index, the market likely will ignore bubble worries and keep chasing the outstanding 2013 performance.

If you want to read about bubbles in much greater detail, and about how to protect your money from the next busted bubble, then I invite you to check out my Successful Investing newsletter today. In our upcoming January issue, we tackle the bubble question and see what’s at the heart of the worries. We also show you how to recognize a bubble before it bursts, and how to protect your serious money from the fallout.

A Skeptical Resolution

There is less than a month left before we close the books on 2013, and this year has been a very good one for the bulls. However, one thing I will caution you on is not to expect the same kind of market year in 2014. Sure, the market may keep rolling unabated to another 25% gain in 2014, but the odds and logic just don’t augur well for that outcome.

So, I think one key New Year’s resolution you can make right now is to simply be skeptical

By skeptical, I don’t mean be bearish. Rather, I mean don’t get lulled into a false sense of security that everything is going to be okay, and that your money is going to just keep rising at 2013 rates, which historically is an extremely atypical performance.

Just remember that markets do not go up forever, but they can go up for a long time without a correction or bear market. However, when bear markets do come, they can be swift and violent, and very unforgiving to the ill-prepared investor.

So, be skeptical and be prepared.

On Doing

“To be is to do.”

–Immanuel Kant

The German philosopher reminds us, with great brevity and wit, that we are what we do in life. That means in order to really be who you want to be, you have to do the things that make you that person. So, if you have a goal in your head you want to accomplish, or a passion that you’ve yet to pursue, don’t wait any longer. Just go out and do it, and remember that to be, is to do.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow Making Money Alert readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read last week’s article about giving thanks for ETFs. I also invite you to comment about my column in the space provided below.

![[interlocking Chinese and American flag puzzle pieces]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_73473043.jpg)