“What I love most about FreedomFest are the debates!”

— John Mackey (CEO, Whole Foods Market)

Many of my free-market friends have attacked Paul Krugman, the inflammatory New York Times columnist and Nobel Prize winner, for deliberately distorting the facts about the economic recovery, austerity programs in Europe, the federal deficit, taxes, school choice, etc. Krugman has been especially critical of the “Austrians” for predicting double-digit inflation and another recession.

In response, Steve Moore, Peter Schiff and Robert Murphy, among others, have challenged Krugman to a formal debate. But Krugman has adamantly refused…

Until now!

I have just confirmed the Dream Debate of the Century at my big show FreedomFest. On July 9, 2015, in the Celebrity Ballroom in Planet Hollywood, Las Vegas, Paul Krugman has agreed to debate the Heritage Foundation’s chief economist Steve Moore on “How Best to Restore the American Dream.”

The Krugman vs. Moore debate will feature the #1 Keynesian vs. the #1 Supply-Sider… the #1 New York Times columnist vs. the #1 Wall Street Journal columnist. I can’t wait.

Krugman is the most sought-after speaker in the world today on all matters financial and economic. He’s so big that the New York Times gives him more space than any other columnist, running his controversial columns twice a week. And he wants to come to FreedomFest. Love him or hate him, everybody reads him — and now you can meet and debate him in person, too (the debate will include questions and answers from the audience).

Krugman and Moore have been taking shots at each other for years, and now they finally will meet on stage to battle it out, one on one, on the hot issues of the day.

This will not be any ordinary debate. I will serve as moderator and we will discuss one issue at a time: Red States vs. Blue States (especially California)… Flat Tax vs. Progressive Tax… Austerity vs Stimulus… Inequality vs. Growth… Market Healthcare vs. ObamaCare… Easy Money vs. Deficit Spending…Market Capitalism (USA) vs. State Capitalism (China)… and many more topics. The debate will be followed by an autograph session by both authors.

This is an event you won’t want to miss at “Liberty’s greatest show on earth.” The dates are July 8-11, 2015 (just think 7-11 in Vegas!) at Planet Hollywood. We take over the entire hotel.

The best and the brightest will be there — the major media, all free-market think tanks and freedom organizations, the Anthem film festival and thousands of freedom lovers. Plus many of last year’s top speakers are returning by popular demand, including Steve Forbes, Dinesh D’Souza, Grover Norquist, Charles Murray and Peter Thiel, among others.

It already has created a lot of buzz, and we expect a standing-room-only crowd at Planet Hollywood in Las Vegas. Due to the heavy demand for FreedomFest tickets next year, we are limiting the “early bird” discount ($100 off per person/$200 per couple) to the first 1,000 people to sign up. After that, the price goes up to $495 per person/$795 per couple. I urge you to sign up now. Go to www.freedomfest.com, or call Tami Holland, 1-866-266-5101.

Special Bonus

Note: Everyone who signs up will receive a special report via email called “Krugman Alert: Fighting It Out with Paul Krugman,” the inside story of my run-ins with Krugman, as well as what the future means for business and Wall Street if Krugman’s policies are enacted. This report will be made available only to FreedomFest attendees. You also will receive regular updates on Krugman’s latest writings and his critics (including Steve Moore) in preparation for the big debate.

You Blew It! Fed Could Have Given Every Household $56,000!

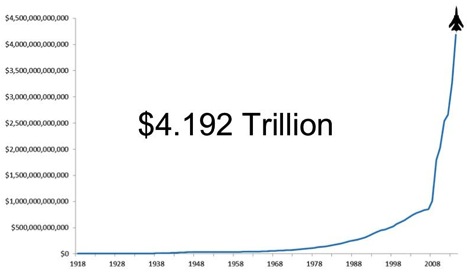

Next year at FreedomFest, we are going to put “The Federal Reserve on Trial,” and for good reason. Following the financial crisis of 2008, Chairman Ben Bernanke and the Federal Reserve Board decided to buy trillions of dollars in Treasury and mortgage-backed securities as part of a broad policy known as Quantitative Easing (QE). Today, the Fed has a balance sheet that has ballooned to more than $4 trillion.

Federal Reserve’s Net Assets

Federal Reserve Board, Morgan Stanley Research

In short, QE was a bailout of Wall Street and the commercial banks. No wonder George W. Bush was given a standing ovation at a recent conference of hedge fund managers in Las Vegas.

Could the government have done something else to stimulate the economy?

Yes, in the latest issue of Foreign Affairs, Brown University political economist Mark Blyth and London-based hedge fund manager Eric Lonergan contend that the Fed could have done better by giving money to individuals directly. “Instead of trying to drag down the top, governments should boost the bottom,” they write in an article titled “Print Less But Transfer More: Why Central Banks Should Give Money Directly to the People.”

It turns out that the Fed could have given $56,000 to every household in America!

In case you missed it, I encourage you to read my e-letter column from last week about how ordinary people become millionaires. I also invite you to comment in the space provided below.