Yields on Treasury notes and bonds of all maturities have been ticking higher in the past week, as evidence of improving economic growth has investors reducing bond exposure in longer-dated fixed-income securities. Last week’s employment report was the best of the year, while this week’s JOLT report that tracks job openings was very positive for job seekers. Retail sales figures out yesterday showed the consumer loosening up on the purse strings to spend some of those savings at the pump, and business inventories were reported up more than expected, indicating manufacturers seeing higher future demand.

So the conversation about the next move for the Fed takes on some fresh light, whereby what looked like a “no need to tighten for 2015” now appears as if a hike in September is back on the table. The fact that the economy is gaining momentum is really good news for the market, in that organic top- and bottom-line growth provides clarity about the health of the economy instead of the Fed propping up equity markets with all manner of financial engineering.

With the prospect of higher rates on the horizon, income investors should fully examine how they are positioned as interest rates are coming off of exaggerated low levels. An improving economy will also be accompanied by an uptick in inflation in both goods and services that will benefit those sectors that are sensitive and leveraged to price increases for such goods and services. Some areas of interest to consider rotating income-oriented capital to would be energy, chemicals, equipment leasing, commercial real estate, floating rate debt, commodities, information technology, bank lending and transportation.

At present, the value proposition lies in the energy, transportation, agriculture and materials sectors, all of which are trading at or near the low end of their yearly or multi-year ranges. Buying into beaten-down sectors that are showing little if any current upside momentum is always difficult, but if the economy continues to show improvement, these sectors will undergo a transition from distribution to accumulation. It’s inevitable that sectors leveraged to domestic and global growth will have their day in the sun, and scouting around at these depressed levels will prove to be savvy due diligence.

Taking a view from 10,000 feet, some former Cash Machine winners in these economically sensitive situations that make the watch list for future consideration include:

CVR Partners LP (UAN), Yield 14.16% — Nitrogen Fertilizer

Rentech Nitrogen Partners LP (RNF), Yield 10.00% — Nitrogen Fertilizer

Teekay Offshore Partners LP (TOO), Yield 10.13% — Floating Oil Storage

Alliance Resource Partners LP (ARLP), Yield 10.01% — Coal

Mesabi Trust (MSB), Yield 19.11% — Iron Ore

CVR Refining LP (CVRR), Yield 15.69% — Crude Oil Coking Refiner

Northern Tier Energy LP (NTI), Yield 17.96% — Retail Gas and Refining

Nordic American Tanker Ltd. (NAT), Yield 11.03% — Crude Oil Shipping

Some of these picks go back five years, and there are always undeniable changes in management and market conditions that require scrutiny. For instance, the landscape for investing in coal has forever changed with the advancement of natural gas in public utilities. And cheap steel imports might keep pricing pressure on iron ore producers for years to come. Not all boats rise when the economy recovers, and thus careful stock selection in these more volatile spaces is at a premium. Yet therein lies the opportunity of catching a rising tide.

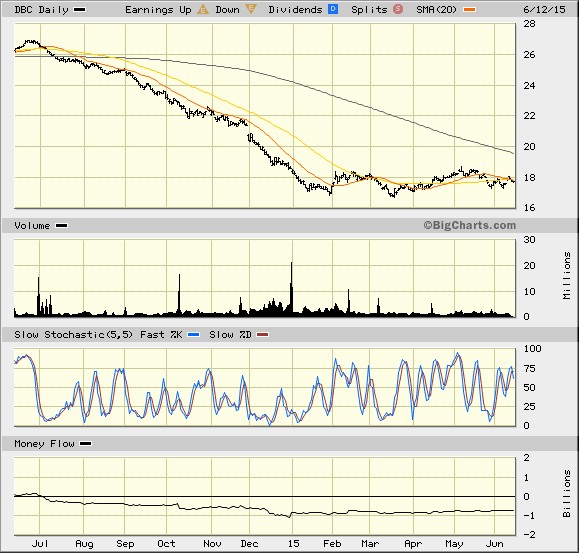

The chart below of the PowerShares DB Commodity Index Tracking Fund (DBC) illustrates that a bottoming process is still in the making, earmarked by two prior false breakouts that led to further consolidation. The message here is that there is no hurry to pile into commodities yet. In fact, they could see another leg lower if global growth doesn’t kick into gear where end demand from goods-producing nations dramatically increases.

The bottom line leads to a shortlist of potential candidates for adding to one’s portfolio if and when market conditions warrant increasing this kind of exposure. Until the global economy is comfortably moving away from central bank intervention, it’s best to tread lightly, if at all, in this space for now. While investing in double-digit yields is hugely desirable, the underlying fundamentals have to be present and improving to justify the risk.

In case you missed it, I encourage you to read my e-letter column from last week about how to invest for income in a rising rate market. I also invite you to comment in the space provided below my commentary.

Upcoming Appearance

I will be attending the San Francisco MoneyShow, July 16-18, at the Marriott Marquis. To register, click here. Mention priority code 038970.