The Federal Reserve kept interest rates unchanged Thursday. Though a slight majority of pundits were predicting that the Fed would do just that, I don’t think many had anticipated the reason why the Federal Open Market Committee (FOMC) kept rates at near-zero.

Here’s the money quote, direct from yesterday’s FOMC statement:

“Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term.”

So, the Fed is admitting that it now takes into account economic and market tumult in China and the emerging markets in its decision on how much interest savers at home will get on their money market accounts.

The Fed also now is basically admitting that the price of stocks here at home is a big factor when it comes to whether there will be a rate hike.

While I’m not too surprised to find this out, it’s interesting that the Fed has now basically admitted as much.

Given this rather overt admission, I think it makes sense to look at the prices of equity markets around the world to see why the Fed is questioning whether the world can handle a 25-basis-point increase in the cost of capital.

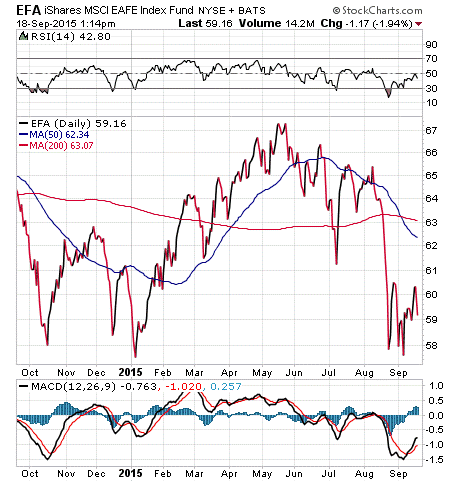

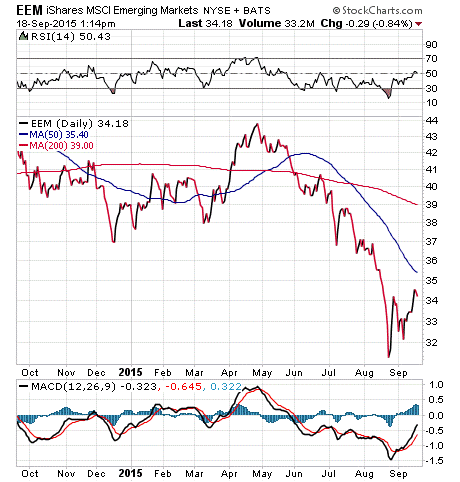

Take a look at the following three charts — the SPDR S&P 500 (SPY), iShares MSCI EAFE (EFA) and iShares MSCI Emerging Markets (EEM).

Although stocks in the S&P 500 (SPY) have seen some recent stabilization, they remain firmly below their 200-day moving average.

As for Europe, the Far East and Australia (EFA), there has been an even bigger downturn, which is something Fed officials apparently think is reason enough not to upset the monetary apple cart.

Finally, the emerging markets (EEM) are now in a confirmed bear market that just looks downright ugly on the chart.

The downturn in stocks both at home and abroad is something we identified and reacted to in my Successful ETF Investing advisory service — and we did so before the damage got really bad.

If you are an ETF investor who is looking for strategies to help get you out of a market when even Fed officials think things are going to hell in a handbasket, then check out my Successful ETF Investing advisory service today!

The Real ‘Deflategate’: A Limerick

The Fed has intensely debated

When interest-rate hikes should be slated.

Like a team I won’t name,

They’re playing the game

With balls that are underinflated.

–Dr. Goose

You don’t normally associate limericks with the Fed, or anything in the realm of markets and the economy. But if you want to read some witty poetry about just that, I recommend a blog site called Limericks Économiques, Humorous Poems on the Dismal Science of Economics by Dr. Goose. It’s guaranteed to generate a smile.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week on Eagle Daily Investor about why investors shouldn’t use stop losses on ETFs. I also invite you to comment in the space provided below my commentary.