What do you get when the dollar is getting weaker due to the growing unlikelihood of a Fed rate hike in 2015?

You get a golden breakout.

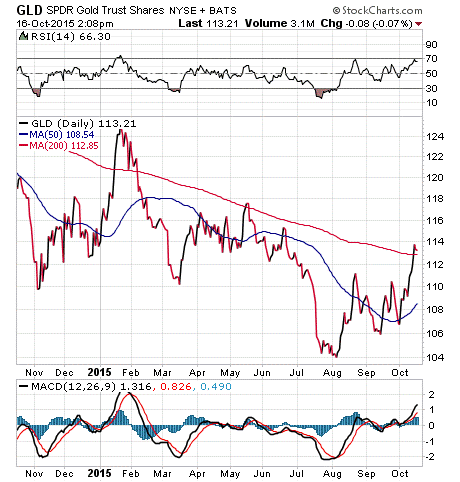

This week, we saw a dramatic rally in gold, silver and gold mining stocks. In the case of gold bullion prices, the chart here of the SPDR Gold Trust (GLD) shows the strong move back above the technically and psychologically significant 200-day moving average.

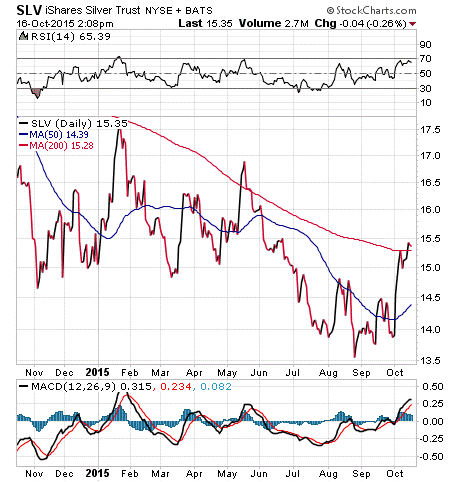

We saw the same lift in silver, as displayed in the chart below of the iShares Silver Trust (SLV). The benchmark silver exchange-traded fund (ETF) now also trades above its 200-day moving average, a bullish sign for the precious metal going forward.

While it remains to be seen if the flow going into gold is “new money,” or whether it is the result of a lot of short positions unwinding, I suspect it’s a combination of both, and I also think that’s why gold and silver are likely to continue going higher from here.

This week, gold also received a vote of confidence from famed investor Paul Singer of Elliott Management. The billionaire told attendees at an investment conference in Israel, “In a world where the value of paper money is affirmatively aimed at being degraded by central bank policy, it’s kind of surprising to me that gold can’t catch a bid.” Singer added, “I like gold. I believe it’s under-owned. It should be a part of every investment portfolio, maybe five to ten percent.”

This week, the Fabian Gold Plan confirmed Singer’s precious metal intuitions, as we received our first new Gold Plan buy signal in quite some time.

The Fabian Gold Plan is designed to get investors into gold and gold mining stocks when things are just breaking out, and that’s exactly what happened this week.

If you want details on how you can get in on this golden breakout, including what specific ETFs we are recommending right now, then check out my Successful ETF Investing newsletter today!

Twain on Facts

“Get your facts first, then you can distort them as you please.”

— Mark Twain

Although Twain’s humorous take on the tendency for humans to distort facts will likely make you smile, when it comes to your investments, looking facts straight in the eye, free of distortion, is a much better approach.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week on Eagle Daily Investor about why ETFs are a better investment than mutual funds. I also invite you to comment in the space provided below my commentary.

All the best,

Doug Fabian

![[Gold bars]](https://www.stockinvestor.com/wp-content/uploads/3533411678_1d4dcacb7a_o.jpg)