To continue our trend of presenting highly focused, specific sector exchange-traded funds (ETFs) each week, we now turn to the technology sector and the third ETF in our new series.

The Technology Select Sector SPDR Fund (XLK) tracks the Technology Select Sector Index and puts a strong focus on products which have been developed by Internet software and service companies, semiconductor equipment and wireless telecommunication services, among other things.

View the current price, volume, performance and top 10 holdings of XLK at ETFU.com.

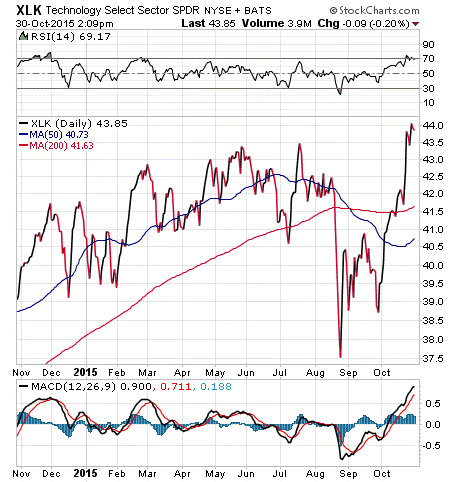

One might expect the technology market to be very stable, with a constant demand for newer and more advanced products. Yet no sector is immune to bear markets, as XLK’s graph, shown below, demonstrates.

XLK suffered in the recent market downturn, but it is up 6.26% year to date. Its current dividend yield fluctuates slightly, but is small, as it remains less than two percent. On top of that, the fund’s expense ratio sits at only 0.14%. One thing that is not tiny about XLK is the depth of its assets, as the fund currently has some $12 billion in assets managed.

The top 10 holdings of XLK maintain about 60% of the fund’s sizable total assets. Well-known computer superstars Apple (AAPL) and Microsoft (MSFT) are the two largest holdings, at 16.19% and 9.11%, respectively. Facebook (FB), AT&T (T) and Alphabet (GOOGL) round out the top five holdings of XLK, each with 5% of total assets.

If a potentially re-emerging fund that focuses on the technology sector seems appealing to you, you may want to take a look at Technology Select Sector SPDR Fund (XLK).

In this column next week, I’ll have another sector highlighted for your consideration.

Remember to look for the current price, volume, performance and top 10 holdings of XLK at ETFU.com.

If you want my advice about buying and selling specific ETFs, including appropriate exit points, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

In case you missed it, I encourage you to read my e-letter column from last week about an energy sector fund. I also invite you to comment in the space provided below.