Since the mid-1970s, I’ve attended every New Orleans Investment Conference, the granddaddy of gold-bug conventions. This year was my 40th time. I started my investment career in the hard-money movement. My first investment wasn’t a stock or bond, but a silver dollar, following the advice of Harry Browne in his bestselling book, “You Can Profit from a Monetary Crisis,” published in 1974 at the height of the first energy crisis in the United States. My Ph.D. dissertation was on the gold standard and the Austrian theory of the business cycle. It was a world turned upside down when the best investments weren’t traditional stocks or bonds, but “gold, silver and Swiss francs.”

But then Ronald Reagan was elected president in 1980. The New Orleans Conference, run by Jim Blanchard, was held right after the election and more than 2,000 people showed up. Gary North and I held sessions into the night talking about what this would mean for hard-money investors.

For me, it was a turning point. It was right around then that I issued my first newsletter, Forecasts & Strategies. I recommended that subscribers sell their gold and silver and buy stocks and bonds. Most of my gold-bug friends stuck with precious metals and their doomsday scenarios. I consequently missed out on one of the greatest bull markets in history.

Fast forward to today, 35 years later, and I’m reminded of the line, “Bears make headlines, bulls make money.” After a six-year rally on Wall Street, the doom-and-gloomers are coming out of the woodwork predicting a dollar collapse, a stock market crash and economic Armageddon. They focus on the “bust” side of the Austrian theory of the business cycle.

The Shock of My Life

I was unprepared for the shock of my life when many attendees at the latest conference came up to me and confessed that they were financially devastated — one losing 80% of his portfolio — after following the advice of the “permabears” and investing their hard-earned money in junior mining stocks that are so abundant in the exhibit hall — and so alluring. And don’t forget the opportunities lost. Those same people could have been up 200% if they had been fully invested in the traditional stock indexes since 2009!

That’s quite a scary lesson (it was appropriate that the conference was held during Halloween) about the importance of getting the right kind of investment advice and being on the right side of the markets.

There’s nothing wrong with being a bear from time to time — but you must get your timing right, because most bear markets are short and treacherous.

As Jesse Livermore said, “There’s only one side to the stock market and it’s not the bull side or the bear side, but the right side.”

Why I’m Still 100% Invested

Since the financial crisis of 2008, we’ve been fortunate enough to be on the right side of the market, and most of our stock picks and funds have been highly profitable. I told the crowd that I was 100% invested, a statement which shocked the audience. Several attendees told me they had large cash positions, waiting for the next crash, or were trying to pick the bottom in gold and gold stocks. They were doubling down in hopes of recovering their losses. So far, they’ve missed out on some real bargains in the traditional stock and bond markets, and gold has gone through several false starts.

I’m willing to be fully invested until the evidence is clear is that the stock market has topped out. Right now, I’m focusing on the “boom” part of the Austrian theory of the business cycle — artificial as it may be.

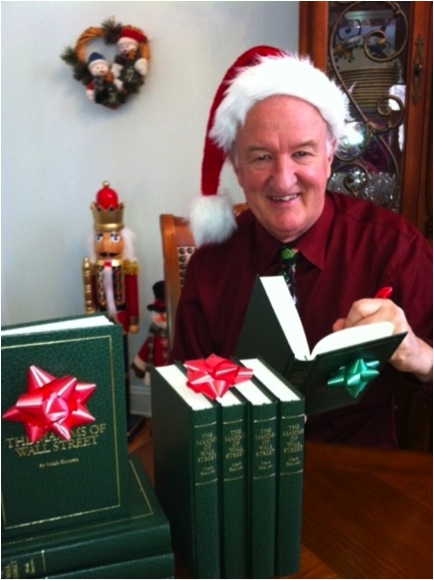

My bullish approach seemed to resonate with the attendees — 10% signed up for my newsletter, and I sold an entire box of “Maxims of Wall Street.”

Warren Buffett’s Favorite Quote Book — and Dennis Gartman’s, Too

Dennis Gartman, a commodity guru, was there and he pointed to a copy of “Maxims,” saying, “I love that book, and have it right on my desk, and refer to it often.”

There’s a lot of wisdom in that book, which took me 30 years to compile.

Do you want an unusual gift idea for your friends and clients for the holidays? “Maxims” is a present they always will remember and use regularly. Buy Warren Buffett’s favorite quote book, “The Maxims of Wall Street” — now available at half price. (He’s quoted 34 times, more than any other person.)

“Loved your great little book. In fact, I plan to shamelessly steal some of the lines.” — Warren Buffett

THE IDEAL HOLIDAY GIFT: SPECIAL ‘HALF OFF’ DEAL

Buyers love this special “half off” price during the holidays and often buy multiple copies. (See below for details.)

“I find them to be ideal gifts for my best clients,” wrote Rodolfo Milani, managing director Dominick & Dominick in Miami, Florida. He recently bought more than a dozen copies.

And Anthony Scaramucci, CEO of SkyBridge Capital and producer of the new “Wall Street Week” and his famous SkyBridge Alternatives (SALT) Conference in Las Vegas, just ordered 50 copies for his top clients.

‘THE MAXIMS OF WALL STREET’:

A Compilation of Financial Adages, Ancient Proverbs and Worldly Wisdom

For nearly 30 years, I have been painstakingly compiling all the wise old adages, proverbs and legends on Wall Street, based on in-depth interviews with old timers, reading rare financial books and my own experiences in the financial markets.

Now in its 4th edition, Maxims has sold more than 20,000 copies. Most buyers buy multiple copies as holiday gifts to clients, friends, students, investors, stockbrokers and money managers.

“Maxims” is destined to be a classic reference that you will read with delight for years to come. The work contains:

O Quotations by such notables as Warren Buffett (“If you wait to see the Robin sing, Spring may be over”)… J. P. Morgan (“Troubled waters make for good fishing”)… Humphrey Neill (“The public is right during the trends but wrong at both ends”)… Richard Russell (“In a bear market, the winner is he who loses the least”)… and Steve Forbes (“Everybody is a disciplined, long-term investor until the market goes down”).

O Old Timers’ stories like the “trading sardines”… where are the customer’s yachts?… the gold bugs… commodity traders… The origin of “blue sky”…

The retail price on Amazon is $24.95, but you pay only $20 for the first copy, and all additional copies are only $10 each. The price of a whole box of 32 books is only $300 postpaid, less than $10 a book. As Hetty Green, the first female millionaire, said, “When I see something cheap, I buy a lot of it!” Each book is personally autographed and mailed to you domestically at no extra charge (I pay the postage). For all foreign orders outside the United States, add $5 per book.

To order your copies at this super discount, call Ensign Publishing toll-free at 1-866-254-2057, or go to www.miracleofamerica.com/maxims. Copies are autographed and mailed out within two days of your order.

You Blew It! Speaker from Canada Denied Trip to New Orleans Investment Conference

A travesty of justice occurred at this year’s New Orleans Investment Conference. One of the speakers, a veteran Canadian investment writer, who has presented at the event almost every year since the 1970s, was denied entrance into the United States because he didn’t have a “work permit” to give a speech in America.

While questioned by U.S. immigration officials before taking his flight in Toronto, he was asked about the purpose of his visit to America. The man said, “To give a speech in New Orleans.” Then they asked if he would be compensated for the speech, and he said “yes.” The officials insisted that he needed a “work visa” to be a paid speaker in the United States, and, therefore, he was denied boarding onto the airplane to New Orleans (he was traveling first class and had a NEXUS travel card).

The border patrol also lied to him, saying that if he voluntarily gave up his seat on the plane, the U.S. authorities would not revoke his U.S. travel card. Even though he agreed to give up his seat, the U.S. authorities sent him an overnight letter revoking his U.S. travel card anyway. He’s fighting now to get it back.

Can you believe this travesty? Has anyone ever heard of requiring a foreigner coming into the United States to give a speech to have a work permit? Unbelievable! What is this country coming to? It is scary to see how much arbitrary power U.S. border agents carry.

Upcoming Conference

Special Announcement: Subscribers to the Skousen CAFE should be happy to know that for the first time in two years, I am hosting the Global Financial Summit, a special private investment seminar, in The Bahamas. The focus will be on “High Income & Fast Money Investing” — combining my two most successful trading services!

My “All Star High Income & Fast Money” experts for this exclusive private meeting will include Alex Green, investment director of the Oxford Club and editor of three trading services (Momentum Alert, Insider Trader and True Value Alert). Alex is rated the #5 best investor according to Hulbert Financial Digest. I’ve also confirmed Martin Truax, vice president at Raymond James, whose “income & growth” portfolio has more than tripled during the past 10 years. He and his partner Ron Miller also have developed a highly successful trading system using “red” and “green” signals to determine when to get in and out of markets (they flashed “sell” in May and now are flashing “buy” — good calls!).

Our keynote speaker will be Steve Moore, the chief economist for the Heritage Foundation and the #1 columnist for the Wall Street Journal, who will speak on “Money & Politics 2016: The Inside Story for Private Investors.”

The dates are March 16-19, 2016, at the five-star Atlantis Resort on Paradise Island, Nassau, The Bahamas. This is during high “Spring Break” season, so I urge you to make your flight reservations now.

I will soon be announcing more top experts in portfolio management, tax and estate planning and foreign investing. But I want to encourage you to sign up now and take advantage of our special “early bird” discount — $200 off the retail price for Skousen CAFE subscribers if you register by Dec. 31. The price is only $495 per person/$795 per couple with the discount. And hotel rates at the five-star Atlantis Resort are only $209 per night. We are limiting this private meeting to 200 attendees only. To sign up, call Karen or Jennifer at 855-850-3733 ext 202, email info@freedomfest.com, or go to gfs.freedomfest.com.

In case you missed it, I encourage you to read my e-letter column from last week about the wealth-building strategies of Warren Buffett and Charles Koch. I also invite you to comment in the space provided below.