Stocks were markedly lower this week, as fear is now brewing on Wall Street about the growing likelihood of the first interest rate hike in nearly a decade as soon as next month.

The major indices all were down more than 3% for the week, but I think this has a lot to do with a sort of normal “digestion” after the nearly 9% run we saw in the major indices in October.

Now, while I think this week’s pullback in stocks is both normal and not too much to worry about right now, there are several other exchange-traded funds (ETFs) I watch daily that are starting to spell trouble — not just for their respective market segments, but for risk assets in general.

The first is the iPath S&P GSCI Oil (OIL). This fund is pegged to the price of crude oil. As you can see by the chart below, oil prices have just cratered this year.

A massive glut in oil supply and a slowdown in demand globally have teamed up to put pressure on the cost of crude such as we haven’t seen in years. Continued slow growth in commodity-consuming countries such as China, a Saudi price war and the fracking boom here in North America now have the world awash in oil, and that has many fearful of a wider global economic slowdown in the works.

The oil glut, a strong U.S. dollar and the likelihood of rising interest rates have created weak commodity demand globally. That’s put added pricing pressure on industrial commodities such as copper, and that has really slammed emerging market economies.

The preceding chart of the iShares MSCI Emerging Markets (EEM) shows the big breakdown in these stocks since April. There were some signs of a rebound in October, but since then the segment has failed to sustain that short-lived rally.

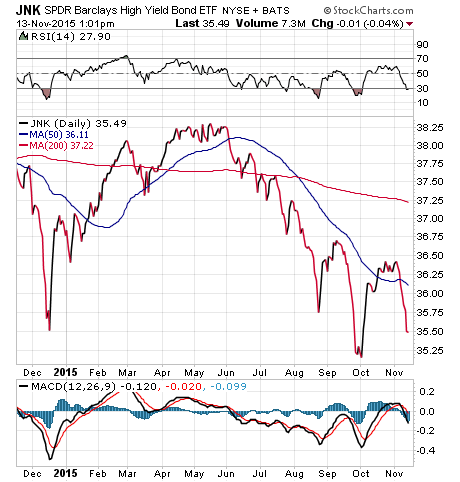

The final ETF I check, and one that’s been an early indicator of weakness to follow, gives the price of high-yield, or “junk,” bonds. These are the riskiest of bonds, but as such they pay very high yields.

Right now, the benchmark ETF that’s pegged to the junk bond segment, the SPDR Barclays High Yield Bond ETF (JNK), has clearly suffered a breakdown. Not only is this a sign that the market expects the Fed is going to hike rates in December, it’s a sign that risk assets in general could be in for a rough ride going forward.

The bottom line here is that all three of these ETFs are signaling weakness for risk assets going forward, but there does remain strength in general in the U.S. economy. If the Fed does hike rates in December, that will be confirmation of this strength, and in the long term that will be good for risk assets.

If you want to know how to take advantage of the current trends in the market, and if you want to put a simple and proven plan in place that can get your portfolio on a winning track, then I invite you to check out my Successful ETF Investing newsletter today!

ETF Talk: Consumer Investment Mirrors Broader Economy

The next exchange-traded fund (ETF) in this series on Select Sector ETFs covers the consumer discretionary sector, which accounts for about 13% of components in the S&P 500. The Consumer Discretionary Select Sector ETF (XLY), known until 2002 as the Cyclical/Transportation Select Sector SPDR, invests in companies in the Consumer Discretionary Select Sector Index and covers areas of the market that sell nonessential goods and services.

In other words, these are goods and services that people will spend more money on when economic sentiment is higher. This area can include media, restaurants, apparel, automobile and household durables businesses.

View the current price, volume, performance and top 10 holdings of XLY at ETFU.com.

As the state of the consumer discretionary sector is heavily dictated by the condition and sentiment of the market, it comes as no surprise that XLY’s price, shown below, rallied along with the market during October. XLY is up more than 13% from its low in late August. Its dividend yield currently sits at 1.3%. In addition, XLY has an expense ratio of only 0.15% and a hefty $11.5 billion in assets managed.

XLY’s top 10 holdings are from a wide variety of industries and backgrounds, reflecting the breadth of this “focused” sector, and total slightly less than 50% of the fund’s assets. Online sales giant Amazon (AMZN) is XLY’s top holding, with close to 10% of total assets. The second and third places are taken by the Walt Disney Company (DIS), with 7.31% of assets, and Home Depot, Inc. (HD), with 6.57% of assets. Rounding out the top five holdings are media company Comcast (CMCSA) and fast-food restaurant McDonald’s (MCD), with 6.57% and 5.48% of assets, respectively.

If a consumer discretionary fund that can potentially benefit during bull market conditions seems appealing, you may want to take a look at Consumer Discretionary Select Sector ETF (XLY). In this column next week, I’ll have another sector highlighted for your consideration.

View the current price, volume, performance and top 10 holdings of XLY at ETFU.com.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

On Simplicity

“Simplicity is the glory of expression.”

— Walt Whitman

When it comes to investing, there are a lot of complicated strategies that use all sorts of complex fundamental and technical metrics. Some of these will work some of the time, and some won’t work some of the time. Over my three-plus decades in this business, I’ve come to learn that in most cases, the simpler a strategy is, the more often it tends to work.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week about what strong economic data could mean for the federal funds rate. I also invite you to comment in the space provided below my commentary.