The industries covered in SPDR Materials Select Sector ETF (XLB) provide the inputs needed by a wide variety of other companies. The exchange-traded fund (ETF) holds a span of large companies that initially harvest and process different materials from nature as well as provide other services necessary for more intermediary and consumer-facing companies to function.

All products must begin somewhere; this sector reflects the beginning of the production process for many final goods. Subsectors found in the index this fund tracks include producers of chemicals, metals, paper and construction materials, among others.

View the current price, volume, performance and top 10 holdings of XLB at ETFU.com.

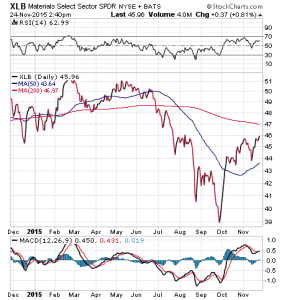

The performance of this fund thus far in 2015 has been less than stellar, as it has declined by 5.48%. Though XLB outperformed the S&P at the beginning of the year, it fell behind in June and has not made up the difference since. The dividend yield, at just over 2%, more than covers the 0.14% expense ratio and offers a bit of extra incentive for investors. Currently, XLB’s assets managed come to about $2.1 billion.

The top 10 holdings of XLB make up about 67% of its assets. In terms of subsectors, chemical companies are the most important aspect of the sector, as a component of the S&P, by a wide margin. XLB’s largest individual holdings are Dow Chemical Co. (DOW), 11.75%; E.I. du Pont Nemours and Co. (DD), 11.52%; Monsanto Co. (MON), 8.02%; LyondellBasell Industries NV (LYB), 7.73%; and Praxair Inc. (PX), 6.28%.

If you believe that the time is coming for this sector to rebound and make up for its underperformance soon, then SPDR Materials Select Sector ETF (XLB) may be a strong way for you to play it.

View the current price, volume, performance and top 10 holdings of XLB at ETFU.com.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

In case you missed it, I encourage you to read my e-letter column from last week about an industrials fund. I also invite you to comment in the space provided below.