The first two weeks of 2016 have crushed just about every investor, and just about every sector out there has seen red, and nothing but red, for nearly all 10 days of this year’s trade.

Stocks now are in a confirmed correction, and many stocks have entered official bear market territory of 20% below the most recent highs. I actually saw a statistic showing that more than half of all S&P 500 stocks are now in official bear market territory.

While the broader S&P 500, as well as the Dow and NASDAQ Composite, have yet to descend into an official bear market, if the selling continues just a little bit more, it may not be long before the grizzlies take official command of Wall Street.

The overall tenor of trading in the first two weeks of the year does not bode well for stock returns, at least in the first half of 2016. Unfortunately, aside from decent jobs data, there aren’t many pieces of good news to give investors hope.

The S&P 500 now is well below its 200-day moving average and near the lows of last August’s plunge, as shown below in the chart of the SPDR S&P 500 ETF (SPY).

Crude oil now has broken down below key support at $30, and the “lifeblood” commodity is telling the financial markets that global growth is flailing and that deflationary pressures are here, right now.

Until there’s some price stabilization in the oil patch, there likely won’t be a bottoming of global equity markets.

Now, as I wrote at the beginning of the year, there are four key exchange-traded funds (ETFs) to watch that will tell us virtually all we need to know about this market.

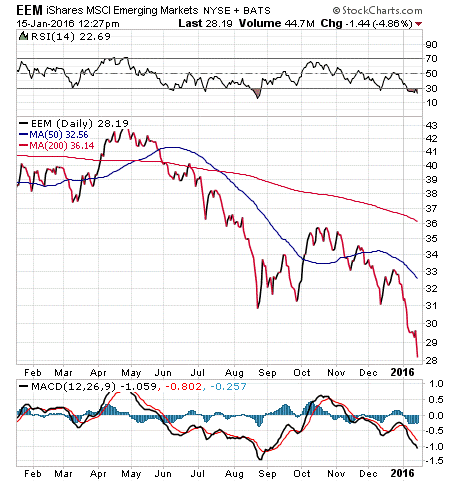

Those ETFs are the DB Commodities Tracking Index Fund (DBC), iShares MSCI Emerging Markets ETF (EEM), iShares FTSE China 25 Index (FXI) and, of course, SPY.

As you can see, a casual glance at each of these sectors is virtually screaming out “bear market!” That situation means now is the time when you want to be out of stocks and on the sidelines holding mostly cash and bonds.

Now, if you were a subscriber to my Successful ETF Investing newsletter, you would have been calm and relaxed in this very tumultuous week. That’s because our proven Fabian Plan gave us a broad-based “sell” signal last week, before the carnage of the past six trading sessions.

Once again, the discipline of a plan that tells you when to exit this market and, just as importantly, when it’s time to get back into stocks is what the Fabian Plan, as well as the Successful ETF Investing newsletter, are all about.

I said this last week, but it’s even more applicable after this week: if this year’s sell-off isn’t enough to get you to put a plan in place, then I don’t know what it will take.

Fortunately, you can check out that plan today in time to avoid any more damage to your hard-earned money.

Real Genius

“A genius is the one most like himself.”

— Thelonious Monk

It is hard to be yourself in a world that demands conformity, rewards compliance and often punishes the man who refuses to accept the status quo. Yet every true genius the world has ever known has done things just a little bit differently. And most often, the real genius of those individuals is that they weren’t afraid to just be themselves.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week about the chaos of the start of this trading year. I also invite you to comment in the space provided below my commentary.