The recent sharp sell-off in global financial markets has put the fear of God into many investors. The election of a socialist president in France; the rejection of austerity by voters in Greece; and prospects of recession in the European Union have resulted in pulling the U.S. S&P 500 back to levels it last hit in February.

Certainly, the mood among investors here at the Money Show in Las Vegas, where I am speaking in no fewer than four panels today, is one of apprehension. (You can watch some of my presentations via webcast by clicking on the appropriate links HERE.) And according to the technical indicators I look at, Mr. Market’s mood swing hasn’t been this bad since November of last year, right before the start of a huge rally in global stock markets.

Nevertheless, there are ways to make money even if the market continues to fall. And as subscribers to my Alpha Investor Letter know, that’s why I’ve constructed what I call my “hedge portfolio.”

The “Hedge Portfolio”

The hedge portfolio’s objective is to assemble a set of assets — in the form of specialist exchange-traded funds (ETFs) — that make money when financial markets fall out of bed.

The hedge portfolio has bets on or against a wide range of assets, including the stock market, commodities and currencies. Broadly speaking, you can expect the ETFs in this portfolio to go up, when the rest of the market goes down. You’ll see from the charts of each of these positions that they spiked sharply upward over the course of the last week, just as global investment assets of all shapes and sizes were tumbling.

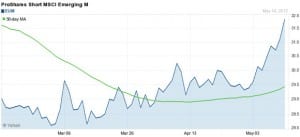

1) Short MSCI Emerging Markets (EUM)

For all of the talk about how emerging markets are set to dominate our economic future, this asset class is always the first one to fall out of bed once markets revert back to “risk-on” mode.

The best way to profit from these short-term moves is through the Short MSCI Emerging Markets (EUM). This ETF is the inverse of the MCSI Emerging Market Index. The fund is designed to profit when the index goes down.

This position is up 7.78% since May 1, and is now trading above its 50-day moving average.

2) ProShares UltraShort MSCI Europe (EPV)

Sure, Europe now has a handful of countries whose credit ratings are higher than that of the United States — including the United Kingdom, France and Germany.

In fact, the U.S. AA+ rating places it right alongside economic powerhouses like Belgium.

But Europe has got plenty of problems at its periphery, in particular, Greece and Spain, all putting pressure on the euro and the entire euro zone. The rise of socialist governments in France and the rejection of onerous austerity measures by the likes of Greece are always keeping the market on edge. And worries about larger economies like Italy and Spain keep emerging.

The easiest way to bet against Europe is through the ProShares UltraShort MSCI Europe (EPV).

This is a leveraged ETF which seeks daily investment results that correspond to twice (200%) the inverse (opposite) of the daily performance of the MSCI Europe Index. The index is made up of common stocks of companies in 16 European countries, and includes weightings in each of the PIIGS (Portugal, Italy, Ireland, Greece and Spain) countries.

This leveraged position is up an eye-popping 14.87% just in May, and is now trading well above its 50-day moving average.

3) ProShares UltraShort DJ-UBS Commodity (CMD)

When markets go down, investors throw out “the baby with the bathwater.” And that applies to commodities, as well. The threat of an economic slowdown meant that commodity prices collapsed back in 2008 — even in the midst of a much-vaunted commodity “supercycle.”

The best way to profit from the commodities decline is through the ProShares UltraShort DJ-UBS Commodity (CMD). This ETF moves twice (200%) the inverse (opposite) of the daily performance of the U.S. dollar price of the DJ-UBS Commodity Index.

Because the movement of the ETF is based on the daily calculation of the underlying commodities index movements (I’ll spare you the math), this ETF won’t behave the way that you may expect.

Still, CMD is up 12.9% in May, and is trading above its 50-day moving average.

4) PowerShares DB USD Bullish Fund (UUP)

The U.S. dollar is the global currency that everyone loves to hate. But that’s nothing new. I remember in the mid-1980s when I tried to use U.S. dollars to pay a fine on a metro in Munich, West Germany. The conductor threw my dollars back at me, cackling to his colleague that the U.S. dollar was worthless. (The U.S. dollar hit a record high against the Deutschmark a year later.)

So, those wishing ill on the U.S. dollar are nothing new… Yes, the explosion of government spending bodes poorly for the U.S. dollar in the long run. But as the financial meltdown of 2008 showed, when the markets get nervous, investors still rush into the U.S. dollar.

You can profit from the U.S. dollar’s rebound by buying the DB USD Index Bullish ETF (UUP), which seeks to track the price and yield performance, before fees and expenses, of the Deutsche Bank Long US Dollar Futures index.

UUP is up 2.3% this month — a huge move over such a short time frame.

Sincerely,

Nicholas A. Vardy

Editor, The Global Guru

P.S. I’ve just launched my first new investment product in five years. It’s called Nicholas Vardy’s Dividend PRO. This trading service focuses on low-risk, high-dividend-paying stocks, but with two twists. First, Dividend PRO employs a “secret,” income-boosting strategy that’s proven effective more than 90% of the time. Second, Dividend PRO regularly features an options play related to a dividend-paying stock that gives subscribers who don’t mind a little more risk a chance to pull down huge gains. If you’re interested in dividends and blockbuster option gains, click here for more information on Dividend PRO.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)