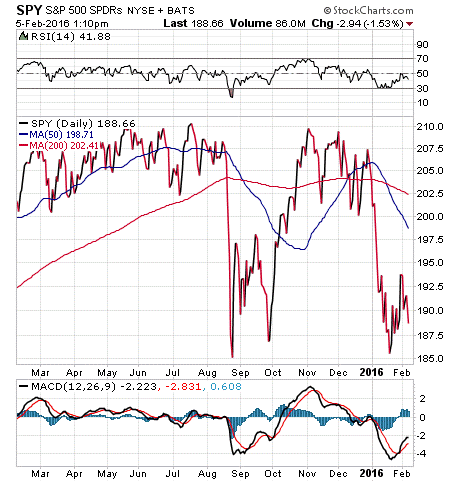

A cold wind blew through the markets this morning, and it caused investors to once again head for the exits.

That cold wind was the chilly January jobs report, which showed the economy created just 151,000 new jobs in the month. That print was well below estimates that called for some 180,000 jobs.

While there was some good news in the report — the unemployment rate fell to 4.9% from 5%, and the workforce participation rate ticked higher — the headline number suggests the economy is getting weaker.

Fear of a weaker economy here at home is something that markets do not like, because it suggests that the global economic weakness has come to U.S. shores. It also suggests that Q1 earnings are going to continue to be pressured. Then when you combine that with pressure on energy and bank stocks from persistently low oil prices, you get a toxic bearish cocktail that could keep stocks in the doldrums for a lot longer.

The one somewhat bullish aspect of the weaker jobs number is that there is very little chance that the Federal Reserve will pull the trigger on another interest rate hike in March. The markets know this, though, and stocks still sold off. This suggests a “dovish” Fed might not even have much influence on equities right now.

We’ll find out more from the Fed about what its intentions are when Chair Janet Yellen gives her Humphrey-Hawkins testimony to Congress next week. Right now, the Fed is still signaling that it intends to raise interest rates up to four times this year.

The problem with that plan is that the market now is pricing in about a 30% chance of zero rate hikes this year. This discrepancy between what the Fed is signaling and what the market expects could turn out to be big trouble for stocks, so it is not a big surprise to me that traders are taking bets off the table before the Yellen testimony.

For investors wondering how to navigate this market correction, your best plan is to play good defense. That’s what we’ve been advising subscribers to do in my Successful ETF Investing investment newsletter since early January — before the market meltdown really heated up.

If you want to find out how we knew to get out of stocks before the correction took place, then I invite you to check out Successful ETF Investing right now.

Gridiron Wisdom

“The measure of who we are is what we do with what we have.”

— Vince Lombardi

This weekend is Super Bowl 50, and it’s become a virtual holiday for many Americans. Today, I thought it would be appropriate to present a quote from the first Super-Bowl-winning coach, the great Vince Lombardi. Lombardi is a virtual quote machine, but today’s wisdom is one of my favorites. I like it because it reminds us that no matter what kind of start we had in life, or what our inherent talents might be, we owe it to ourselves to do the most we can with what we have.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Ask Doug.

In case you missed it, I encourage you to read my e-letter column from last week how global central bank movements provided a leg up for the market. I also invite you to comment in the space provided below my commentary.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)