In this week’s ETF Talk, I examine an interesting exchange-traded fund (ETF) that is closely linked to the rise of emerging markets, the EMQQ Emerging Markets Internet and Commerce ETF (EMQQ).

Technology and commerce in up-and-coming countries are areas just beginning to hit their stride, and the world as a whole is only beginning to realize the full impact of these trends. In the next five years, the number of smartphone users worldwide is expected to double, while an estimated 4.2 billion people worldwide will become consumers of both online and brick-and-mortar retail in the next 10 years.

Founded a little over a year ago, EMQQ is designed to offer investors exposure to the “consumption” sectors of developing countries, with the fund tracking an index of leading Internet and e-commerce companies in Asia, Latin America, Africa and Europe. While 98% of assets are allocated outside of the United States, many of the companies contained in the fund are listed on the NYSE or NASDAQ, which grants them greater transparency and more visible listing. To be included in the fund, a company must generate at least 50% of its revenue in emerging markets.

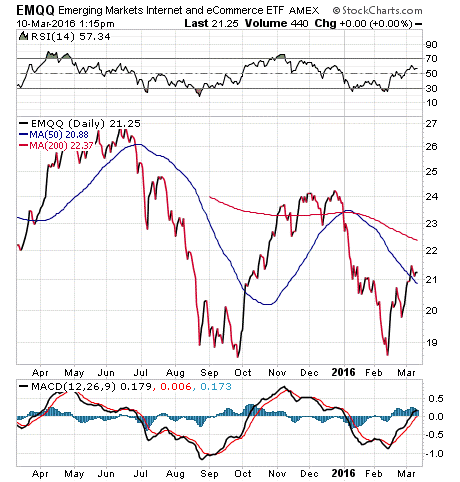

As an emerging markets ETF, EMQQ’s share price was heavily battered by the uncertainty in European and Asian markets, falling over 20% in the latter half of 2015. However, it has started to rally again as the worst of the economic storm seems to have passed. It has a small dividend yield of 0.10%, an expense ratio of 0.86% and about $13 million in assets under management. While that means EMQQ is below my recommended threshold for investment, I still think it is a fund worth bringing to your attention. As I am fond of saying, the more knowledge you have as an investor, the better you can make informed decisions.

With the exception of Alibaba (7.81% of assets), you may not be too familiar with most of the biggest e-commerce, Internet and technology holdings in EMQQ. These include Chinese investment holding company Tencent, 8.33%; Naspers, a multi-country internet and media group, 6.76%; and Baidu, a Chinese web services company, 6.22%.

View the current price, volume, performance and top 10 holdings of EMQQ at ETFU.com.

If you feel that the growth of technology and commerce in emerging market countries is going to be a driving global force over the next decade, I’d recommend you spend some time checking out the EMQQ Emerging Markets Internet and Commerce ETF (EMQQ). This fund is still in its infancy, but in my mind, it shows promise.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.