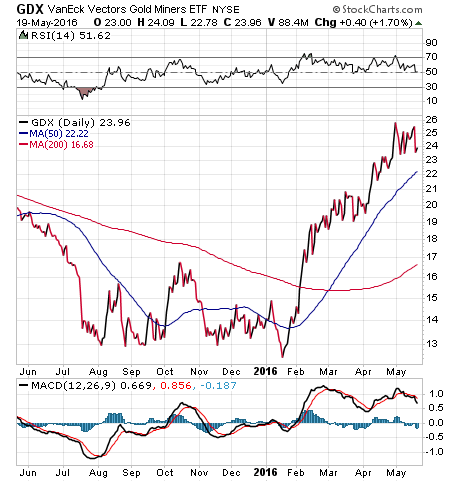

For the past several weeks, my ETF Talks have focused on precious metals mining funds that invest in more volatile, potentially risky companies. These funds recently have shown some powerful returns, but likely have more downside risk to them as well. This week, I’d like to discuss an exchange-traded fund (ETF) that invests in a broad range of gold mining companies without any emphasis on smaller ones. This more mainstream fund is the VanEck Vectors Gold Miners ETF (GDX), also known as the Market Vectors Gold Miners ETF.

This fund replicates the NYSE Arca Gold Miners Index, an index of public gold mining companies. Among the fund’s top holdings are the biggest names in the industry. As a result, a large percentage, 55%, of the holdings are in companies originating in Canada. However, GDX does not shy away from companies elsewhere around the globe, and thus has holdings in South Africa, Australia and even Peru.

Although GDX is not quite as high-risk as its counterpart GDXJ, its returns so far this year are nonetheless striking. The fund is up 74% so far this year, an astonishing gain in just under six months. For the same period, the S&P 500 has managed an overall weak performance, clocking in at -0.3%. GDX manages $7.33 billion, making it a big and well-known player in the gold mining ETF field. Its expense ratio is 0.52%.

View the current price, volume, performance and top 10 holdings of GDX at ETFU.com.

GDX is fully invested in stocks. Its portfolio includes Barrick Gold Corp. (ABX), 9.46%; Newmont Mining Corp. (NEM), 7.76%; Goldcorp Inc. (GG), 7.01%; Franco-Nevada Corp. (FNV), 5.22%; and Agnico Eagle Mines Ltd. (AEM), 5.14%.

The top 10 holdings of this fund make up 57.07% of its total investments, so while it may not be as diversified as some funds, it is still an improvement over buying a single stock in that regard.

If you want to invest alongside $7 billion worth of other gold investors, VanEck Vectors Gold Miners ETF (GDX) is a simple, no-frills way to accomplish that.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.