In one of my May ETF Talks, I brought to your attention the VanEck Vectors Gold Miners ETF (GDX), the largest gold mining ETF in the world with $7 billion in total assets. This week, I feature the junior version of that mega exchange-traded fund (ETF) — VanEck Vectors Junior Gold Miners ETF (GDXJ), which is the second-largest gold mining fund in the world, with nearly $3.1 billion in total assets.

This fund replicates, as closely as possible, the MVISA Global Junior Gold Miners Index, and 80% of the fund’s assets are in securities that comprise the index. One notable difference between GDXJ from its big brother is that GDXJ invests in small- and medium-cap firms (hence the term “junior”) that generally fall below the market-cap cutoff for GDX.

Put another way, GDXJ invests in companies that are deemed to have too small a market cap for GDX. This exposes the fund to more risk than GDX due to the higher volatility of these small firms.

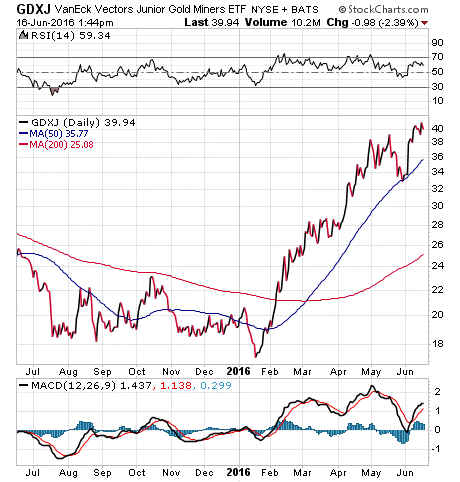

But with higher risk sometimes comes higher returns. GDXJ has done very well for itself, as it is up 113.48% so far this year, according to my ETF tracking site, etfu.com. That triple-digit-percentage gain means that it handily beating out its big brother GDX’s performance of 92% and the S&P 500’s disappointing 0.72% gain. GDXJ has an expense ratio of 0.55% and a dividend yield of 0.36%.

View the current price, volume, performance and top 10 holdings of GDXJ at ETFU.com.

The top five holdings of the fund are First Majestic Silver Corp. (AG), 5.89%; Alamos Gold Inc., 5.38% (AGI); B2Gold Corp. (BTG), 5.03%; Pan American Silver Corp. (PAAS), 4.97%; and Hecla Mining Company (HL), 4.52%.

The top 10 largest holdings make up 44% of GDXJ’s total investments. While this is less than the 57% of GDX’s top 10 holdings, in another sense GDXJ is not as diversified because 71.25% of its investments are in Canada, and another 19% are split between the United States and Australia.

If you want to invest in large gold funds, but seek more than the modest gains such funds typically provide, I encourage you to research VanEck Vectors Junior Gold Miners ETF (GDXJ).

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.