This exchange-traded fund (ETF) offers income by tapping into blue-chip stocks that have paid rising dividends for a number of years. That’s why the fund is known as the S&P 500 Dividend Aristocrats ETF (NOBL).

This fund seeks to include only the best yield-based S&P stocks that have long, consistent records of hiking dividends. Every single one of NOBL’s holdings has consistently raised its dividends for at least 25 years running, and the 51 holdings are weighted on near-equal terms rather than by market cap or any other measure.

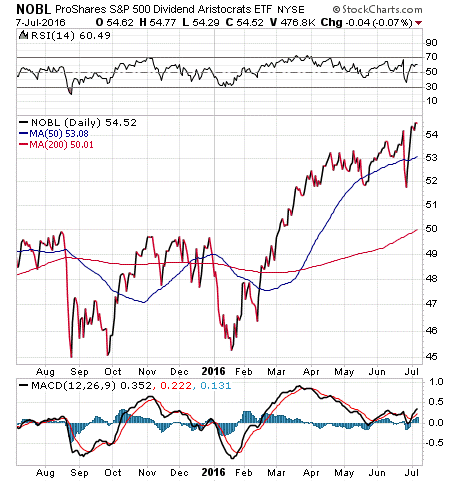

The result is a fund with low volatility and strong relative performance. Indeed, the past 12 months’ worth of performance are a particularly strong demonstration of how NOBL can be more powerful than the S&P 500. It has gained 8.75% while the benchmark S&P fund, SPDR S&P 500 ETF (SPY), is up only 0.84% in the same period. Much of NOBL’s relative outperformance has come since the start of 2016. The yield for this fund hovers around 2%, a nice bonus, while its expense ratio sits at 0.35%. Currently, assets managed for this fund clock in around $67.5 billion.

View the current price, volume, performance and top 10 holdings of NOBL at ETFU.com.

All of the fund’s top holdings are weighted about equally, with near 2% of total assets allocated to each. Some of NOBL’s more familiar holdings are AT&T (T), Johnson & Johnson (JNJ), Exxon Mobil Corp, (XOM), Procter & Gamble (PG) and The Coca-Cola Company (KO).

If you’re looking for an investment that offers relative stability and also has the capacity to provide some outstanding performance, you may wish to include S&P 500 Dividend Aristocrats ETF (NOBL) in your search for the right fund.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.