Global market conditions have made it a very difficult year for income investors due to negative interest rates, bullish trends without economic data to support them and uncertainty in normally strong sectors prompting many investors to seek alternative sources of income. SPDR S&P Emerging Markets Dividend ETF (EDIV) is an exchange-traded fund (ETF) that gives investors the opportunity to collect dividend payments and to gain access to an improving sector of the global market.

Emerging markets have been the dark-horse market sector of 2016. After consistently underperforming the S&P 500 for the last several years, emerging markets were not inspiring some investors with confidence.

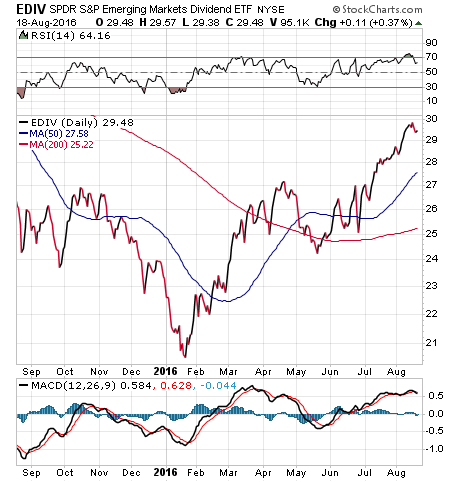

Indeed, some observers may have dismissed investing in emerging markets early in 2016. But so far for this year, the sector’s benchmark, the iShares MSCI Emerging Markets (EEM), has a double-digit percentage return. However, dividend-oriented emerging market ETFs have performed even better, with several, including EDIV, up more than 20% year to date.

EDIV tracks a series of 100 high-dividend-paying firms in emerging markets through the S&P Emerging Market Dividend Opportunities Index. The fund is fairly diversified in terms of national origin, with Taiwan (27.82%), South Africa (15.94%) and Brazil (15.41%) ranking as the primary countries in which it invests. Sector-wise, EDIV is heavily focused in financials (28.88%), telecommunications (21.54%) and technology (18.35%).

EDIV is currently up 28% year to date, making it among the strongest emerging markets dividend funds in terms of performance this year. A 3.5% dividend yield only adds to that impressive gain. The fund has a 0.49% expense ratio and approximately $303 million in assets under management.

The top 10 holdings of EDIV comprise slightly more than 25% of the fund’s total investments. While that may not sound like a large amount, remember that EDIV follows an index of more than 100 companies around the globe and doesn’t have a heavy allocation in any one specific sector or country.

Top five holdings include Brazilian transportation company CCR S.A., 3.9% of assets; Turkish steel manufacturer Eregli Demir ye celik Fabrikalari T.A.S., 3.88%; MTN Group Limited, 3.56%; Vodacom Group Limited, 3.04% and Mobile TeleSystems PJSC Sponsored ADR, 3%.

Stocks and exchange-traded funds (ETFs) with strong dividend yields are in demand right now, make no mistake about it. If you are on the hunt for extra income but also find the idea of an emerging markets play appealing, then you may want to investigate the double opportunity offered by the SPDR S&P Emerging Markets Dividend ETF (EDIV).