Beginning today, we will turn our attention in this column to a different area of investing — the emerging markets (EM). This week’s EM exchange-traded fund (ETF) pick is the Vanguard Emerging Markets ETF (VWO), a huge, $43.7 billion fund run by Vanguard, one of the largest American investment management companies.

As a quick review, the term “emerging market” is generally used in reference to any country that has some of the characteristics of a developed nation (e.g. the United States), but yet does not quite meet the standards for being considered fully developed. The four largest “emerging” economies in the world are the BRIC countries — Brazil, Russia, India and China.

VWO is a broad ETF, which means that it is pegged to a benchmark index that measures the returns of certain companies located in non-specific emerging markets. As such, VWO provides market-cap-weighted exposure to equities from 22 EM countries, including China, Brazil, Russia, India, Taiwan and South Africa.

Emerging market stocks and funds are notorious for their volatility, as their corresponding national economies are much more prone to big swings than developed economies tend to be. However, here, VWO’s widespread investment strategy gives it an edge over other single-country funds. Rather than any risk an investor assumes when he owns this fund being dependent on the performance of a single country, it is spread out over many different ones.

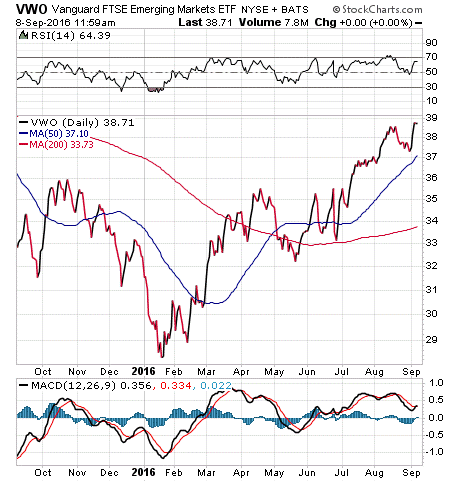

While emerging markets are volatile, the old saying “nothing ventured, nothing gained” comes to mind here, as many EM ETFs have generated impressive double-digit percentage returns in 2016, VWO among them. VWO has a year-to-date return of 15.99%, making it one of the best performing broad EM ETFs amongst its peers. From the graph below, you can see that VWO has experienced a surge in the last three months. The fund has an expense ratio of 0.15% and a dividend yield of 2.35%.

View the current price, volume, performance and top 10 holdings of VWO at ETFU.com.

VWO has considerable holdings in many Chinese companies. Its top holdings are Tencent Holdings Ltd., 3.36%; Taiwan Semiconductor Manufacturing Co. Ltd., 2.38%; Naspers Ltd. Class N, 1.79%; China Mobile Ltd., 1.71%; and China Construction Bank Corporation H, 1.60%.

If you wish to take advantage of the bullish surge in emerging markets this year but don’t want to deal with the increased risk of trying to pick specific foreign stocks, consider looking into the Vanguard Emerging Markets ETF (VWO) as a broad-based addition to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.