Our coverage of broad-based emerging markets exchange-traded funds (ETFs) today will feature another huge U.S.-based emerging markets fund, iShares MSCI Emerging Markets Index (NYSE: EEM), with a whopping $30.6 billion in net assets.

A “broad-based” emerging markets ETF is one with investments not concentrated in a specific region. The fund seeks to track the investment of the MSCI Emerging Markets Index, which is composed of large- and mid-capitalization emerging market equities.

With money in more than 800 emerging-markets stocks, it is an understatement to say EEM’s portfolio is well diversified. The holding with the highest weight in the portfolio only makes up 3.77% of the fund’s investments, and all except nine holdings in the portfolio have weightings of less than 1%. This means is that two or three underperformers likely will have scant impact on the fund’s overall performance.

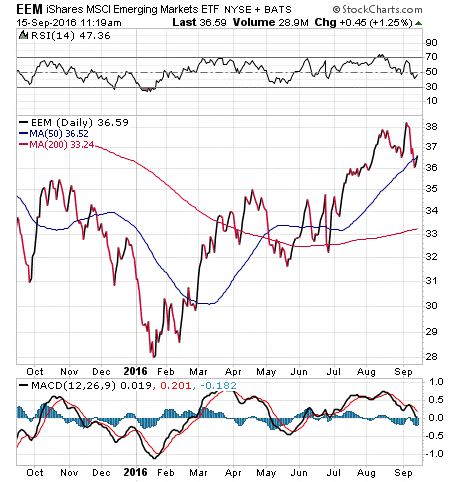

EEM has had a terrific year in 2016, with a total cash inflow of more than $6.7 billion, a number exceeded by only four other ETFs in the world. Its year-to-date return is 13.17%, beating the S&P 500’s 4.66% return by a large margin. The graph below indicates a clear rise in the price of the fund in 2016, starting at $28 at the beginning of the year to its current price of around $37, a tremendous increase of 32%.

View the current price, volume, performance and top 10 holdings of EEM at ETFU.com.

The fund has a dividend yield of 1.67% and an expense ratio of 0.69%. EEM’s top five holdings are Tencent Holdings Ltd, 3.77%; Samsung Electronics Co Ltd, 3.40%; Taiwan Semiconductor Manufacturing Co Ltd, 3.39%; Alibaba Group Holding Ltd ADR, 2.80%; and China Mobile Ltd, 1.89%. EEM typically holds onto most of its investments for the long term.

If you are interested in gaining exposure to large and mid-sized companies in emerging markets and simple access to over 800 emerging market stocks, consider iShares MSCI Emerging Markets Index (EEM).

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.