A U.S. incorporated exchange-traded fund (ETF), the iShares MSCI Emerging Markets Asia ETF (EEMA), holds a market-cap-weighted index of Asian emerging markets companies.

Since the fund’s inception in February 2012, it has provided good coverage of the Asian market, with significant allocation of funds in Asia’s major economies such as China, South Korea and Taiwan. The fund also gives exposure to the region’s biggest current sectors: technology and financials.

EEMA favors large-cap rather than small-cap companies, with more than 69% of the fund’s portfolio invested in companies with a market capitalization of $5 billion or more. The fund has an expense ratio of 0.49% and a dividend yield of 1.92%.

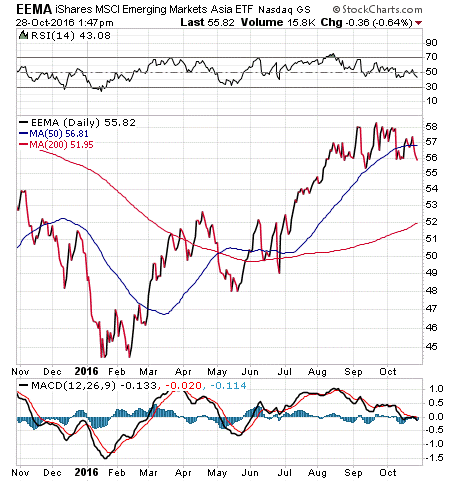

EEMA currently has $195.03 million assets under management and is growing, which is a positive sign, especially for the long term. However, as depicted in the graph below, the return for the fund has fluctuated wildly. Year to date, it has notched a return of 14.45%, beating out the S&P 500’s return of 4.98%. One example of the fund’s volatility is its irregular dividend payouts over the years, with an income distribution of $1.38 in 2013, $0.78 in 2014 and $1.23 in 2015.

Financial research firm Morningstar has given EEMA an “Average” rating and mentions that it is an “opportunity buy” for adventurous investors. Currently, Wharton Business Group owns 20% of the fund’s total shares, and the firm continues to purchase further shares as a sign of belief in the fund’s strength.

View the current price, volume, performance and top 10 holdings of EEMA at ETFU.com.

EEMA’s top five holdings are Tencent Holdings Ltd., 5.33%; Taiwan Semiconductor Manufacturing, 5.13%; Samsung Electronics Ltd., 4.81%; Alibaba Group Holding, 3.99%; and China Mobile Ltd., 2.45%. These five holdings combined make up more than 20% of the fund’s investments. EEMA provides investors with targeted access to a specific subset of emerging market stocks, mostly large-cap companies, and it can be used to tailor an investor’s portfolio by expressing a regional view of the emerging markets. If you feel confident about Asia’s continuous growth in the long run, I encourage you to look to iShares MSCI Emerging Markets Asia ETF (EEMA) as a possibility for your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)