As we round out our list of regional emerging markets exchange-traded funds (ETFs), this article features VanEck Vectors Africa Index ETF (AFK), a fund that tracks many Africa-based companies and invests most of its $68 million total assets in those companies.

Africa likely is a relatively untapped region for most investors, even though it offers vast commodity resources and growth potential. In fact, as far as ETFs go, AFK is almost the sole choice for broad, pure-play African coverage.

ARK offers one-stop access to a broad range of sectors and African countries, including exposure to some less traditional markets. The fund screens both local listings of companies that are incorporated in Africa, as well as companies outside of Africa that generate at least 50% of their revenues within that continent.

AFK’s index focuses on Gross Domestic Product (GDP), rather than market cap like many other emerging market ETFs. This puts an emphasis on the economic well-being of the country where a selected company is based. As a result, small- and medium-capitalization public companies often are included in the fund.

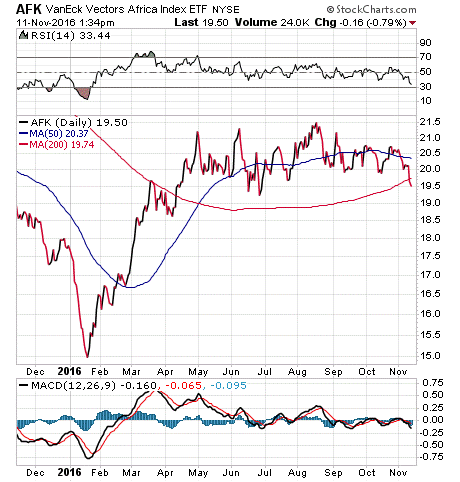

Year to date, AFK has enjoyed moderate success, with an 11.91% return versus the S&P 500’s 5.48%. Even though the fund is diversified, in the sense that it stretches over many sectors and firms, it is considered relatively high-risk due to the large number of small- and medium-caps in its holdings and the less politically stable nature of Africa compared to other regions. As you can see in the following chart, the fund has managed a small positive overall trend, but not without frequent ups and downs. AFK has a dividend yield of 1.89% and an expense ratio of 0.79%.

View the current price, volume, performance and top 10 holdings of AFK at ETFU.com.

The fund’s top five holdings are: Commercial International Bank (Egypt) SAE GDR, 7.92%; Naspers Ltd Class N, 7.42%; Guaranty Trust Bank PLC, 5.21%; Nigerian Breweries PLC, 4.65%; and Safaricom Ltd, 4.20%. AFK has 37.5% of its assets in the financial sector, 14.6% in materials, 11.7% in telecommunication services and 12% in consumer luxury goods. All of these sectors could flourish with strong growth of Africa’s economies.

If you want one-stop access to growing Africa-based companies and you believe in the strength of African economies in the long-run, consider looking into VanEck Vectors Africa Index ETF (AFK) as a possible future addition to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.