Uncertainty about the Fed’s next interest rate move has increased volatility in the overall real estate investment trust (REIT) sector and left investors to wonder whether to include them in their portfolios going forward.

However, the comparatively high dividend return from REITs vis a vis alternative investments is hard to beat in this market. In addition, an entire REIT category with enticing dividend yields can be hard to argue against.

Mortgage REITs (mREIT) purchase and originate residential and commercial mortgages, as well as residential mortgage-backed securities (RMBS) and commercial mortgage-backed securities (CMBS). Such mREITs aim to profit from their net interest margin – the spread between their borrowing costs and interest income on mortgages.

These kinds of REITs borrow money in the short-term to invest in long-term credit instruments. Plus, mREITs are unlike every other type of REIT in that they do not own any physical assets, only financial instruments.

In a rising rate environment, these kinds of REITs are risky, since they are highly levered and thus interest-rate sensitive. For example, the value of the older mortgages of these REITs will fall when new loans can be originated at higher rates, and vice versa. In 2020’s current interest-rate environment, the cost of borrowing is falling for all mortgage seekers.

Keep in mind that most mREITs do not pay a fixed dividend – the amount paid can vary depending on how well the company is doing. But mREITs typically manage and mitigate this risk through conventional hedging strategies such as interest rate swaps and other financial futures contracts.

Despite any market volatility in the REIT industry caused by concerns about the future direction of interest rates, mortgage REITs may have a place in a diversified investor’s portfolio holdings.

Even when residential mREITs rise faster than their commercial counterparts, commercial mREITs offer strengths, too. Here are some of teh key reasons:

Residential mREITs: Cautionary Advice

Residential mREITs earn most of their income through residential mortgages that are insured against default by the U.S. government (through Fannie Mae & Freddie Mac). Because of this insurance, the return on these investments is comparatively low, so it requires higher leverage to maximize return.

Most residential mortgages also are fixed and decline in value whenever interest rates rise again, since newer loans can be made at higher rates. Nonetheless, residential mREITs thrive in a falling rate environment such as the current one in 2020.

Commercial mREITs: Betting on Businesses

Commercial mortgage REITs, on the other hand, invest in or originate commercial mortgages, which have no government backing and thus carry a higher risk. Because of this, the loans are higher yielding and allow commercial mREITs to maximize returns with much lower debt. Moreover, commercial mortgages are usually floating rate loans, rising in conjunction with interest rate which should be profitable for commercial mREITs.

In addition, commercial mREITs that have gone public since 2008 are fairly different from the older ones. The 2008 crisis and resulting credit crunch forced commercial mREITs to shake up their business model – the newer companies operate with lower leverage, eschew cross collateralization and lend to more favorable loan-to-values ratios.

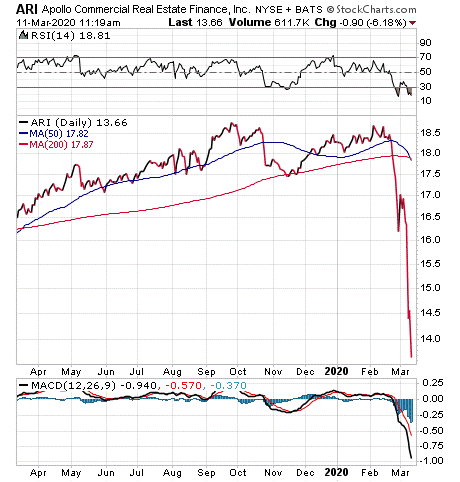

For those who want to make a commercial mortgage REIT play, consider Apollo Commercial Real Estate Finance Ltd. (NYSE:ARI) after its recent pullback. This commercial mREIT originates, acquires, invests and manages commercial first mortgage loans, subordinate financings, commercial mortgage-backed securities and other commercial real estate-related debt investments.

Apollo Commercial offers an impressive 10.99% trailing dividend yield, with five-year historical dividend growth rate of 2.92%, according to DividendInvestor.com. Income investors should love that yield.

Karn Brij is a managing director at an international investment firm with interests in real estate, banking and alternative investments. He specializes in real estate, finance and India-focused investments.