Our coverage on single-country exchange-traded funds (ETF) brings us to iShares MSCI Taiwan Capped ETF (EWT), a fund that is incorporated in the United States and provides exposure to large and mid-sized companies in Taiwan.

EWT targets the equity market in Taiwan by holding only stocks that are traded on the Taiwan Stock Exchange. Since its launch in 2000, EWT has amassed $2.92 billion in total assets and has retained its robust liquidity with a high daily trading volume, far outranking its competition.

In fact, many investors consider EWT the most stable Taiwan play going into 2017. The potential benefit of investing in EWT instead of a more broad-based emerging market ETF is that investors could gain a great deal more from a growing Taiwanese economy by buying shares of EWT.

The fund is intended to replicate the top 85% of the Taiwanese stock market, in terms of market capitalization. EWT is a heavyweight player in the technology sector, with 55% of the fund’s assets invested in technological companies. Financial services and basic materials are the other two major sectors for the fund, composing 18.3% and 10.5% of EWT’s portfolio, respectively.

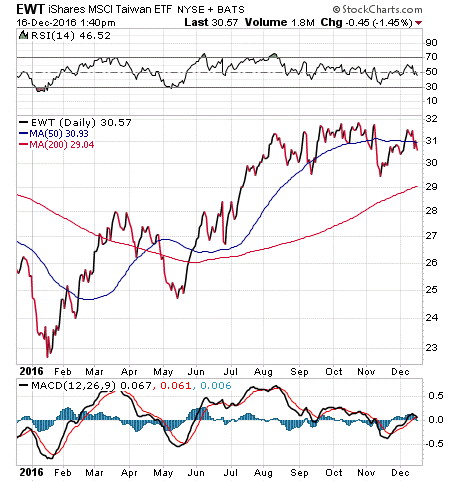

As you can see from the graph below, EWT has zoomed in price from the low $20s to the $30s, an increase of nearly 50%. Its year-to-date return is 21.14%, which is almost double that of the S&P 500’s gain of 10.86% for the same period. EWT has a reasonable expense ratio of 0.62%. It pays a distribution annually and has a dividend yield of 1.27%.

View the current price, volume, performance and top 10 holdings of EWT at ETFU.com.

The fund’s top five holdings are Taiwan Semiconductor Manufacturing Co Ltd, 22.28%; Hon Hai Precision Industry Co Ltd, 8.64%; Cathay Financial Holding Co Ltd, 2.69%; Chunghwa Telecom Co Ltd, 2.62%; and Formosa Plastics Corp, 2.46%. The fund’s focus on the Taiwan market makes it non-diversified, so investors need to diversify their portfolios with other investments.

Taiwan currently has a quasi-developed economy that is growing at a good rate. If you believe in the strength of Taiwan’s economy, I encourage you to look to iShares MSCI Taiwan Capped ETF (EWT) as a possible addition to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.