Mutual funds are America’s favorite investment vehicle but there are drawbacks to consider when making investment decisions.

As a result, mutual funds might not be the best place for your money. With significant barriers to exit, tax implications and high expenses of mutual funds, you might get higher returns investing your money in exchange-traded funds (ETFs), for example.

Half of all U.S. households own mutual funds. More than $15 trillion is invested in more than 8,000 available mutual funds. While mutual funds might be a popular investment choice, other investment vehicles may produce higher investment returns.

Here are five reasons why you should not invest your money in mutual funds.

Mutual funds are expensive to own

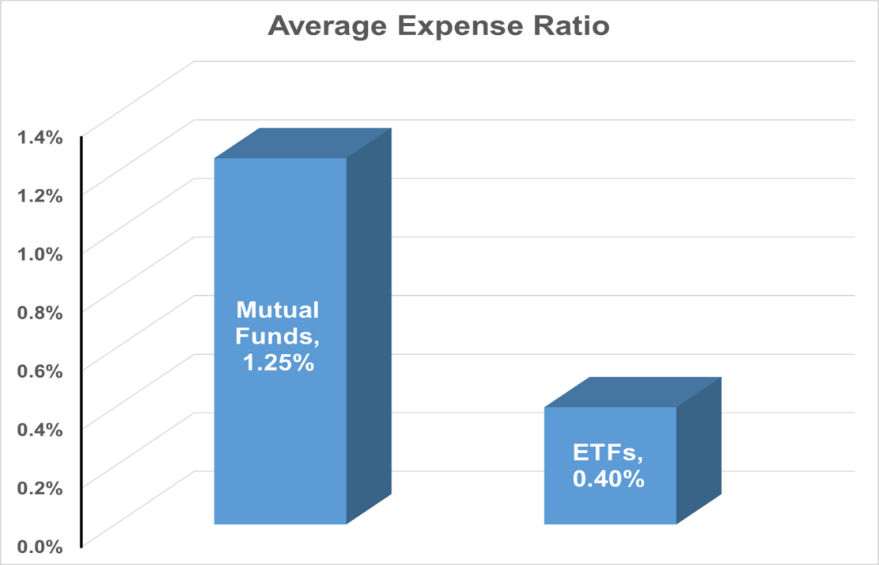

On an annual basis, mutual funds have significantly higher expense ratios than ETFs. The June 2014 edition of the “Morningstar Mutual Fund Expense Ratio Trends” reported average mutual funds expense ratio of 1.25%. In an article, Wall Street Journal Online reported 0.4% as the average ETF expense ratio. The difference between these two numbers is almost 70%.

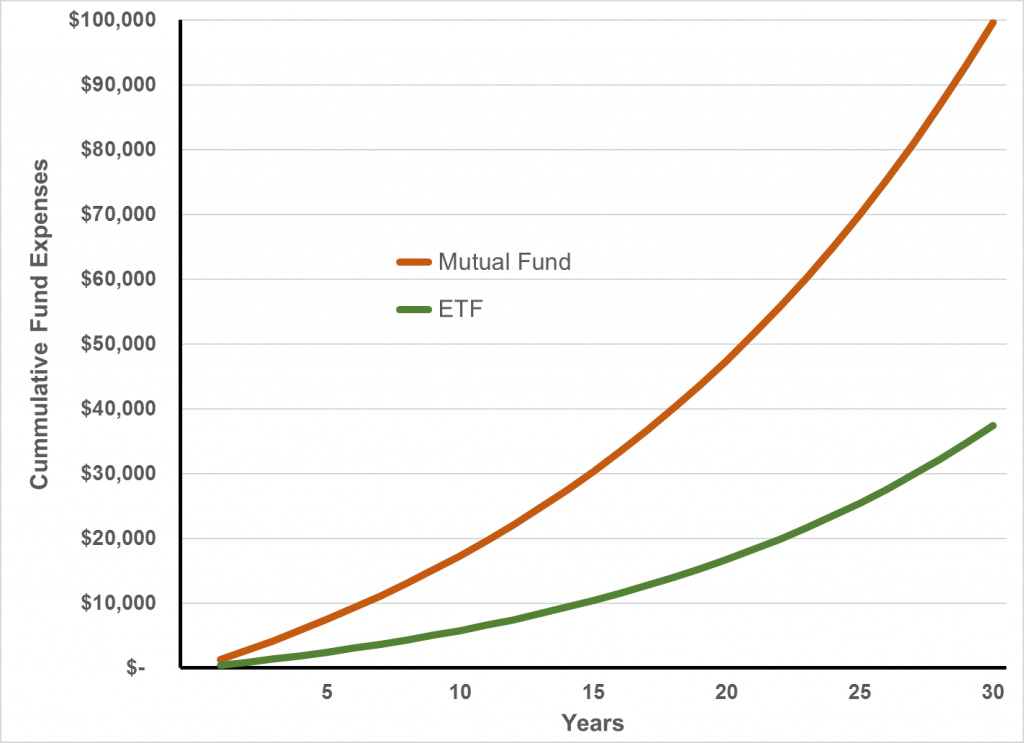

This expense difference has a massive effect over a long time. The graph below shows the cost of these fees over 30 years. I am using a 7% gross return rate on a $100,000 initial investment as the example. After 30 years, the accumulated cost for the ETF is a little more than $37,000. At the same time, the accumulated cost for the mutual fund is almost $100,000. The total cost difference is more than $60,000.

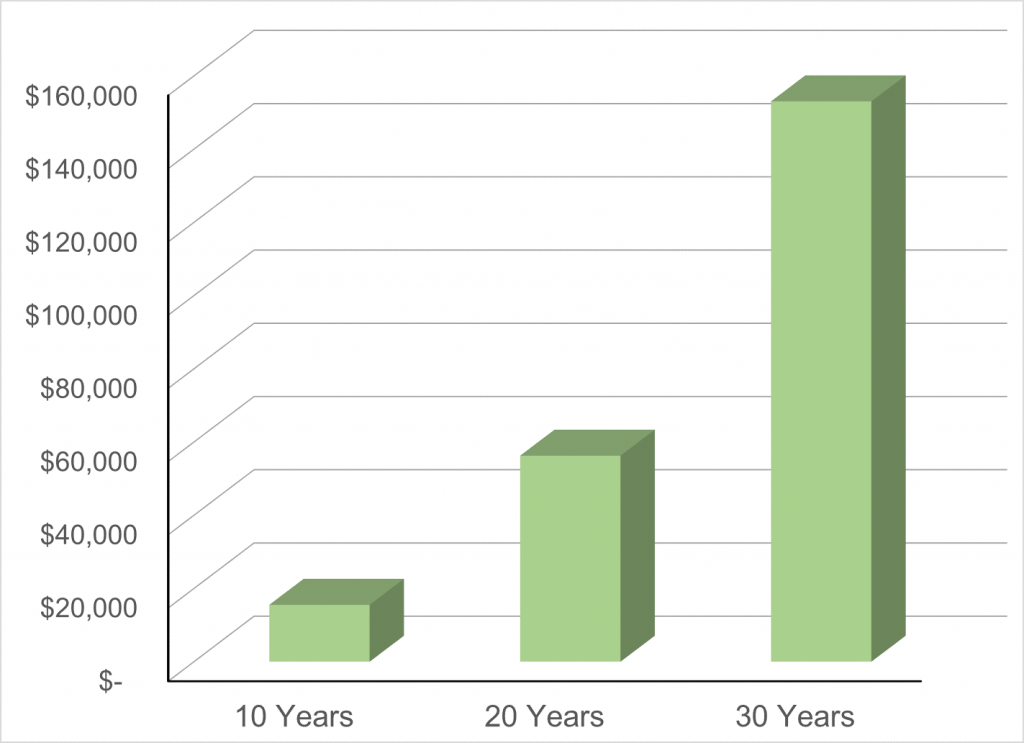

However, you must consider also that you will miss compounded returns on the cost difference over the same period. The net difference in total assets is more than $150,000 after 30 years. That is 50% more than your initial investment.

Mutual funds have additional fees

In addition to regular expenses, many mutual funds come with sales loads, commissions and other fees. Various mutual funds are sold through brokerage companies. These brokerage companies have sales people who are paid to promote and sell the funds. Those funds are called load mutual funds.

Other mutual funds have early withdrawal penalties. You must pay an exit fee if you do not hold the fund for a certain period. Other funds charge a 12b-1 fee to service the account on an annual basis. While almost all ETFs have transaction fees, some mutual funds also have transaction fees — in addition to all the other fees mentioned here.

Significant barriers to exit

In some cases, mutual funds have specific rules if you want to sell. Some mutual funds might have rules about how long you need to stay in a fund before selling. If you sell the mutual before that time, the fund will charge you a fee for the early exit.

Also, advisors might discourage you from selling your mutual funds. Some brokers, fund companies or financial media occasionally will advise you to buy or hold mutual funds over the long term even if that strategy is not in your best interest.

Because of these barriers to exit, many people will hold their mutual funds for too long. Consequently, these investors end up selling the mutual funds in a bad market environment, which is the worst time to sell a mutual fund.

Large portion of mutual funds are actively managed

A mutual fund portfolio manager makes all the decisions on a fund’s individual securities. The managers buy and sell securities in the fund at their sole discretion.

However, most mutual funds that are actively managed underperform index funds. Also, 75% of all actively managed mutual funds underperform their benchmark.

Sixty-two percent of large-cap equity mutual funds underperform their benchmark. International equity funds underperform by 78% and emerging markets underperform by 83%. Investment-grade bonds are the worst and typically underperform their benchmark by 97%.

Mutual funds have tax implications

When you own mutual funds outside of a retirement account, you could have significant tax liabilities. Actively managed funds lose on average about 1% of fund performance on an annual basis because of taxes.

Sometimes, you can incur capital gains taxes because the portfolio manager decided to sell a security. You might be responsible for this capital gains tax even if you have no overall gain in that fund. Also, taxable events could happen when major changes happen to the mutual fund. For instance, if the fund portfolio manager leaves, a large portion of fund holders could decide to redeem their shares from the mutual fund. That might cause a taxable event for the remaining shareholders.

These are five reasons against investing in mutual funds. While it is possible to avoid investing in mutual funds completely, I am not suggesting that you do that. However, I believe that mutual funds are expensive to own, they have significant barriers to exit and, unless they are part of a retirement account, they have serious tax implications.

One alternative to mutual funds are exchange-traded funds. If you are not familiar with ETFs or if you are not comfortable investing in ETFs, check out the resources available on stockinvestor.com to learn more. The ones about “10 Questions You Need Answered Before Investing in Exchange-Traded Funds” and “7 Reasons Why Exchange-Traded Funds are Better Than Mutual Funds” are good places to start.

Doug Fabian is the editor of three publications: Successful ETF Investing, ETF Trader’s Edge, and Fabian’s Weekly ETF Report. Doug was previously known as one of America’s top mutual fund advisors, but in recent years he has made a revolutionary 100% shift to exchange traded funds (ETFs). He regularly appears at seminars around the country.