“The government doesn’t create resources, it distributes them.” –Art Laffer

This week, I met up with the Four Horsemen of the Supply Side Revolution — Steve Forbes, Larry Kudlow, Art Laffer and Steve Moore — at a private event sponsored by the Committee to Unleash the Economy. All four supply-siders are officially or informally advising Donald Trump on what policies his administration should pursue to get the economy growing again.

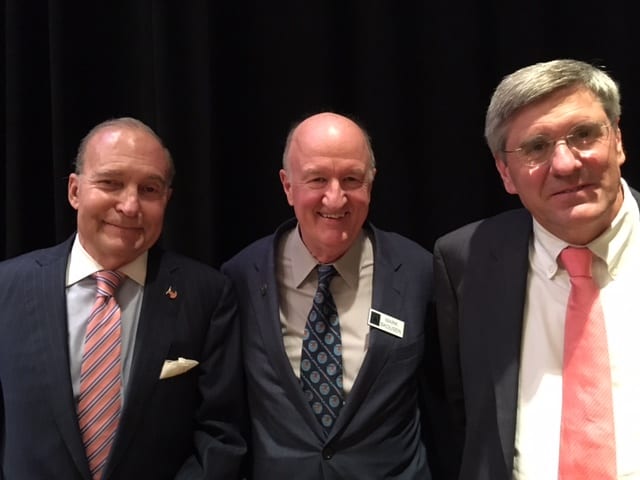

Larry Kudlow, Mark Skousen and Steve Moore at a Council for National Policy meeting.

Maria Bartiromo, of Fox Business, moderated a discussion on the impact Donald Trump would have on the economy and the markets.

She asked what top priority Trump should favor to get the economy going again, given that under eight years of Obama the U.S. economy never grew more than 3% — the worst performance since the Great Depression. Steve Moore noted that business investment has not increased in 16 years. The supply-siders agreed that higher taxes and more regulation (Obamacare, Dodd-Frank) held back the recovery.

According to the four economists, the #1 priority should be to cut the corporate tax rate from 35% to 15%. That more than anything would make the United States a tax haven for American corporations, and would bring back trillions to our shores, creating more jobs and more revenue for the government. The 15% corporate tax rate would also benefit small business, the backbone of the U.S. economy. Trump told Steve Moore directly that, more than anything, he wants to help small businesses, not the fat cats of Wall Street.

The second priority is deregulation — to cut back the bureaucracy and burden of ObamaCare and Dodd-Frank.

Bartiromo asked each of the panelists to give a number on how fast the economy could grow if their policies of tax cuts and deregulation were put into place. Steve Moore said 3½ – 4% a year. Steve Forbes predicted 5%. Art Laffer was the most optimistic, saying that Trump could do as well as Reagan did in 1983, up 8%! Larry Kudlow said he expected a solid recovery, but chose not to give a specific number.

Throughout the private meeting, there was an enthusiasm about the next four years that I had not seen in a long time.

My take: If the new Trump administration cuts taxes and deregulates the economy, expect higher economic growth and another good year on Wall Street. However, I also expect higher interest rates and more inflation. “King Dollar” should continue its rise, which will make it difficult for gold and other commodities. Avoid bonds and gold — stay invested in the stock market.

Steve Moore, founder of the Committee to Unleash the Economy, promised to duplicate this private meeting with the four supply-siders at next year’s FreedomFest, and give us an update on how well the Trump administration is doing after six months in office. Don’t miss it. Sign up here: www.freedomfest.com and take advantage of the “early bird” discount.

5th Edition of Maxims of Wall Street”

Good news! I’ve sold out of the 4th edition of “Maxims of Wall Street” and have gone back to press. Maxims has sold over 23,000 copies.

The new 5th edition — with many new quotes — is now available. I’ve been collecting these quotations for more than 30 years, and I put them all together by category in this new edition. Alex Green (Oxford Club) calls it a classic. It has been endorsed by Warren Buffett, Bert Dohmen and Dennis Gartman (who keeps it on his desk and refers to it regularly).

Amazon sells it for $24.95, but you can buy it directly from me for only $20 for the first copy, and all additional copies sent to the same address cost only $10. Investors like to buy multiple copies as gifts. And I autograph each book and pay the postage to recipients inside of the United States!

It makes the perfect holiday or birthday gift to friends, relatives, business associates and your favorite broker/money manager. In fact, many have purchased an entire box — all 32 copies autographed — for only $300 postpaid to give to their clients and friends. As Hetty Green, America’s first female millionaire, states, “When I see something cheap, I buy a lot of it!”

To make your purchase, call Harold at Ensign Publishing, toll-free 1-866-254-2057. Or go to https://www.miracleofamerica.com/products/maxims-of-wall-street.

In case you missed it, I encourage you to read my e-letter column from last week about the importance of trade to the global economy.

Upcoming Conferences

Join me for the MoneyShow Orlando

One of my first speaking appearances in 2017 will be at the MoneyShow Orlando, February 8-11, 2017, Omni Orlando Resort at ChampionsGate. Use my priority code, 042311, and mention it when you call 1-800-970-4355 to register.

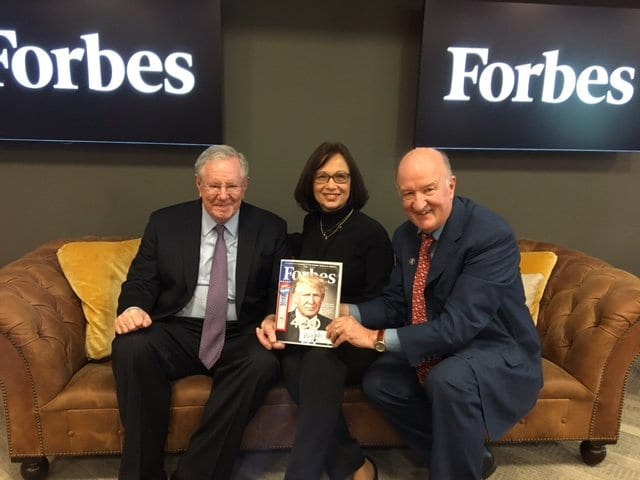

Steve Forbes, Jo Ann and Mark Skousen hold up last year’s issue of Forbes 400 Richest People in America with the President-elect Trump on the cover. Mr. Trump spoke at last year’s FreedomFest.

My wife Jo Ann and I met recently with Steve Forbes (see accompanying photo), our conference ambassador, and he is excited about our 10th anniversary. It also happens to be Mr. Forbes’s 70th birthday that week, and we plan to celebrate his life and work, and hope you will join us for this most memorable FreedomFest.

To sign up, go to www.freedomfest.com. For the fabulous Danube river cruise, go to http://www.globalfinancialsummitcruise.com/?scode=035323.

The Year of the Businessman at FreedomFest 2017

O WOW! Forbes Billionaire Ken Fisher and Publisher Rich Karlgaard to address FreedomFest for the first time! Next year will be the 100th anniversary of Forbes magazine, and we’re celebrating. Come join the festivities! B. C. Forbes, Steve Forbes’s grandfather, started the magazine in 1917. We’re going to have a special session on the impact that the founding Forbes had in business and investing with his grandson Steve Forbes and these experts: Ken Fisher holds the record for writing a Forbes column for 33 years, and is now a member of the Forbes 400 Richest List. Rich Karlgaard has been publisher since 1998. It will be their first time at FreedomFest, and you won’t want to miss meeting them.

Also joining us will be top financial gurus Jim Rogers, Doug Casey, Nicholas Vardy, Adrian Day, Alex Green, Dennis Gartman and many more. Keynote speakers confirmed include William Shatner (Hollywood’s entrepreneur), Robert Frank (New York Times columnist), Deirdre McCloskey (top economist and author), Conrad Black (Canada’s top publisher), Marc Eliot (Hollywood’s biographer) on his latest book, “Charlton Heston,” and, of course, our co-ambassadors Steve Forbes and John Mackey. Mackey will be speaking on his new book, “The Whole Foods Diet.” The event is not to be missed! For more details, go to www.freedomfest.com.

This is going to be our biggest and best FreedomFest ever, so now is the time to plan a trip to Vegas in July. We are expecting a record turnout, so I encourage you to sign up now and take advantage of our “early bird” discount — save $100 per person/$200 per couple over the registration fee — which ends on Jan. 15.

Our registration page is now up and running, so go to http://freedomfest.com/register-now/. You can also registered by calling our toll-free number 1-855-850-3733, ext. 202, and by talking to Jennifer, Amy or Karen. Call today!

You Blew It!

Does Right-to-Work Lower Wages for All?

“Right to work: Lower wages for all.” — Union billboard in Missouri

On our annual drive across America to California, where Jo Ann and I teach at Chapman University, I saw a billboard in Missouri that claimed that passing a right-to-work law in Missouri would “lower wages for all.”

They are only half right. A right-to-work law would tend to reduce union power and lower union wages. And that’s a good thing in a world where unions have excessive power and uncompetitive wage levels. As I tell my Chapman students, unions are cartels that limit employment and thus artificially raise wages above their level of productivity.

F. A. Harper wrote a famous small book, “Why Wages Rise.” He argues that the only way to raise wages legitimately and permanently is to increase the productivity of labor through technology, improved training and capital investment.

I point out to my students that studies show that companies that are more profitable tend to pay their workers more. Certainly right-to-work states attract more profitable firms and that means, in the long run, higher wages for its citizens.