After covering single-country exchange-traded funds (ETFs) for the last few weeks, we are going to move into covering a series of sector-specific emerging market ETFs, beginning with the Columbia India Consumer ETF (INCO).

Sector-specific ETFs seek holdings where companies share a related product or service. As the name of the fund suggests, INCO fully concentrates on investments in the consumer industry in India.

Since its inception in August 2011 under the brand EGShares — a brand that has nine ETFs that all trade within the United States — INCO’s policy has been to hold a maximum of 30 Indian market-cap-weighted consumer stocks. Each of the 30 securities is capped at a maximum weight of 7% of the total portfolio, which helps to provide diversification and more balanced exposure to the Indian consumer sector.

One of the biggest risks investors may face when considering INCO is the fund’s low total assets under management of only $77.81 million. This subjects the fund to liquidity risk and results in relatively high management fees, as is evident in its expense ratio of 0.89%.

However, this does not take away from INCO’s potential. A study by the World Bank has shown that consumption in India is predicted to double from 2015 to 2025. So far, the prediction has held up quite well, with India clocking in as the fourth-fastest-growing economy in the world in 2016 and annual gross domestic product (GDP) growth of 7.5%, according to the World Economic Forum.

To put this in perspective, U.S. GDP has grown by 1.8% this year and China, another emerging markets leader, has grown by 6.7%. INCO provides exposure to Indian companies in the field of automobiles, food, beverages, media and other household products, which all stand to gain from increased consumption brought on by a fast-growing economy.

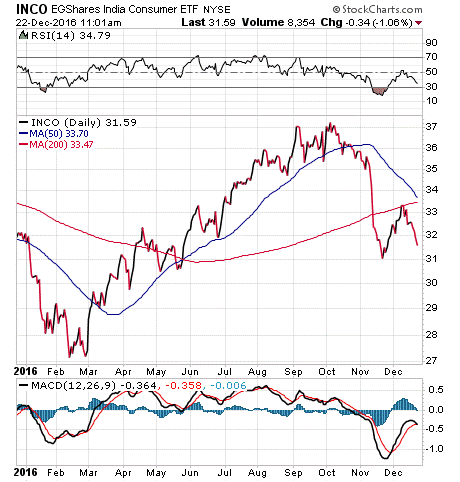

As you can see from the chart below, INCO maintained steady growth from February 2016 through November 2016, when uncertainty on foreign relations rose after Trump’s election as president. It remains to be seen where the fund will head once Trump takes office. INCO’s year-to-date return is 1.12% versus the S&P 500’s 10.82% (as a result of the Trump rally). The fund does not pay dividends.

The fund’s top five holdings are Maruti Suzuki India Ltd, 6.30%; Tata Motors Ltd, 5.91%; Nestle India Ltd, 5.04%; Godrej Consumer Products Ltd, 4.97%; and Bajaj Auto Ltd, 4.96%.

Notice that several of INCO’s top holdings are automobile-related. This is because automobiles are considered to be consumer discretionary products, meaning people will more likely spend money on them as their standard of living increases. If India’s consumption continues to rise as forecasted, automobile manufacturers and distributors could very well be leaders in the Indian economic surge. To take advantage of India’s projected growth, I encourage you to look at Columbia India Consumer ETF (INCO) as a potential addition to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)