Even with intense volatility and fickle boom-and-bust cycles, technology investing has been incredibly profitable for long-term investors.

The industry is unique in that it avails itself liberally to Wall Street, Main Street and corporate America alike. Despite the lingering wariness caused by the dot-com bust of the 2000s even for seasoned investors, outsized returns from the Information Technology sector in the last few years have whetted the appetites of many.

(Source: Fidelity.com. IT sector in red, S&P in green)

Within Information Technology, one of the best-performing sub-sectors is internet business. The internet business industry consists of e-commerce companies, as well as companies that provide online services to individuals and businesses.

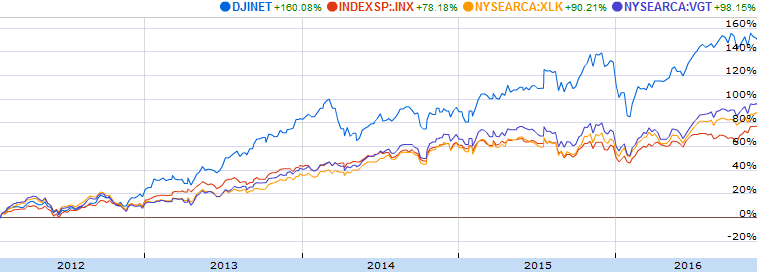

Over the last five years, DJINET – the Dow Jones Internet Composite Index, which tracks a basket of the 40 largest American companies operating in the internet business sub-industry – has outperformed the broader technology market represented by the two most popular ETFs in the sector – Vanguard Information Technology (VGT) and the S&P Technology SPDR (XLK). DJINET has beaten VGT and XLK by more than a whopping 60% and doubled the return of the S&P 500.

Technology investing is not for the faint of heart, however. While associated with innovative products and services, dynamic growth also comes with high research and development costs, seemingly arbitrary cycles of obsolescence and irrationally high valuations.

Indeed, a few high-value technology companies do not create profits or even positive cash flows. The sector often draws criticism for its high valuations, with most stocks trading at multiples of their forward earnings. For example, Amazon (AMZN) trades at more than 180 times its 2017 earnings, yet the stock is poised to move even higher this year.

The industry is also rapidly changing and evolving, with the winners of yesterday turning into the losers of today. Apart from a handful of industry giants such as IBM, Hewlett-Packard and Xerox, few purely technology companies have lasted longer than 50 years.

While none of this is good news for traditional “buy and hold” investors, research and due diligence can be an excellent hedge. With so many companies operating in the Technology space, competition in the sector is brutal. For that reason, exchange-traded funds (ETFs) are an excellent vehicle to play the market without the need to become an expert stock-picker.

Despite being an innovative and dynamic industry, not all internet business companies are created equally. Like all businesses, internet businesses depend on the strength of their underlying economy. While the U.S. bull shows signs of renewed vigor, the bear has reared its head in parts of Asia and Europe, and the market reflects that.

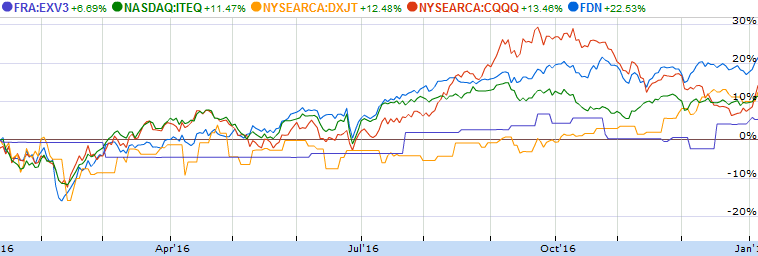

The First Trust Dow Jones Internet Index Fund (FDN) is an ETF that tracks and invests 90% of its assets in the American DJINET index. The ETF outperformed other ETFs in 2016 that track technology and internet companies in Europe (EXV3), Israel (ITEQ), Japan (DXJT) and China (CQQQ).

The difference is even starker over longer periods. In the last four years, FDN has returned an eye popping 104.3%, double that of its nearest rivals (Europe & China funds). Moreover, given the robust economic outlook in the US in 2017 compared with stagnant or low levels of growth in other regions, investors are advised to stick to America-based investments this year.

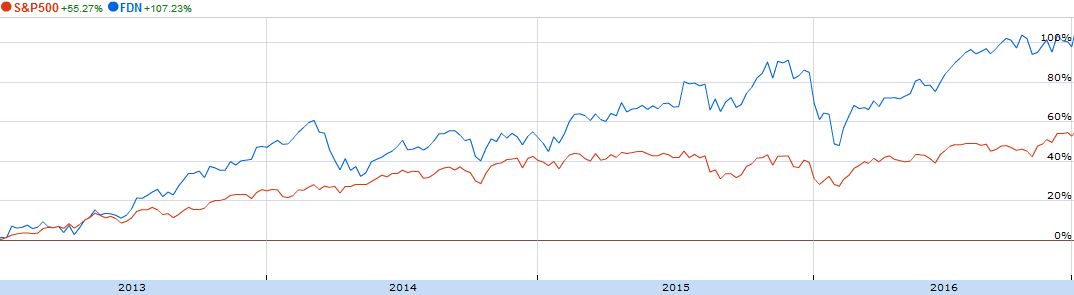

The $3.2 billion ETF also has outperformed the S&P by more than 50% during the last three years. Heavily weighted towards the e-commerce and online consumer services sectors, the fund only tracks U.S.-based stocks with an average three-month market cap of $100 million, as well as a three-month average closing price above $10 – ensuring their basket of highly valuable stocks is tilted towards size and stability.

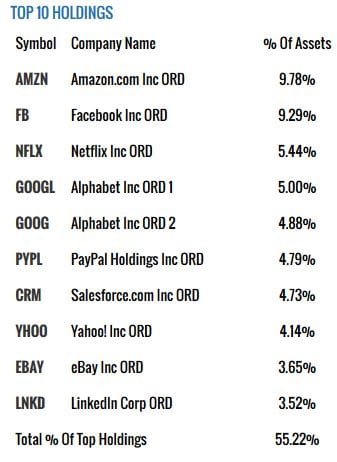

Despite the concentration in internet business stocks, FDN offers investors a diverse basket of companies with varied focus. The ETF’s top 10 holdings are as follows:

While FDN offers no dividend and a fairly high expense ratio of 0.54% (although this is lower than quite a few of its peers in the specialized technology sectors), the growth in the industry is impressive. Each of the ETF’s top five holdings returned more than 13% in 2016, despite missing out on the Trump-related rally following his election as the next U.S. president.

With Cloud Computing and the Internet of Things being anointed as the key buzzwords in Silicon Valley in this year, FDN’s holdings seem likely to flourish. Given the ETF’s historical performance and exposure to dynamic growth companies, 2017 bodes well for FDN.

Karn Brij is a managing director at an international investment firm with interests in real estate, banking and alternative investments. He specializes in real estate, finance and India-focused investments.