While internationally focused exchange-traded funds (ETFs) have been my topic of choice lately, I’m going to shift gears and examine ETFs related to initial public offerings (IPOs), starting with the Renaissance IPO ETF (IPO). For clarity, this fund will always be mentioned by its full name in this article.

As the Renaissance IPO ETF’s name implies, this fund invests in companies that recently have become part of the stock market by offering shares of their stock to the general public. An IPO occurs when the owner or owners of a private company decide to sell shares of their company on the open market, rather than selling directly to a private buyer.

Immediately after a company goes public, its share price is allowed to float freely on the open market. This can result in quick, substantial changes if the market doesn’t agree with the current IPO price. For instance, if the market has received a lot of hype about the company and views the prospects as stronger than the company’s actual current value implies, a quick run-up of the stock can occur. Sometimes though, this adjustment can be overdone and result in a decline, as was the case with the 2013 IPO of Twitter (TWTR).

The Renaissance IPO ETF is a fund that tracks companies with recorded initial public offerings within the previous two years. This can be a time of strong price change for the stocks in question, and is generally considered a period of high risk. The fund quickly adds new American public companies to its portfolio so long as they meet a certain market cap requirement.

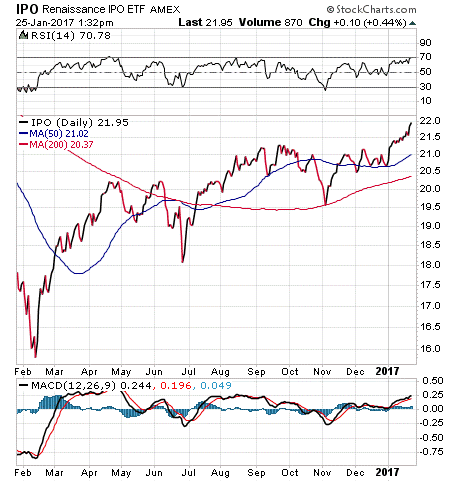

Over the last 12 months, the Renaissance IPO ETF has gained 19%, about even with the S&P 500’s return over the same time period. The expense ratio for owning this fund is 0.60% and the dividend yield is 0.40%, subject to change as its holdings rotate. The fund has $12.4 million in assets under management. This means that it is below my minimum threshold for investment, but its strategy is one worth bringing to your attention.

The majority of this fund’s holdings are mid-cap stocks at present. But because its holdings last for two years each, this could change in the future. The fund also has a disproportionately high weighting in technology, but this situation makes sense because technology is a constantly changing and expanding field that is conducive to new businesses which may choose to do an IPO.

The top five holdings for this fund are First Datacorp (FDC), 9.26%; Transunion (TRU), 7.85%; Shopify Inc. (SHOP), 5.47%; Summit Materials Inc. (SUM), 4.29%; and Univar Inc. (UNVR), 4.17%.

IPOs are an interesting segment of the market, and the Renaissance IPO ETF (IPO) provides an intriguing way to invest in that segment.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.