We turn our attention this week to a series of financial sector exchange-traded funds (ETFs), including today’s look at SPDR S&P Bank ETF (KBE).

KBE tracks an equal-weighted index of U.S. banking stocks. This focus differentiates KBE from many cap-weighted funds, since it puts giant banks and small banks on equal footing.

This fund gives investors exposure to a slice of the financial sector that historically has exhibited significant volatility but also is capable of turning in strong performances under the right circumstances. Frequently, investors buy into a high-volatility ETF, such as KBE, with the intention to benefit from short-term upward movements in the financial sector instead of a long-term buy-and-hold strategy.

KBE invests most of its $3.1 billion total assets in the securities that comprise the index it tracks. The fund also holds cash and invests in equities that are not in the index, as well as cash equivalents and money market instruments, such as repurchase agreements and money market funds. These actions increase the fund’s overall liquidity.

The fund is very liquid and has a competitive expense ratio of 0.35%. KBE also pays out a quarterly dividend. The most recent dividend was a $0.184 distribution on December 16, 2016. KBE has a dividend yield of 1.67%.

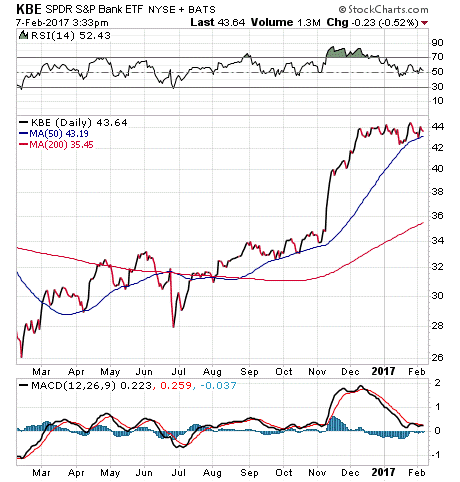

The chart below shows that KBE started off 2016 trading just slightly above $26, stepped up to the $30-$34 range mid-year, and has shot up to $44 since Election Day. KBE’s one-year return is 53.99%, compared with the S&P 500’s 17.45%. Year to date, KBE’s return is 1.28%, compared to S&P 500’s 2.60%.

KBE is a concentrated, non-diversified fund, with a total of 68 pure financial service stocks among its holdings.

The fund’s top five holdings are: Five Republic Bank (FRC), 2.45%; M&T Bank Corp (MTB), 2.44%; PNC Financial Services Group Inc. (PNC), 2.44%; Bank of the Ozarks Inc. (OZRK), 2.43%; and SunTrust Banks Inc. (STI), 2.42%.

If you wish to participate in the currently very active financial sector, I encourage you to research SPDR S&P Bank ETF (KBE) as a possible addition to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.