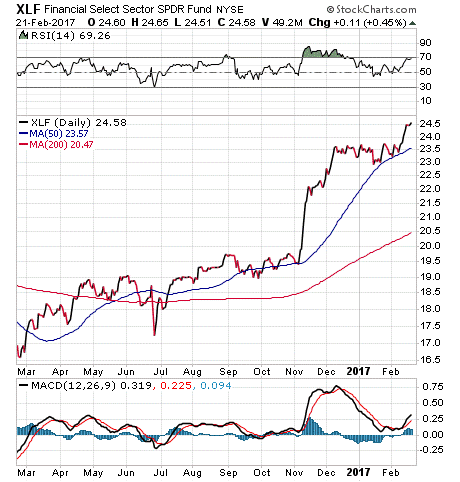

An exchange-traded fund (ETF) in the financial arena that is worth highlighting is the Financial Select Sector SPDR ETF (XLF), which tracks a market-capitalization-weighted index of S&P 500 financial stocks.

As a result, in contrast to two previously featured funds — KBE and KRE — XLF concentrates on the large U.S. banks and steers clear of small-cap financial institutions. With $24.94 billion in total assets and daily trading volume nearing $1.4 billion, XLF is a behemoth that also is massively liquid.

In the past year, XLF alone accounted for more than half of all inflows that flowed into financial ETFs. The fund’s valuation has increased by nearly 45% over the past year. With the expected upcoming interest rate hikes from the Fed, financial experts at Barron’s anticipate that large banks have much to gain.

Another attraction for this fund is that it has a very active trading pit for options. Since December 2016, XLF has been buying a lot of puts to set up a more defensive stance. This helps to limit downward risk, in case unfavorable regulations are passed against the large banks.

XLF charges a low fee for its services, with an expense ratio of just 0.14%. On top of that, it also carries a distribution yield of 2.47% and pays a quarterly distribution. The fund’s one-year return is 34.92%, handily beating out the S&P 500’s one-year return of 17.45%.

XLF holds 63 of the largest financial institutions in its portfolio. Its top five holdings are JPMorgan Chase & Co (JPM), 10.76%; Berkshire Hathaway Inc B (BRK.B), 10.67%; Wells Fargo & Co (WFC), 8.75%; Bank of America Corporation (BAC), 8.26%; and Citigroup Inc. (C), 5.71%.

If you believe in the strength of the largest U.S banks, I encourage you to research Financial Select Sector SPDR ETF (XLF) as a possible addition to your portfolio.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)