Tomorrow is an important anniversary for investors.

On March 9, 2009, U.S. stocks hit their recession low. The Dow Jones Industrial Average dropped to 6,547, a level not previously seen since April 1997. The S&P 500 fell below 700, which was as a 13-year low.

Well, nearly eight years ago to the day, there weren’t many investors who thought that stocks would more than triple by now, with the Dow ascending to the 21,000 mark and the S&P 500 vaulting near 2,370.

Yet that’s what happened.

10-Year Dow Jones Industrial Average Chart. Source: BigCharts.com

Unfortunately, many investors missed out on a lot of that upside, and many more continue to let one BIG factor keep them from achieving their goals.

That factor is fear.

Fear in the markets translates into holding way too much cash, and being reluctant to put your money to work because you think stocks are going to go into another correction/bear market.

While the potential for a correction and/or a bear market is always present, that’s no reason to shelter your money in the mattress.

The same is true for putting money to work during big rally times such as right now.

Yes, stocks are overbought here. And yes, the market is trading at relatively high (although not prohibitively high) valuations.

And yes, the market gains since the election have been largely predicated on President Trump and the Republican Congress passing a host of pro-growth policy proposals. Chief amongst those proposals is Obamacare repeal/replace, and corporate tax reform.

This week, we had progress of a kind on the Obamacare front. The patriotically named House bill, the American Health Care Act, isn’t what I call a panacea to the albatross of Obamacare. And while there are some good things about the plan (no more mandates, lower taxes), there’s still way too much big government and not enough capitalism.

Still, I suspect that some kind of “deal” will be engineered to get the legislation through the Senate via the reconciliation process (where only a majority vote is required). That’s important, as it will be the biggest hurdle cleared toward achieving what the markets and investors really want… a corporate tax cut.

So, even though stocks are at all-time highs, that’s still not a reason to let fear control your investment decisions.

The bottom line here is that yes, there are always reasons to be cautious about corrections and bear markets. Yet the important lesson of March 9, 2009, is that markets are resilient, and over time the bulls have always proven stronger than bears.

Investors who remember this will win… and those who let fear win, will lose.

Don’t be a loser.

If you want a proven, 40-year trend-following strategy that signals you when you should be in stocks, and when you should be out of stocks, then I invite you to check out my Successful ETF Investing advisory service, today!

Hiking Rates Until ‘Something Breaks’

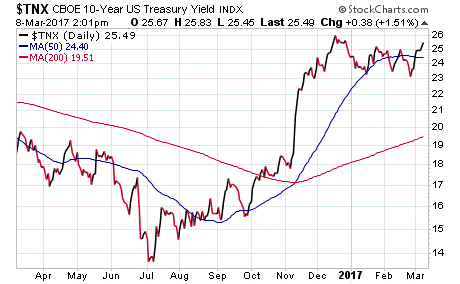

The Fed is going to go “old school” and begin a campaign of sequential interest rate hikes until “something breaks.”

That’s the opinion of the “New Bond King,” Jeffrey Gundlach, chief executive officer at DoubleLine Capital.

Gundlach is one of the voices I respect, and often concur with, on the markets. He correctly predicted the Trump victory, and he correctly predicted the big jump in stocks following that victory.

Mr. Gundlach told an investor webcast audience on Tuesday that he thinks U.S. economic data support an interest rate increase as soon as the next Fed policy meeting on March 14-15. He also expects the Fed to make further hikes as the year unfolds.

I agree with Mr. Gundlach here, and so do most of my Wall Street colleagues. In fact, there seems to be a near consensus among my peers that we will get a rate hike at next week’s Federal Open Market Committee meeting. The only thing likely to prevent the Fed from hiking rates is a disappointingly cool February jobs report (to be released Friday).

It will be interesting to see how the market reacts to a rate hike, and/or a series of up to three rate hikes this year. If those hikes are based on actual economic growth, then all will be well… and that also likely will mean stocks are doing well.

But what if “something breaks?” Well, that something would be the Fed stepping a little too hard on the rate hike pedal, and possibly prompting a recession.

If that happens, look for the bulls to taste dirt.

The Truest Sentence

“All you have to do is write one true sentence. Write the truest sentence that you know.”

—Ernest Hemingway

Write the truest sentence that you know. That’s one of my personal mottos, and it’s the kind of direct and honest thinking that pervades this publication, and my Successful ETF Investing advisory service. If you want to increase the truth in your life, make a commitment to writing (i.e. thinking and living) the truest sentence you know.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.

In case you missed it, I encourage you to read my e-letter from last week about the pro-growth agenda touted by President Trump in last week’s address to Congress.