NOTE: I was on CNBC this morning with Rick Santelli to talk about the new Republican alternative to ObamaCare. The Republican health care bill offers two good changes that would remove the individual mandate and expand Health Savings Accounts, but it didn’t go far enough towards sound economic principles. In the interview, I discussed the A&W principles of sound economics and showed a bottle of A&W root beer as a visual aid. Click here to see my CNBC interview.

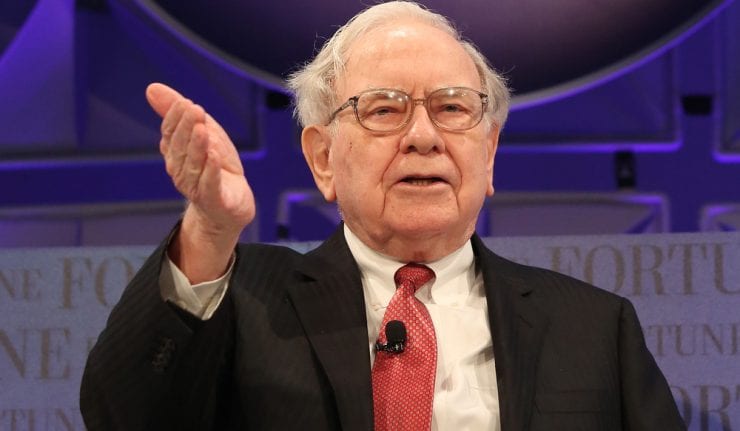

Buffett Outperforms — Elephants Can Still Dance!

“When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds.”

— Warren Buffett, 2017 Shareholder Report

In 2015, when my son and I attended Berkshire Hathaway’s 50th anniversary shareholders’ meeting in Omaha, Nebraska, Warren Buffett shocked the audience by admitting defeat in the battle over stock performance. For decades, he had proven that you can beat the market by carefully buying quality companies at a discount and holding for the long term. But since his investment company has grown so large, he threw in the towel and decided it was better to invest in index funds like Jack Bogle’s gigantic Vanguard S&P 500 Index Fund.

He reiterated the virtues of passive investing in his 2017 annual report to shareholders, condemning the $100 billion hedge-fund industry for charging excessive fees and underperforming the indexes. He called Jack Bogle, the Vanguard Group founder who pioneered low-cost market trackers, a “hero.”

Buffett also has a $1 million bet with Protege Partners. Buffett challenged the asset manager to pick a group of hedge funds that would beat an S&P 500 Index fund over 10 years. Proceeds from their wager go to charity.

So far, the $1 million investment in the bundle of hedge funds has generated a $220,000 gain in the nine years through 2016, compared with the index fund’s $854,000 increase. Buffett surely will win the bet when it ends on Dec. 31. According to Buffett, about 60 percent of the gains that the hedge funds produced during that period were eaten up by management fees.

But what about his own investment company? Berkshire Hathaway Inc. (NYSE: BRK-A) stock actually has outperformed the S&P 500 Index, even when you include dividends. Click here to check it out!

While it’s true that most hedge funds and actively managed mutual funds underperform the indexes, why does investing in individual stocks continue to appeal to most investors?

Simple. Index investing is boring. Nobody walks into a cocktail party to talk about how much money they made in an index fund. The thrill of victory — and the agony of defeat — is in the storytelling of individual stocks.

Subscribers to my newsletter, Forecasts & Strategies, receive recommendations of individual stocks and mutual funds. You make the call! I personally like investing in both and comparing their performance. In my own experience, my stock picks have done slightly better than index funds. To learn about my newsletter, click here.

In case you missed it, I encourage you to read my e-letter from last week about why an extreme “America-centric” foreign policy could actually hurt America.

P.S. Thanks to all of you who have taken our survey of “The Top 50 Most Influential Libertarians.” You can still take it anonymously without giving your email address here: https://www.surveymonkey.com/r/FFNewsmax50Lib.

My Next Investment Conference

–Investment U, March 15-18, The Vinoy Renaissance Resort, St. Petersburg, Florida: Join the Oxford Club experts (Alex Green, Dave Fessler, Rick Rule and Frank Holmes) and me as we discuss the most profitable strategies to achieve the American Dream under President Trump. To find out more, go to http://events.oxfordclub.com/IU2017/IU-2017-MarkSkousen.html.

You Blew It! How George Soros Lost $1 Billion

Many financial gurus and political pundits had egg all over their faces after the surprise election of Donald Trump last November.

Nobel prize-winning economist Paul Krugman predicted that the stock market would collapse after Trump won. But the worst decision was made by George Soros, the billionaire investor who was known for his support of Hillary Clinton.

Most famously, Soros is known to be a clever investor who made a billion dollars shorting the British pound in 1992.

But what the gods give, they also take away.

According to the Wall Street Journal, George Soros lost close to a billion dollars betting against Trump. Soros is a defender of the “open society” (the name of his foundation). Many of Trump’s views go counter to the idea of an open society.

Meanwhile, billionaire Carl Icahn made upwards of $700 million on Nov. 9. John Paulson reaped over $463 million on the same day. No doubt they have made even more since then.

The lesson is clear: Never let politics interfere with your investment decisions. You must always keep your emotions separate from your money.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)