When the epic space saga “Star Trek” first aired on TV, it addressed an idea that no other series had really covered before: the notion of a world that could perform daily life without having to worry about money and finances. As idyllic as this idea may seem on the surface, investing in promising companies, stocks and sectors is ultimately a better alternative.

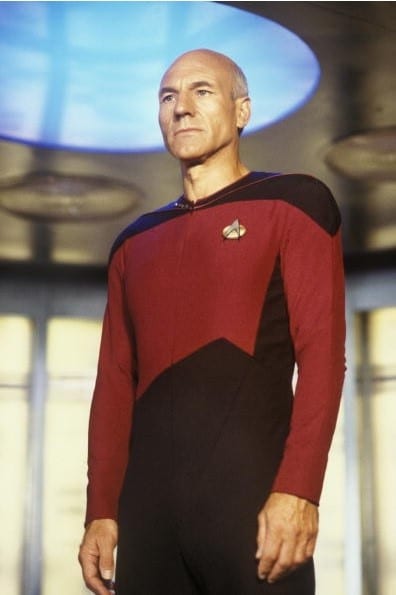

Perhaps the best description of how Star Trek’s futuristic economy works was given by the fictional Captain Jean-Luc Picard in the 1996 film “Star Trek: First Contact.” Picard explained, “The economics of the future is somewhat different. You see, money doesn’t exist in the 24th century… The acquisition of wealth is no longer the driving force in our lives. We work to better ourselves and the rest of Humanity.”

Some benefits that might come from eliminating money readily spring to mind. For instance, taxes would not exist anymore and there wouldn’t be a constant struggle to pay for the necessities of life.

However, don’t be fooled. There is a lot hiding underneath the attractive outer surface of this idea. Consider the following from the study of economics:

1) A monetary standard leads to a higher degree of life.

As a basic definition, money is anything that can be used to facilitate exchange between two parties. Without money, a primitive barter and trade system would probably be all that existed.

For instance, suppose a farmer raises cows and he is able to trade his milk for eggs from another farmer who raises chickens. These two farmers have established a mutually profitable trade. However, if the cow farmer also needs clothing, he must then trade with a weaver, too. If the weaver doesn’t want the cow milk, the farmer must find an alternative way to trade, possibly by going to another person who has what the weaver wants.

In the end, this system would provide only the barest essentials of life and nothing with beauty or high-quality craftsmanship. Why? Because there is no incentive, or need, to create such frivolous things — everyone is busy trading goods to cover basic essentials.

By contrast, using some form of money would give the cow farmer, the chicken farmer and the weaver a stable field on which to exchange. Money could be “traded” for required goods and, in turn, be easily exchanged by the holder for other things to allow more time for the creation of less necessary, but quality, goods.

This is why currency has existed for thousands of years, since no matter what type is used, man has found it easier to gain what he needs with money. Eliminating a common currency would hold back human progress.

2) Our best work is normally done for an adequate reward.

It is a widely accepted principle today that a person should be compensated for his time and labor. While humans are capable of selfless actions, knowing that some form of compensation is involved helps boost motivation and effort. For example, I will probably be willing to help out a friend for a few hours without asking for any reward. If that help should stretch for a day or two though, my willingness to help is going to decrease significantly unless I am compensated for my time.

“Star Trek” doesn’t address the issue of motivation. In that universe, highly technical starships are assembled by unpaid workers who don’t complain.

3) Money puts a limit on what we can own.

Money plays an integral role in our desires for material goods and their fulfillment. Obviously, you can’t just walk into a store, grab products of off the shelves and walk out. You need to factor in the cost, the amount you’re willing to spend and how valuable to you an item really is.

Yes, this system means that can’t buy everything you want, but it provides enormous satisfaction when you save up and buy something you really want, or receive as a gift.

This cycle of expectation and fulfillment enhances everyday life, but is non-existent in a world without money. When everything imaginable can be gained with a minimum of effort, as in “Star Trek,” what is the incentive to work?

Why investing is the better option

Thus, two key problems in eliminating money from society are: 1) the likelihood of fostering a primitive economy and 2) the potential to have an unmotivated populace.

Ironically, investing in the stock market avoids these pitfalls.

First, the stock market creates a continually progressive economy as publicly traded companies innovate to build shareholder value. Investors tend to reward strong performance and growth, which lifts the stock prices of deserving companies. This cycle spurs companies to push beyond existing boundaries of efficiency and technology.

Secondly, investing allows people to grow wealth and spend it. Investing can act as substitute income to allow for a higher quality of life, or to maintain an income during retirement. Furthermore, a successful investor may pass his “legacy” on to his heirs in the form of an estate or substantial amounts of money. This is an action that older, retired folks commonly find very meaningful.

Maybe someday money won’t be necessary for everyday life, but that time is a long ways off… at least on Earth as we know it.

Tim Johnston writes for StockInvestor.com, among other Eagle Financial Publications’ websites. He also has written for CNS News, MRCTV and RightlyWired.com. Tim graduated from Christendom College in 2014 with a B.A. in Political Science and Economics and a minor in History. When not discussing politics or analyzing financial markets, Tim enjoys studying and practicing Historical European Martial Arts.

![[instant messaging via tablets and phones]](https://www.stockinvestor.com/wp-content/uploads/shutterstock_125411345.jpg)